In 2013, interest rates in Europe and the United States stood at all-time lows. In this situation, BBVA Group’s structural interest-rate risk remained under control within the limits established by the Executive Committee. These exceptionally low interest rates also constitute a defense of the Group’s exposure and position it favorably in the event of interest-rate rises.

The management of structural interest-rate risk on the balance sheet aims to maintain BBVA Group’s exposure to market interest-rate fluctuations and movements at levels in accordance with its strategy and risk profile. With this aim, the Bank actively manages the balance sheet through operations that aim to optimize the level of risk assumed in relation to expected earnings while respecting the maximum tolerable risk levels. The ALCO is the body that takes the decisions to act according to the proposals made by the Asset/Liability Management unit. This unit designs and executes the strategies to be implemented, using internal risk metrics that have to be aligned with the corporate model.

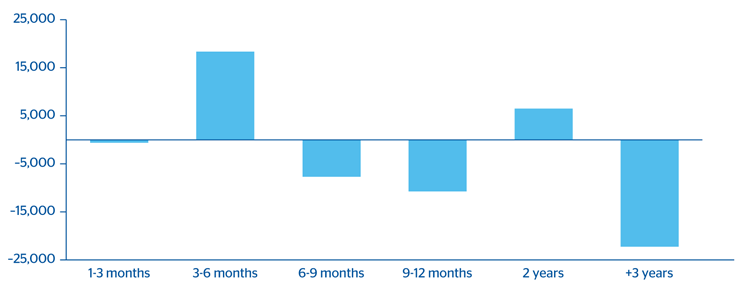

The changes in market interest rates affect net interest income and the book value of entities. This potential impact is included in the structural interest-rate risk. Its main source of risk arises from different maturities or repricing of assets and liabilities in the banking book and off-balance-sheet positions. The accompanying chart shows the gaps in BBVA’s structural balance sheet in euros.

Maturity and repricing gaps of BBVA\s structural balance sheet in euros.

(Million euros)

A financial institution’s exposure to adverse changes in market rates is a risk inherent in its business, and at the same time represents an opportunity to generate value. That is why structural interest-rate risk should be managed effectively and must retain a reasonable relation to the entity’s equity and expected earnings.

The management of structural risks in BBVA Group is handled by the Asset/Liability Management unit, within the Financial Management area. Through ALCO, the unit is in charge of maximizing the Bank’s economic value, preserving net interest income and guaranteeing the generation of recurring earnings. With this aim, the Financial Management area assesses possible alternatives and proposes the most appropriate actions based on its expectations, balancing expected economic results and the impact on the risk level. This is done while adapting to the established risk profile, as well as the management strategy and policies defined by the Group’s management bodies. BBVA has a transfer pricing system that centralizes Bank’s interest-rate risk on ALCO’s books and is designed to facilitate this task.

Within the Global Risk Management corporate area, the Corporate Risk Management (CRM) unit is responsible for controlling and monitoring structural interest-rate risk with the aim of preserving the Group’s solvency, supporting its strategy and ensuring the successful carrying out of its business. To do so it acts as an independent unit, which guarantees a proper separation between the risk management and control functions, as recommended by the Basel Committee on Banking Supervision. CRM designs the measurement models and systems, develops the monitoring, information and control policies, and prepares the structural interest-rate risk measurements used by the Group’s management. At the same time and through the Risk Management Committee (RMC) it carries out the function of risk control and analysis, reporting to the main management bodies such, as the Executive Committee and the Board of Directors’ Risk Committee.

BBVA Group’s structural interest-rate risk management procedure has a sophisticated set of metrics and tools that enable its risk profile to be monitored precisely. The model is based on a series of deeply analyzed assumptions designed to characterize the balance sheet more accurately. Interest-rate risk measurement includes probabilistic metrics as well as calculations of the sensitivity to a parallel shift of +/- 100 basis points in the market interest-rate curves. The model regularly measures the Bank’s earnings at risk (EaR) and economic capital (EC), defined as the maximum adverse deviations in net interest income and economic value, respectively, for a given confidence level and time horizon. These deviations are obtained by applying a simulation model of interest-rate curves that takes into account other sources of risks apart from directional movements, such as changes in the slope and curvature, and also the diversification between currencies and business units. The model is regularly subjected to internal validation that includes backtesting.

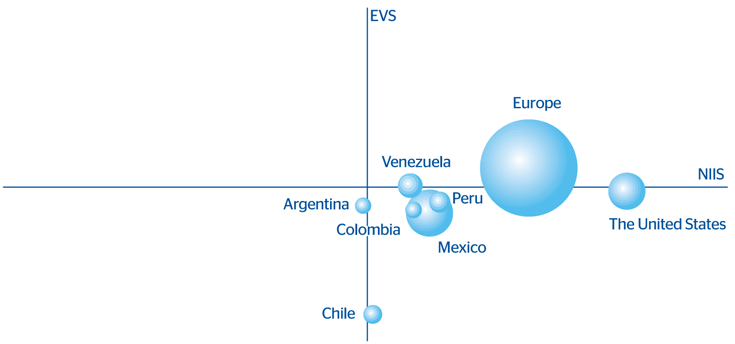

The accompanying chart shows the sensitivity profile of the main entities of the BBVA Group.

BBVA Group. Structural interest/rate risk profile

EVS: Economic value sensitivity (in percentage) of the franchise to +100 basis points.

Size: Core capital to each franchise

The risk appetite of each entity is determined by the Executive Committee through the limits structure. Thus the maximum negative impacts in terms of both net income and value, are defined in each entity. In 2013, active balance-sheet management has enabled exposure to remain aligned with the Group’s target risk profile.

Interest-rate risk measurements are supplemented by BBVA Research’s analysis of specific and forecast scenarios, as well as stress testing, which evaluates extreme scenarios of a possible break-off in both interest-rate levels and historical correlations and volatility.