2013 marked the start of the transition towards a new cycle in the United States and the Eurozone

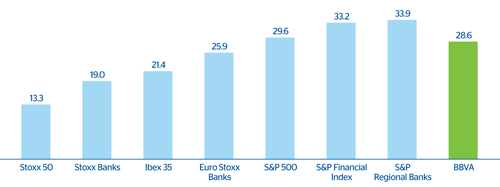

In 2013 there was confirmation of recovery in the United States and improved market sentiment about the Eurozone. This marks the start of the transition period of the Fed’s expansive monetary policy strategy, as well as the relaxation of sovereign tension in Europe, and thus a reduction in risk premiums in peripheral Eurozone countries. This has been reflected in the good performance of stock market indices in the main developed economies. In the United States, the S&P 500 index rose by 29.6% since the close of 2012, while the Stoxx 50 index in Europe gained 13.3%. In Spain, the Ibex 35 index increased 21.4% over the same period. In fact, the banking sector has posted the biggest increases with respect to the general indices. The S&P Regional Banks index gained 33.9%, while the Euro Stoxx Banks index, which includes banks in the Eurozone, rose by 25.9%. In both cases, the increase was higher than that of the S&P 500 and Stoxx 50 indices.

Year-on-year evolution of the principal stock-market indexes and the BBVA share

(Percentage)

BBVA earnings have once again stood out among Spanish banks

BBVA earnings for 2013 once more stand out by their high level of solvency and sound liquidity position. Market analysts have mainly highlighted the balanced diversification of revenue between developed and emerging regions. By areas, Spain is considered the market with the highest potential for recovery in the medium term, while Mexico and South America are still rated better. In addition, analysts have made a positive assessment of the Group’s divestment of non-strategic assets, such as the sale of the pension businesses in Latin America and of BBVA Panama. In addition, in Asia, BBVA has signed a new agreement with CITIC Group, which includes the sale of 5.1% of its stake in CNCB and helps assign the Group’s capital more efficiently within the Basel III regulatory framework, as this stake has been reduced below 10%. Following these operations, BBVA maintains its strategic commitment in both regions (Latin America and Asia) and is still a significant shareholder in CNCB, with 9.9% of the share capital. Strategically, analysts have understood the reason behind these divestments, as they are businesses whose synergies with the Group’s core business are very limited, or in markets where there was no possibility of achieving a critical mass.

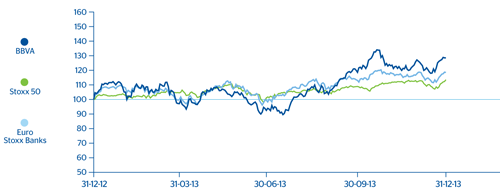

The BBVA share outperforms the Ibex 35 and Euro Stoxx Banks indices

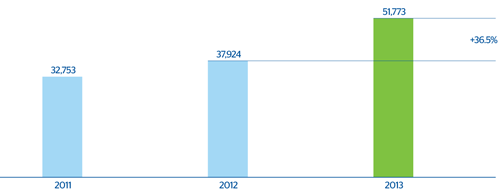

The BBVA share has performed extraordinarily well over the year. Its price has risen since the end of 2012 by 28.6%, closing as of 31-Dec-2013 at €8.95 per share. This price represents a market capitalization of €51,773m, a price/book value ratio of 1.1, and a P/E ratio of 23.2 (calculated on the BBVA Group’s net attributable profit for 2013). In these conditions, the BBVA share continues to be attractive at its current levels, based on its potential for revenue growth and excellent capital position.

Share price index

(31-12-2012=100)

BBVA’s market capitalization

(Million euros)

The BBVA share and share performance ratios

Download Excel

Download Excel

|

|

31-12-13 | 31-12-12 | 31-12-11 |

|---|---|---|---|

| Number of shareholders | 974,395 | 1,012,864 | 987,277 |

| Number of shares issued | 5,785,954,443 | 5,448,849,545 | 4,903,207,003 |

| Daily average number of shares traded | 55,515,852 | 68,701,401 | 60,363,481 |

| Daily average trading (million euros) | 411 | 406 | 452 |

| Maximum price (euros) | 9.40 | 7.35 | 9.49 |

| Minimum price (euros) | 6.18 | 4.31 | 5.03 |

| Closing price (euros) | 8.95 | 6.96 | 6.68 |

| Book value per share (euros) | 8.18 | 8.04 | 8.35 |

| Market capitalization (million euros) | 51,773 | 37,924 | 32,753 |

| Price/book value (times) | 1.1 | 0.9 | 0.8 |

| PER (Price/earnings; times) | 23.2 | 21.5 | 10.9 |

| Yield (Dividend/price; %) | 4.1 | 6.0 | 6.3 |

BBVA changes its dividend policy towards 100% cash remuneration

As regards shareholder remuneration in 2013, on July, 10 an interim dividend was paid in cash for a gross €0.10 per share. In addition, in October the flexible “dividend option” remuneration system was carried out, for a gross €0.10 per share, which offers shareholders the option to receive the dividend either in newly issued BBVA shares or, under their choice, in cash. The percentage of shareholders choosing to receive new BBVA shares was 88.3%, higher than on previous occasions, thus again confirming the confidence of shareholders in the future evolution of the shares. Furthermore, a proposal will be made to the next Annual General Meeting on March 14, 2014 to implement again the “dividend option” remuneration system. If this proposal is approved, BBVA’s intention is to increase, up to a gross €0.17 per share, the shareholder remuneration payable in April 2014 through the “dividend option” system, which will replace the traditional final dividend. The approval of this proposal would bring the total shareholder remuneration to a gross €0.37 per share, equivalent to a dividend yield of 4.1%, one of the most attractive in the sector in Spain and the rest of Europe.

On October 25, 2013 BBVA announced its intention to replace gradually the current shareholder remuneration with another one fully in cash and linked with the Group’s earnings. The final goal is to pay out every year between 35% and 40% of each year’s earnings depending on market and regulatory circumstances.

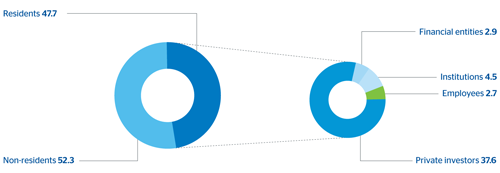

Increased participation by foreign shareholders in BBVA’s capital

The number of BBVA shares as of 31-Dec-2013 stood at 5,786 million compared with the figure of 5,449 million at the close of 2012. This increase is the result of the execution of the “dividend option” and conversion on 30-Jun-2013 of the outstanding subordinate mandatory convertible bonds issued in December 2011.

The number of BBVA shareholders as of 31-Dec-2013 stood at 974,395, compared with 1,012,864 as of 31-Dec-2012, a slight decline of 3.8%. The main reason for this fall is sales by new shareholders after voluntary or mandatory conversions of subordinate bonds in 2012. The granularity of shareholders has remained at similar levels in 2013, with no significant holding.

Shareholder structure

(31-12-2013)

Download Excel

Download Excel

| Number of shares | Shareholders | Shareholders | ||

|---|---|---|---|---|

|

|

Number | % | Number | % |

| Up to 150 | 253,046 | 26.0 | 18,113,667 | 0.3 |

| 151 to 450 | 214,245 | 22.0 | 58,100,378 | 1.0 |

| 451 to 1800 | 278,268 | 28.6 | 258,981,483 | 4.5 |

| 1,801 to 4,500 | 119,812 | 12.3 | 343,106,916 | 5.9 |

| 4,501 to 9,000 | 55,680 | 5.7 | 351,596,874 | 6.1 |

| 9,001 to 45,000 | 46,925 | 4.8 | 822,302,489 | 14.2 |

| More than 45,001 | 6,419 | 0.7 | 3,933,752,636 | 68.0 |

| Total | 974,395 | 100.0 | 5,785,954,443 | 100.0 |

In addition, 47.7% of the share capital belongs to investors resident in Spain, while the percentage owned by non-resident shareholders has increased to 52.3% (compared with 46.9% in 2012). This demonstrates once more the renewed confidence and recognition of the BBVA brand among foreign investors, even after the recent period of heightened uncertainty in financial markets and the banking sector.

BBVA Group. Shareholder structure 31-12-2013

(Percentage)

High liquidity of the BBVA share

BBVA shares are traded on the stock exchange market in Spain and, also, on the stock exchange markets of London and Mexico. The BBVA American Depositary Shares (ADS) trade in New York and in the Stock Exchange of Lima (Peru) through a swap agreement in both markets. The BBVA share was traded on each of the 256 days in the stock market year of 2013. A total of 14,157 million shares were traded on the stock market in this period, representing 245% of the Groups’ share capital. Thus, the daily average volume of traded shares has been 56 million, 0.96% of the total number of shares making up the share capital and a daily average of €411m.

BBVA is listed on the main stock market and sustainability indices

Lastly, BBVA shares are included in the key Ibex 35 and Euro Stoxx 50 indices, with a 12.3% weighting in the Ibex 35 and 2.9% in the Euro Stoxx, as well as in several banking industry indices, most notably the Stoxx Banks, with a weighting of 5.9%, and the Euro Stoxx Banks, with a weighting of 12.8%. In addition, BBVA’s presence on the main sustainability or ESG (environmental, social and governance) indices which evaluate the performance of the companies in this matter is increasingly significant. At global level, institutional investors assign increasing importance to inclusion in these ESG indices (based on environmental, social, ethical and corporate governance ratings), as well as to financial fundamentals, when it comes to making an investment decision. The permanence and punctuation in those stock market indices depend on how the steady progresses in sustainability can be demonstrated. BBVA is one of the highest-rated shares by nearly all the ESG analysts and indices, such as the Dow Jones Sustainability, the FTSE4Good and the MSCI indices, maintaining an outstanding presence among the main international sustainability indices. Its weighting as of 31-Dec-2013 in each of these indices is shown in the following table:

Main sustainability indexes with BBVA presence

(Data as of 31-12-2013)

Download Excel

Download Excel

|

|

|

Weighting (%) |

|---|---|---|

|

DJSI World | 0.75 |

| DJSI Europe | 1.53 | |

| DJSI Eurozone | 3.12 | |

|

Euronext Vigeo Europe 120 Index | 0.80 |

| Euronext Vigeo Euro 120 Index | 0.83 | |

|

MSCI World ESG Index | 0.46 |

| MSCI World ex USA ESG Index | 0.98 | |

| MSCI Europe ESG Index | 1.63 | |

| MSCI EAFE ESG Index | 1.08 | |

|

FTSE4Good Global | 0.43 |

| FTSE4Good Global 100 | 0.73 | |

| FTSE4Good Europe | 1.04 | |

| FTSE4Good Europe 50 | 1.73 |

In view of the many indexes currently available in the market, PricewaterhouseCoopers (PwC) has developed a synthetic sustainability index. This pioneering methodology provides aggregate information on the Bank’s position in relation to the 19 global institutions that make up its peer group in matters related to sustainability. According to the latest analysis conducted, in 2012, BBVA has moved from third to first place in this index and is the leader among its main competitors.