With the aim of providing a better understanding of the area’s recurrent business, the results in the fourth quarter from the mark to market valuation of BBVA’s current stake in CNCB and the income by the equity method (excluding dividends) have been classified as results from corporate operations within the Corporate Center.

Earnings in the year have been affected by the negative impact of the depreciation of the Turkish lira, which has distorted the year-on-year comparison in all the lines, particularly net interest income. This heading has also been affected by the reduction in the customer spread in Garanti caused by the interest rate increase in Turkey in the second half of the year. Apart from the foregoing, the most significant aspects of Eurasia’s income statement in 2013 are as follows.

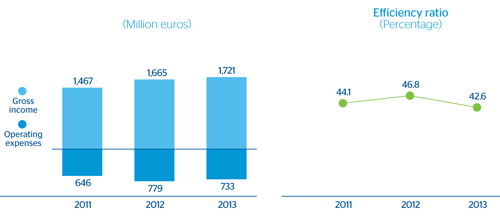

In the second half of the year, net interest income continued to be negatively affected by interest-rate movements in Turkey during that period and their impact on customer spreads in Garanti. This is despite the slight improvement seen in the last weeks of the year, due to better performance in new loan origination and the easing of the increase in deposit costs. Nevertheless, the area’s net interest income increased by 14.7% compared to the figure for the same period in 2012, to €911m. Net income from fees and commissions stands at €391m, down 10.1% over the year, influenced by lower revenue from wholesale banking customers. This heading has improved steadily throughout the year due to the more positive performance of Garanti, especially in those headings most closely related to business activities with its customers. A good performance by NTI, which totals €194m in 2013, up 54.2% on the amount for 2012, thanks to the excellent performance of the area’s Global Markets unit. As a result of the above, gross income in Eurasia stands at €1,721m in 2013, up 8.6% year-on-year.

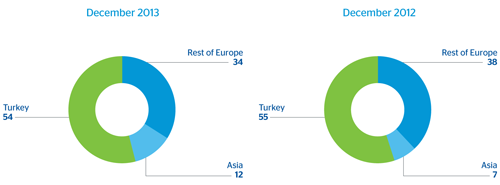

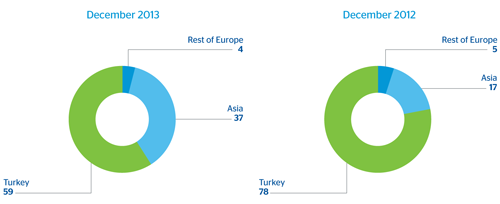

Eurasia. Gross income breakdown by geographical area

(Percentage)

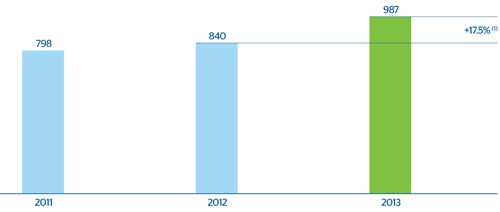

Operating expenses continue to be held in check. They declined 1.4% over the last twelve months to €733m, despite the effect of the expansion plans implemented by Garanti during the year. In fact, since the close of 2012, Garanti Bank’s branch network has increased by 65 and the number of ATMs by 495; the expenses resulting from the launch of i-Garanti before the summer should also be taken into account. This performance of revenues and expenses has led to an improvement in the area’s efficiency ratio, which closed as of 31-Dec-2013 at 42.6%, and a year-on-year increase in operating income of 17.5% to €987m.

Eurasia. Efficiency

Eurasia. Operating income

(Million euros at constant exchange rates)

Impairment losses on financial assets as of December stand at €330m, up 3.8% on the amount for the same period in 2012. This rise was due to the greater generic provisions arising from increased activity in Garanti and new regulations in Turkey, which came into force recently, increasing the percentage of generic provisions for the credit card and consumer loan portfolios.

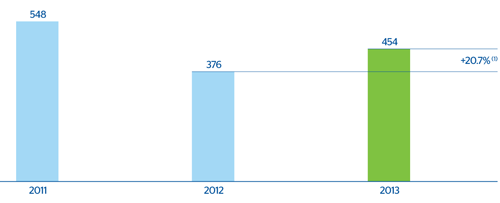

Overall, Eurasia generated a net attributable profit in 2013 of €454m, up 20.7% on 2012. Of this figure, €267m (58.9%) comes from Garanti’s contribution.

Eurasia. Net attributable profit

(Million euros at constant exchange rates)

Eurasia. Net attributable profit breakdown by geographical area

(Percentage)

Garanti Bank provides service to 12.4 million customers through a staff of 18,738 people across a network of 1,001 branches and has 4,003 ATMs, according to data available at the close of 2013. The main highlights of its earnings are summarized below:

- Net interest income performance closely linked to the country’s macroeconomic situation. In the first half of the year, Garanti experienced a significant reduction in the cost of its liabilities in liras. However, market conditions led to an upturn in the cost of deposits, particularly in the third quarter. But the bank’s reaction, raising the interest rates for its loans, has enabled it to recover its income in the latter part of 2013. Thus, Garanti Bank’s net interest income increases by 13.6% on the figure for the same period the previous year .

- Good performance of income from fees and commissions, underpinned by stronger activity and the high capillarity of the branch network.

- Higher level of loan-loss provisions as a result of the increase in generic provisions due to stronger activity and the new regulations that have been introduced.

- To sum up, increased activity and a diversified revenue base have enabled Garanti Bank to generate a net attributable profit of €1,186m in 2013 (€1,214m in 2012). Combined with the contribution from the other subsidiaries which belong to Garanti Group, the net attributable profit amounts to €1.344m, compared with the €1,326m registered in 2012.

Garanti. Significant data at December 2012 and 2013 (1)

Download Excel

Download Excel

|

|

31-12-13 | 31-12-12 |

|---|---|---|

| Financial statements (million euros at constant exchange rate) |

|

|

| Attributable profit | 1,186 | 1,214 |

| Total assets | 66,508 | 54,110 |

| Loans and advances to customers | 40,085 | 30,880 |

| Deposits from customers | 34,309 | 28,265 |

| Relevant ratios (%) |

|

|

| Efficiency ratio (2) | 46.7 | 46.3 |

| NPA ratio | 2.1 | 2.3 |

| Other information |

|

|

| Number of employees | 18,738 | 17,285 |

| Number of branches | 1,001 | 936 |

| Number of ATMs | 4,003 | 3,508 |

(2) Normalized figure excluding the effect of regulatory and non-recurrent items.