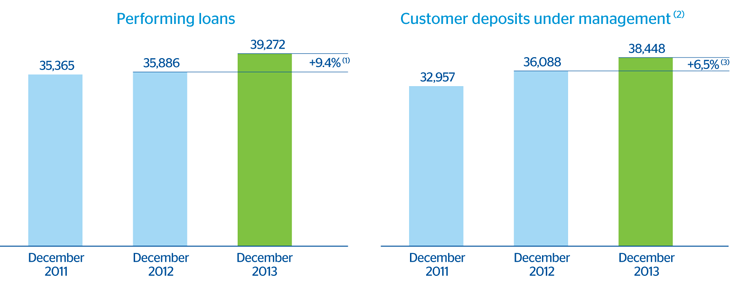

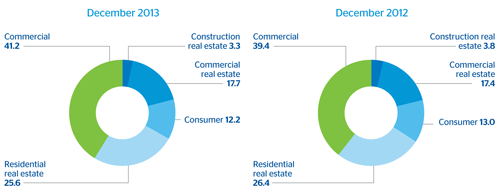

As of 31-Dec-2013 the area’s performing loans totaled €39,272m, rising again by 9.4% over the year. This increase was widespread across all of the Bank’s portfolios. Lending to corporates (commercial) increased by 14.7% since the end of 2012, while residential mortgages (residential real estate) grew by 10.1% over the same period. There was also an increase in consumer loans (5.9% over the year) and a recovery in the construction real-estate portfolio, up 4.6% in the quarter, after several quarters of falling balances, which meant a year-on-year decrease of 4.6%.

The United States. Key activity data

(Million euros at constant exchange rate)

| (1) At current exchange rate: +4.7%. |

(2) Excluding repos. (3) At current exchange rate: +1.9%. |

|---|

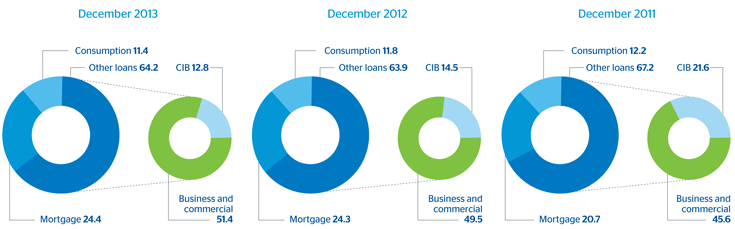

The United States. Performing loans breakdown

(Percentage)

BBVA Compass accounts for 95% of the all performing loans. This means the aforementioned evolution of the various loan portfolios of this franchise is highly influenced by the trends of each of them in it.

BBVA Compass. Loan mix

(Percentage)

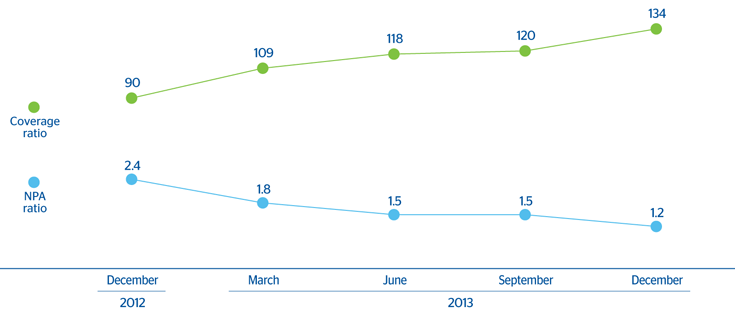

The main indicators of the area’s asset quality and risk management improved significantly in the year, with the NPA ratio down 111 basis points to 1.2% and the coverage ratio up 44 percentage points to 134%. Moreover, BBVA Compass achieved its goal of continuing to reduce the amount of problem portfolios, particularly those related to the construction real-estate sector. This was achieved while also expediting the origination process and maintaining the same quality standards in control and monitoring. As a result, a record level of new loans was granted during the year.

The United States. NPA and coverage ratios

(Percentage)

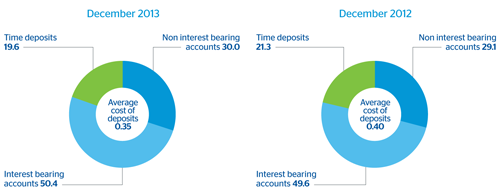

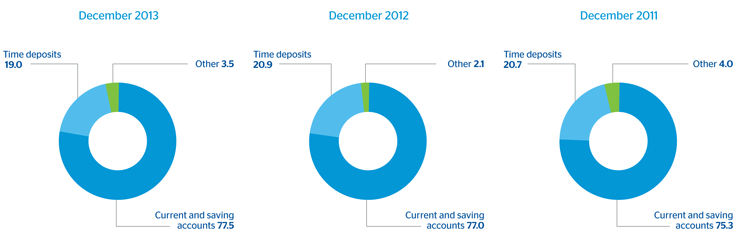

Customer deposits under management, €38,448m as of 31-Dec-13, increased by 6.5% if compared with the existing volume as of 31-Dec-12. This favorable trend is due to the good performance of the modalities of lower cost, represented by current and savings accounts, which experienced a rise of 7.2% from the end of December 2012. By contrast, time deposits decrease 3.2% over the year.

The United States. Breakdown of customer deposits under management

(Percentage)

As the case of the performing loans, BBVA Compass provides almost all of the volume of customer funds in the area (96% of customer deposits under management). The breakdown of customer deposits in the bank is exposed, distinguishing between time deposits, interest bearing accounts and not interest bearing accounts.

BBVA Compass. Deposit mix

(Percentage)