In 2013 BBVA generated a net attributable profit of €2,228m, above the figure of €1,676m in 2012. If the effect of corporate operations, earnings from the real-estate activity in Spain and the provisions made in the third quarter of 2013 as a result of the classification of refinanced loans are not included in this figure, the Group’s adjusted net attributable profit in 2013 would be €3,195m, compared with €4,490m in 2012.

BBVA Group. Net attributable profit (1)

(Million euros)

(2) At constant exchange rates: -24.8%

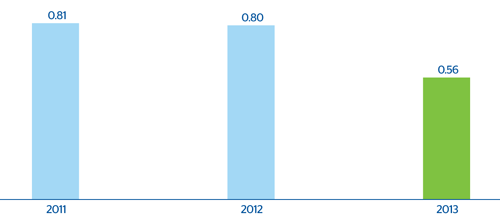

BBVA Group. Earnings per share (1)

(Euros)

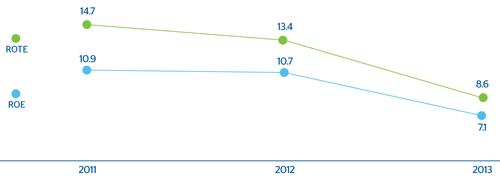

As a result, earnings per share (EPS) stand at €0.39 (€0.56 adjusted), return on total average assets (ROA) 0.48% (0.64% adjusted), return on equity excluding goodwill (ROE) 5.0% (7.1% adjusted) and return on tangible equity (ROTE) 6.0% (8.6% adjusted).

BBVA Group. ROA (1)

(Percentage)

BBVA Group. ROE (1) and ROTE (1)

(Percentage)

By business area, Spain has contributed €583m, real-estate activity in Spain generated a loss of €1,254m, the United States contributed €390m, Eurasia €454m, Mexico €1,805m and South America €1,249m.