BBVA’s banking model translates into three competitive advantages: recurrence in earnings, structural soundness and a single model of principles adjusted return.

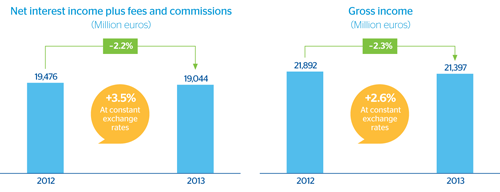

- Recurrence, because BBVA continues to show year after year a strong capacity to generate recurrent income to absorb the demanding requirements imposed by the different supervisors.

Recurrent earnings

BBVA is ready to lead the banking of the future

- Structural soundness, because the Group maintains a balanced and well-capitalized balance sheet with risks that are well-known and under control, and with an adequate funding structure relying on its broad base of customer relations. BBVA also has a comfortable liquidity position, and its capacity to generate capital organically is among the soundest in its peer group. In addition, BBVA has been one of the few banks in the world that has continued to pay dividends during these years of crisis.

- And a unique principles adjusted return model based on absolute principles of integrity, prudence and transparency, the main object of which is to create value for its shareholders.

In short, community involvement, principle-based management and technological leadership, together with the strength and balance of its business model, define BBVA’s DNA. All of these factors continue to make the Group stronger and place it in a good position to lead the banking industry of the future.