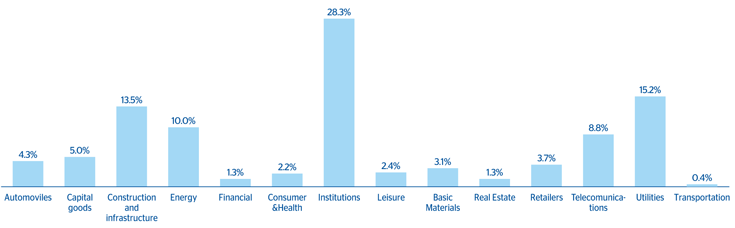

Excluding sovereigns and financial institutions, there are 113 holding groups in BBVA Group’s clients (129 in 2012), with risk drawn (loans, contingent liabilities, credit derivatives and fixed-income issues) exceeding €200m, of which 77% hold investment grade rating. The credit risk (loans plus guarantees) of these groups accounted for 22% of the BBVA Group’s total risk (20% in 2012). This risk can be broken down as follows: 87% in Europe and 13% in the Americas (47% in Mexico). Risk is diversified among the main sectors of economic activity, with the most important being: institutions 28.3%, utilities 15.2%, construction and infrastructure 13.5%, energy 10.0% and telecommunications 8.8%.

Concentration. Breakdown by sectors

(Risks above €200m as of 31-12-2013)