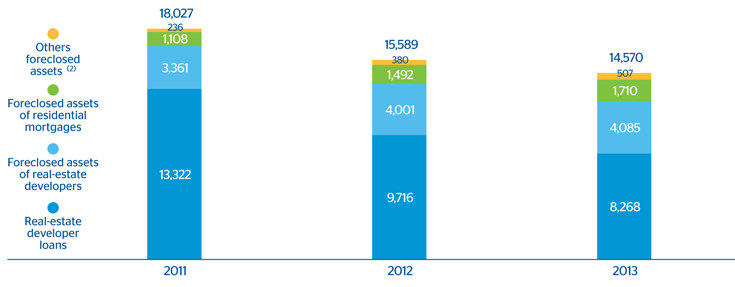

There are two very different realities for the Group within the real-estate sector. On the one hand, net exposure to the developer segment (lending to developers plus the foreclosed assets resulting from this lending) has been falling every quarter and will continue to decline in the future. On the other, are the retail foreclosures, i.e. the foreclosed assets from the residential mortgage sector, whose increase is linked to the rise in gross additions to NPA in this portfolio in 2008 and 2009.

After complying with the requirements imposed by Royal Decree-Laws 2/2012 and 18/2012 in 2012, BBVA’s net exposure to the real-estate sector in Spain is declining. As of 31-Dec-2013, the balance stood at €14,570m, down 6.5% on the figure at the close of 2012 and 19.1% below the figure at the close of 2011.

Spain. Real-estate activity. Net exposure to real estate (1)

(Million euros)

In 2013 there was an increase in the balance of non-performing developer loans, basically due to the application of the classification of refinanced loans in the third quarter. In fact, a significant percentage of the volume of loans reclassified as non-performing as a result of this classification corresponds to customers who are up-to-date with their payments.

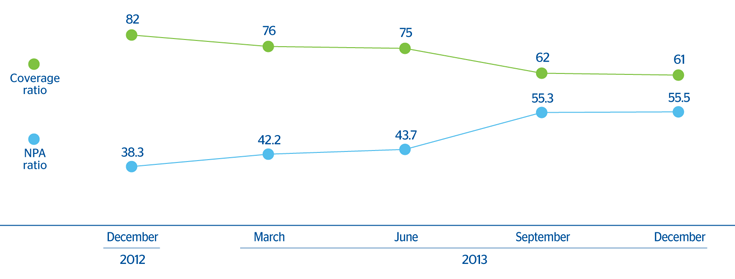

Spain. Real-estate activity. NPA and coverage ratios

(Percentage)

Within the exposure to the Spanish real-estate sector, property securing mortgage loans to private individuals has increased year-on-year by 14.6%. As has been noted, this rise is closely linked to the increase in gross additions to NPA in this mortgage portfolio during 2008 and 2009.

At the close of 2013, coverage of non-performing and substandard loans (51%) and of assets from foreclosures and purchases (also 51%), improved compared with the data for the previous year. Overall coverage of real-estate exposure closed the year at 45% (43% at the end of 2012).

Coverage of real-estate exposure in Spain

(Million euros as of 31-12-13)

Download Excel

Download Excel

|

|

Risk amount | Provision | % Coverage over risk |

|---|---|---|---|

| NPL + Substandard | 10,283 | 5,237 | 51 |

| NPL | 8,838 | 4,735 | 54 |

| Substandard | 1,445 | 502 | 35 |

| Foreclosed real-estate and other assets | 12,965 | 6,663 | 51 |

| From real-estate developers | 9,173 | 5,088 | 55 |

| From dwellings | 2,874 | 1,164 | 41 |

| Other | 918 | 411 | 45 |

| Subtotal | 23,248 | 11,900 | 51 |

| Performing | 3,222 |

|

|

| With collateral | 2,851 |

|

|

| Finished properties | 2,058 |

|

|

| Construction in progress | 401 |

|

|

| Land | 392 |

|

|

| Without collateral and other | 371 |

|

|

| Real-estate exposure | 26,470 | 11,900 | 45 |

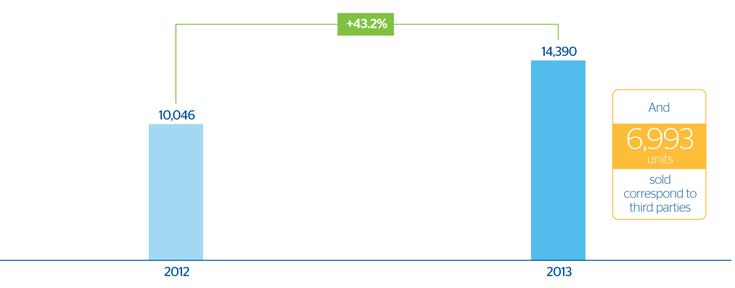

Sales of owned real-estate assets picked up pace year-on-year, at 14,390 units over the twelve months of 2013, a rise of 43.2% on the previous year. If third-party sales are added to the total, for the year as a whole cumulative sales amount to 21,383 units, of which 6,993 were on behalf of third parties.

Spain. Real-estate activity. Sales avolution

(Units)