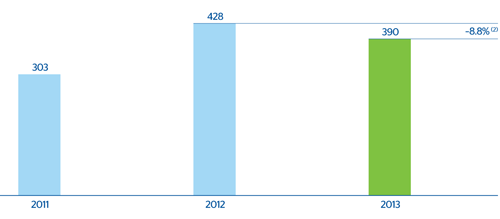

The area’s earnings in 2013 were strongly influenced by the impact of the current environment of low interest rates on revenue, the control of operating expenses and the increase in loan-loss provisions, very much in line with the upward trend seen in business activity. As a result, the area generated a net attributable profit of €390m in 2013 (down 8.8% year-on-year), of which 86% came from BBVA Compass.

The United States. Net attributable profit (1)

(Million euros at constant exchange rate)

(2) At current exchange rate: –11.8%.

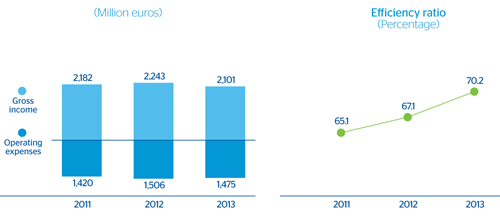

As mentioned above, the performance of revenue in 2013 was strongly affected by the scenario of low interest rates. This impact has offset the positive effect of the improvement of activity in the year. As a result, net interest income declined by 6.2% over the year to €1,407m. However, this trend began to revert and in the last quarter net interest income registered an improvement of 2.1% on the third quarter of 2013. Income from fees and commissions, at €557m, remained practically flat in 2013 (down 0.8%), influenced by regulatory changes and the sale of the insurance business in 2012. NTI is down 5.4% over the same period, while the other income/expenses shows a less negative amount. As a result, the area’s gross income stands at €2,101m, down 3.1% year-on-year.

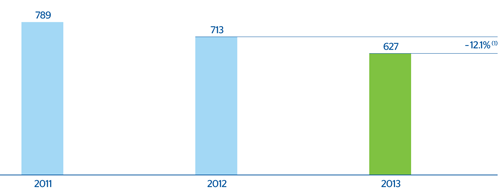

The area continues to manage its operating expenses efficiently by applying a strict cost control policy. As a result, this heading totaled €1,475m in 2013, with a year-on-year rate of change of 1.3%. Overall, operating income generated in the year was €627m, 12.1% less than in 2012, strongly influenced by the performance of net interest income.

The United States. Efficiency

The United States. Operating income

(Million euros at constant exchange rate)

Lastly, impairment losses on financial assets detracted €78m from the 2013 income statement and increased by 12.7% due, above all, to the absence of recoveries and atypical items (unlike in 2012). Excluding these effects, this heading grew in line with business activity.