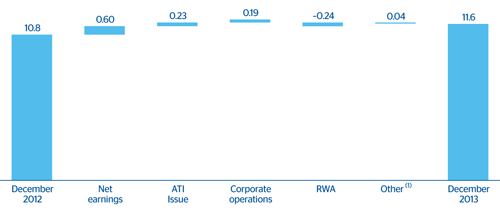

The most significant events that influenced the Group’s capital base in 2013 are:

1. Organic generation of earnings and capital gains obtained on the sale of the pension business in Latin America and BBVA Panama and for the reinsurance operation on the individual life and accident insurance portfolio in Spain.

2. A USD 1,500m issuance of contingent convertible securities into ordinary shares. BBVA is the first European bank to strengthen its Tier I capital position through this type of instrument. This issuance was placed entirely among institutional investors. It is eligible as additional Tier I (ATI) capital under Basel III (CRDIV). In addition, it was chosen as the best issue of the year in the Financial Bond category in the awards granted by the prestigious magazine International Financing Review (IFR).

3. Sale of 5.1% of the stake in CNCB, which brings BBVA’s current holding in this bank to 9.9%. Although this had a negative impact on core capital, it has a positive effect in capital base. Such positive effect is further heightened under the new Basel III regulation in which BBVA’s fully-loaded core capital ratio improves 71 basis points.

4. Reduction in risk-weighted assets (RWA) due largely to the exchange rates and lower activity in Spain. As the remaining stake in CNCB is not deducted, it increases the RWA and partially offsets the aforementioned reduction.

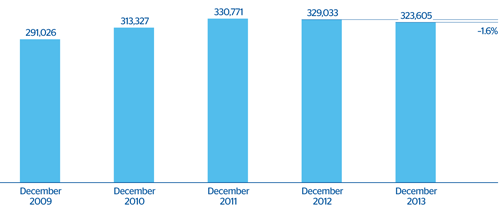

BBVA Group. RWA Evolution

(Million euros)

Capital base (BIS II Regulation)

(Million euros)

Download Excel

Download Excel

|

|

31-12-12 | 31-12-11 | 31-12-10 |

|---|---|---|---|

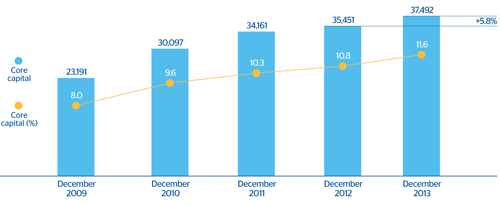

| Core capital | 37,492 | 35,451 | 34,161 |

| Capital (Tier I) | 39,611 | 35,451 | 34,161 |

| Other eligible capital (Tier II) | 8,695 | 7,386 | 8,609 |

| Capital base | 48,306 | 42,836 | 42,770 |

| Risk-weighted assets | 323,605 | 329,033 | 330,771 |

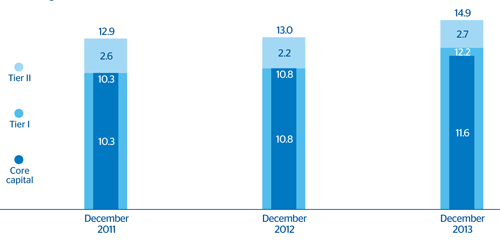

| BIS ratio (%) | 14.9 | 13.0 | 12.9 |

| Core capital (%) | 11.6 | 10.8 | 10.3 |

| Tier I (%) | 12.2 | 10.8 | 10.3 |

| Tier II (%) | 2.7 | 2.2 | 2.6 |

As a result, at the end of December 2013 the Group’s capital base stood at €48,306m, up 12.8% over the year. Of this amount, €37,492m correspond to core capital, which is up 5.8% over the same period thanks to earnings generation in the year, net of dividends, which offsets the negative impact of currencies during the period. Tier I capital as of 31-Dec-2013 totals €39,611m, up 11.7% over the same period in 2012, due to the inclusion of the aforementioned issuance of contingent convertible securities into ordinary shares and the effect of the sale of the 5.1% stake in CNCB. Lastly, Tier II capital amounts to €8,695m, up 17.7% year-on-year, also as a result of the aforementioned sale of the 5.1% stake in CNCB and other factors of less importance (including an issuance of subordinate bonds completed in Colombia in the first quarter of 2013).

The above, combined with the performance of RWA over the period, has strengthened the Group’s capital ratios. The core capital ratio closed the year at 11.6%, 81 basis points above the figure posted at the end of December 2012. The Tier I ratio ended at 12.2% (10.8% as of 31-Dec-2012) and the Tier II ratio at 2.7% (2.2% the previous year).

BBVA Group. Core capital evolution (BIS II Regulation)

(Million euros and percentage)

BBVA Group. Core capital ratio evolution

(Percentage)

To sum up, the BBVA Group’s BIS II ratio as of December 31, 2013 stands at 14.9%, a year-on-year improvement of 191 basis points.

BBVA Group. Capital Base. BIS II Ratio

(Percentage)

Lastly, the new capital requirements set out in the European CRDIV directive, commonly known as Basel III (BIS III), came into force in January 2014. It should be noted that the Group is very well positioned under this new regulation:

- The reduction in BBVA’s stake in CNCB below 10% means a 71 basis point improvement in the Group’s fully-loaded core capital, according to BIS III, as aforementioned.

- Royal Decree 14/2013, dated November 29, which establishes that certain deferred tax assets are to be converted into accounts receivable from the Tax Authority, implies that they do not have to be deducted from the BIS III core ratio. This new regulation is estimated to have a positive effect on the Group’s BIS III fully-loaded core capital ratio of between 60 to 70 basis points.

- The above has resulted in a BIS III fully-loaded core capital ratio as of December 31, 2013 of 9.8% and a leverage ratio of 5.6%.

In short, BBVA continues to manage its solvency ratios adequately, leading to a strong and adequate capital position.