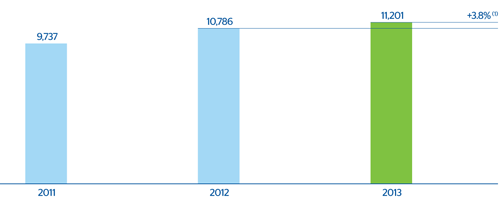

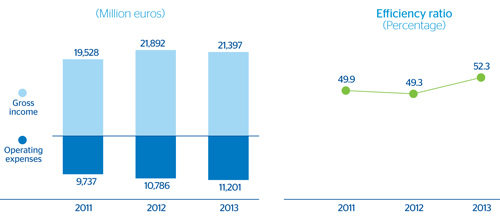

Operating expenses in 2013 totaled €11,201m, up 3.8% year-on-year (up 8.4% at constant exchange rates). The policy of cost control applied in developed countries has largely offset the execution of plans for investment in technology and the expansion projects in emerging areas. The following are two examples of this: the announcement in the first quarter of 2013 of an investment plan in Mexico of around €2,700m for the period from 2013 to 2016 with the aim of improving customer relations and experience, and thus continuing to offer a quality service, boosted by the range of innovative and specialized products offered; and the launch in the third quarter of 2013 of a new expansion program in South America which envisages an investment of around €1,900m until 2016, aimed basically at boosting online banking in the region.

BBVA Group. Operating expenses

(Million euros)

Breakdown of operating expenses and efficiency calculation

(Million euros)

Download Excel

Download Excel

|

|

2013 | Δ% | 2012 | 2011 |

|---|---|---|---|---|

| Personnel expenses | 5,788 | 2.2 | 5,662 | 5,191 |

| Wages and salaries | 4,392 | 1.0 | 4,348 | 4,022 |

| Employee welfare expenses | 866 | 5.8 | 819 | 746 |

| Training expenses and other | 530 | 6.9 | 495 | 423 |

| General and administrative expenses | 4,280 | 4.3 | 4,106 | 3,707 |

| Premises | 966 | 5.5 | 916 | 839 |

| IT | 801 | 7.4 | 745 | 647 |

| Communications | 313 | (5.4) | 330 | 289 |

| Advertising and publicity | 391 | 3.3 | 378 | 369 |

| Corporate expenses | 106 | 3.8 | 102 | 103 |

| Other expenses | 1,268 | 5.6 | 1,201 | 1,104 |

| Levies and taxes | 437 | 0.7 | 433 | 356 |

| Administration expenses | 10,068 | 3.1 | 9,768 | 8,898 |

| Depreciation and amortization | 1,133 | 11.3 | 1,018 | 839 |

| Operating expenses | 11,201 | 3.8 | 10,786 | 9,737 |

| Gross income | 21,397 | (2.3) | 21,892 | 19,528 |

| Efficiency ratio (Operating expenses/gross income, in %) | 52.3 |

|

49.3 | 49.9 |

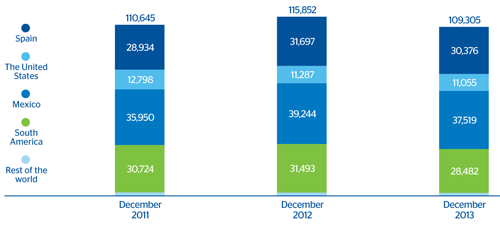

The number of employees, branches and ATMs has been affected by the changes in the scope of consolidation during the year (the sale of BBVA Panama and the pension business in Latin America).

- The number of people working in BBVA as of 31-Dec-2013 was 109,305, a year-on-year decrease of 5.7% explained, mainly, by the sale of the pension businesses and BBVA Panama and the integration of Unnim

BBVA Group. Number of employees (1)

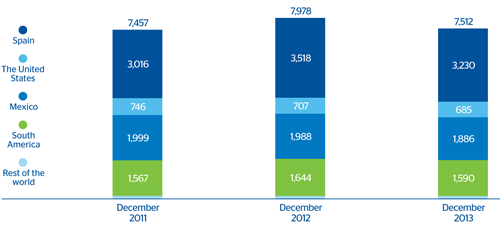

- The total number of branches at the close of December was 7,512 units. By geographical areas the number has risen in the majority of the South American countries, above all in Colombia, Peru and Venezuela, and fallen in Spain (the process of integrating Unnim), and has remained without significant changes in the rest of the areas.

BBVA Group. Number of branches (1)

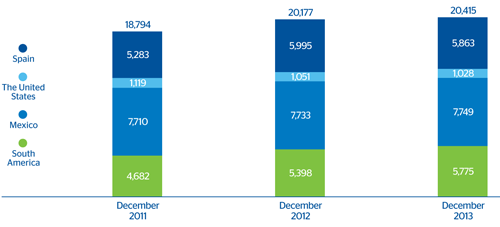

- The number of ATMs at the end of the year stood at 20,415 units. Over the year, their number has increased in South America and, to a lesser extent, in Mexico.

BBVA Group. Number of ATMs (1)

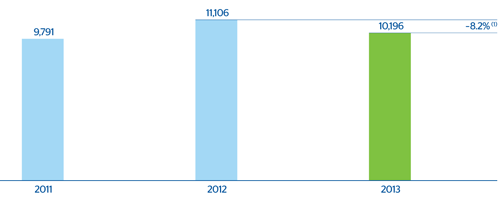

Despite this, the efficiency ratio closed December at an outstanding 52.3%, one of the lowest among BBVA’s peer group, while operating income was €10,196m, 8.2% below the figure for the same period in 2012 (down 3.0% excluding the exchange-rate effect).

BBVA Group. Efficiency

BBVA Group. Operating income