One highlight in the area’s activity is the changing mix seen in 2013. Performing loans are very much supported by the retail business, thanks to their positive performance in Garanti, while they have declined in wholesale portfolios. One highlight in customer funds is the positive performance of retail customer deposits and the recovery of deposits in the wholesale segment.

Eurasia. Key activity data

(Million euros at constant exchange rates)

| (1) At current exchange rates: –6.6%. |

(2) Excluding repos. (3) At current exchange rates: –0.1%. |

|---|

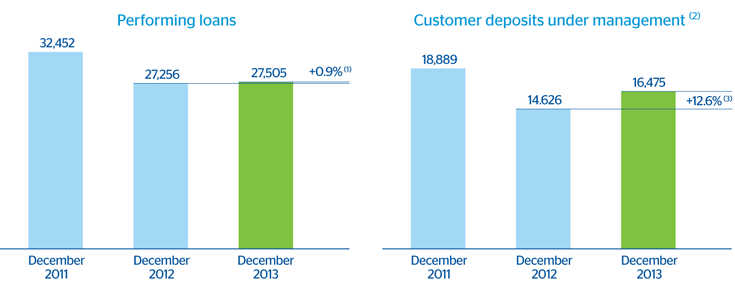

In the aforementioned context, the area’s balance of performing loans as of 31-Dec-2013 is very similar to the close of the preceding year, €27,505m (up 0.9% year-on-year). This is due to the deleveraging process underway among the customers of the wholesale business in the region, since retail activity continues to perform well. Worth noting is the strong performance of Garanti Bank’s portfolios, particularly those of Turkish lira-denominated loans, which are up 27.3% in year-on-year terms. There has also been an improvement in the foreign-currency portfolio, geared to project finance (up 9.9% year-on-year).

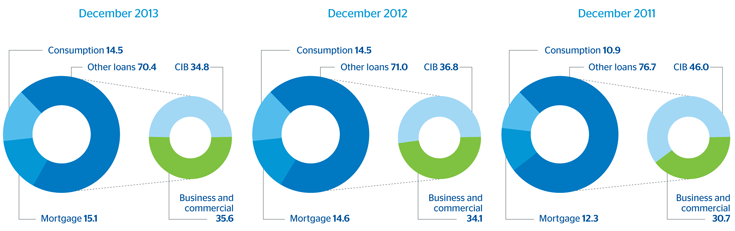

Eurasia. Performing loans breakdown

(Percentage)

Eurasia. Performing loans breakdown by geographical area

(Percentage)

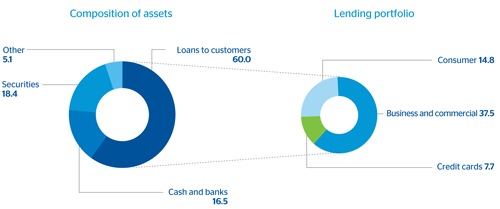

Garanti. Composition of assets and lending portfolio (1)

(December 2013. Percentage)

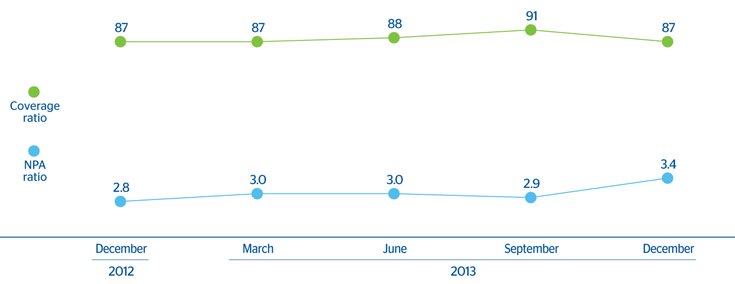

As regards the area’s asset quality, there has been a slight upward movement in the NPA ratio in the year (from 2.8% as of 31-Dec-2012 to 3.4% as of 31-Dec-2013) due to the deleveraging process in Europe and the exchange-rate effect in Turkey. The area’s coverage ratio closed the year at the same levels as in 2012, at 87%.

Eurasia. NPA and coverage ratios

(Percentage)

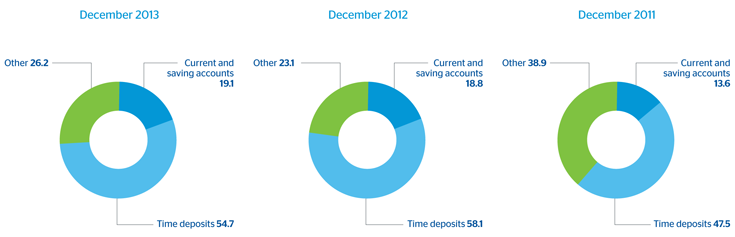

Customer deposits under management closed 2013 at €16,475m, up 12.6% on the figure at the end of 2012. Noteworthy is the increase in the balances of wholesale banking customers, which were up 9.3% over the year, and in the retail business, which registered year-on-year growth rates of 13.6%. In customer funds, Garanti Bank’s local-currency deposits have performed well (up 20.6% year-on-year), well above the sector average (up 14.6%), which has resulted in a year-on-year increase in market share of around 50 basis points, according to the latest information available as of 31-Dec-2013. The year-on-year increase in foreign-currency deposits has been 3.5%.

Eurasia. Breakdown of customer deposits under management

(Percentage)

Eurasia. Breakdown of customer deposits under management by geographical area

(Percentage)

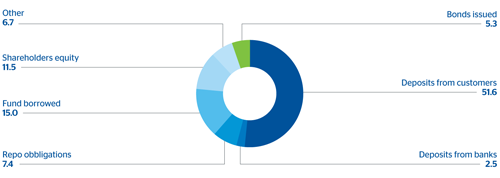

Garanti. Composition of liabilities (1)

(December 2013. Percentage)

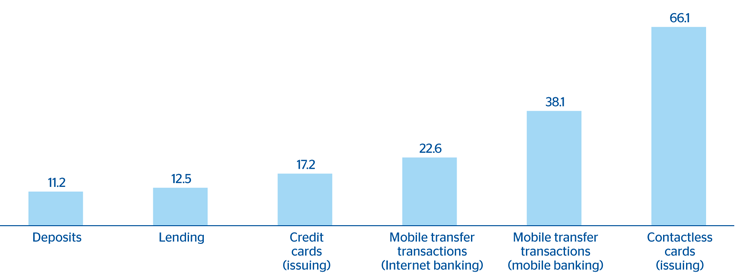

Garanti Bank. Market shares

(Percentage)

Source: BRSA/Bank Association of Turkey (TBB).

From the point of view of solvency, Garanti Bank continues to have sound levels of capitalization (CAR at 14.4% as of December 31), despite the aforementioned impact of the lira depreciation.