Loss given default (LGD) is another of the key metrics used in quantitative risk analysis. It is defined as the percentage exposure at risk that is not expected to be recovered in the event of default.

BBVA basically uses two approaches to estimate LGD. The most common one is known as “workout LGD”, in which estimates are based on the historical information observed by the entity, by discounting the flows observed throughout the recovery process of the contracts that have been in default at some point. In portfolios with a low rate of default (low default portfolio, or LDP), there is insufficient historical experience to make a robust estimate using the workout LGD method, so external sources of information have to be combined with internal data to obtain a representative rate of loss given default.

LGD estimates are carried out by segmenting operations according to different factors that are relevant for its calculation, such as the default period, seasoning, the loan-to-value ratio, type of customer, score, etc. The factors considered may be different according to the portfolio being analyzed. Some of these are illustrated below with examples.

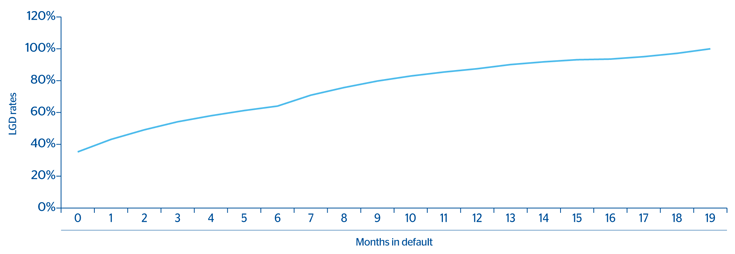

- For contracts already in default, an important factor is the time elapsed since the default. The longer the contract has been in default, the lower the recovery of the outstanding debt. For the purposes of calculating the expected loss and economic capital, the contracts that are not in default are also attributed an LGD comparable to contracts that have just defaulted.

LGD of BBVA credit cards in Spain (for domestic customers and by time in default)

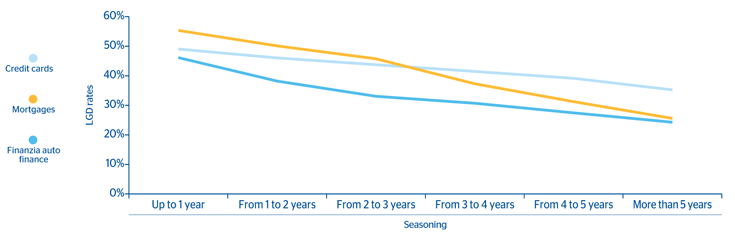

- The seasoning of a transaction is the period elapsed from the origination of the contract to the default date. This is also relevant, as there is an inverse relationship between LGD and seasoning: the longer the contract persists without defaulting, the greater its recovery.

LGD curves by seasoning for various products in Spain

There are portfolios in which LGD changes when combining the aforementioned axes.

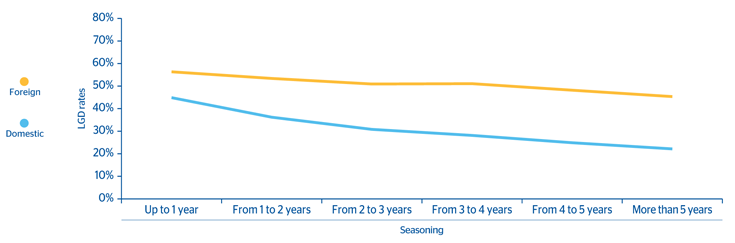

- Nationality and seasoning. In recent years, nationality has been a relevant factor in LGD in BBVA’s retail portfolios in Spain.

LGD for Autos Finanzia by nationality and seasoning, BBVA in Spain

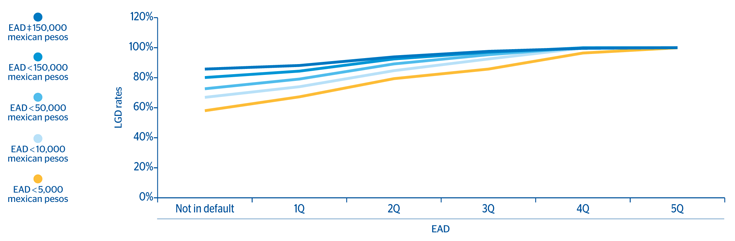

- Time elapsed between the default event and EAD (exposure at default). There are portfolios in which LGD depends on several axes, as is the case of credit cards in BBVA Bancomer, where the LGD grows with the time in default and the greater the amount of EAD.

BBVA Bancomer’s credit card LGF, based on the quarter in default and exposure at the time of default (EAD)

Progress in building LGD scorings and ratings is becoming increasingly important in order to adapt LGD estimates to social changes and the economic situation. These estimates allow new factors to be included without losing the robustness of the information and make it possible to obtain models that are more sensitive to improvements or deterioration in the portfolio.

In the BBVA Group, different LGDs are attributed to the outstanding portfolio (default and non-default), according to combinations of all the significant factors, depending on the features of each product and/or customer. This can be seen in the Chart “LGD for Autos Finanzia, BBVA in Spain by nationality and seasoning”, where LGD is explained according to the seasoning of the contract and its nationality.

Lastly, it is important to note that LGD varies with the economic cycle. Hence, two concepts can be defined: long-run LGD (LRLGD) and LGD at the worst moment in the cycle, or downturn LGD (DLGD).

LRLGD represents the average long-term LGD corresponding to an acyclical scenario that is independent of the time of estimation. DLGD represents the LGD at the worst time of the economic cycle, so it should be used to calculate economic capital, because the aim of EC is to cover possible losses incurred over and above those expected.

Every estimate of loss given default (LGD, LRLGD and DLGD) is performed for each portfolio, taking into account all the aforementioned factors. However, no LRLGD or DLGD estimates are made in portfolios in which the loss given default is not significantly sensitive to the cycle, as they are recovery processes that cover extended periods of time in which the isolated situations of the economic cycle are mitigated.

In addition to being a basic input for quantifying losses (both expected and capital losses), LGD estimates have other internal management purposes. For example, LGD is an essential factor to discriminate prices, in the same way that it can determine the approximate value of a defaulted portfolio in the hypothetical event of outsourcing recoveries or defining which potential recovery actions have the highest priority.