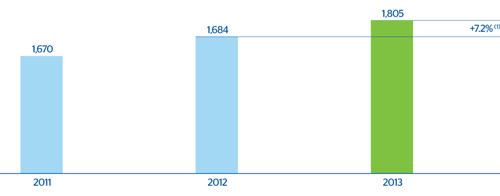

At the end of 2013, BBVA in Mexico reported a net attributable profit of €1,805m, a year-on-year growth of 7.2%. Some of the most important factors accounting for this performance are given below.

Mexico. Net attributable profit

(Million euros at constant exchange rate)

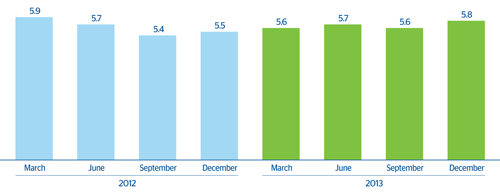

Cumulative net interest income amounts to €4,484m, up 7.7% year-on-year, on the back of higher lending volumes and good management of customer spreads. This performance in net interest income by BBVA Bancomer compares positively with that of its main peers. In fact its net interest income over ATA (according to local accounting data) stands at 5.6%, more than 80 basis points above the market average, according to CNBV figures for the close of December 2013. Income from fees and commissions is up 10.7% over the year, boosted by more credit card transactions and increased revenue from the Bank’s participation in market issuance by its corporate customers. It was a positive year for NTI, albeit more moderate than in 2012 (down 4.3%). Lastly, the other income/expenses heading, which basically includes revenue from the insurance business, has increased by 13.7% during the year. As a result, gross income amounted to €6,201m, an increase of 8.1% on 2012.

Mexico. Net interest income over ATA

(Percentage)

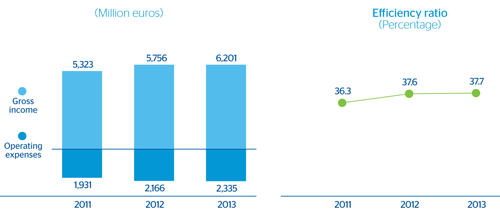

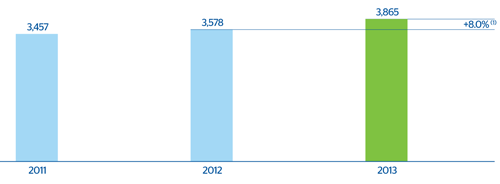

Operating expenses rose by 8.2% in 2013 to €2,335m. This increase is largely the result of the implementation of the area’s Investment Plan mentioned above. Despite this, the efficiency ratio remained practically unchanged over the year (37.7% compared with 37.6% in 2012), making the bank one of the most efficient in the Mexican banking sector. These income and expenses figures have resulted in operating income ending the year at €3,865m, up 8.0% on the 2012 figure.

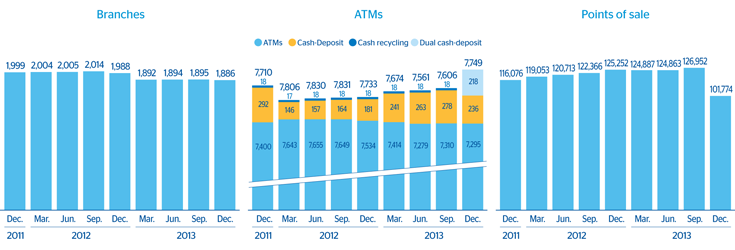

Mexico. Distribution network evolution

(Branches, ATMs and points of sale)

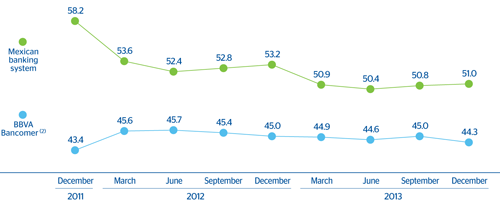

Mexico. Efficiency

BBVA Bancomer and Mexican banking system Efficiency (1)

(Percentage)

(2) Data collected under local accounting principles.

Source: CNBV. Data from banks without subsidiaries.

Mexico. Operating income

(Million euros at constant exchange rate)

Lastly, impairment losses on financial assets stood at €1,439m, an increase of 9.4%, very much in line with the growth in activity over the year.

Below are some of the most important aspects of the performance of the various business units in 2013.