Business Areas

Print this page

Banking activity in Spain

Real-estate activity in Spain

The United States

Eurasia

Mexico

South America

-

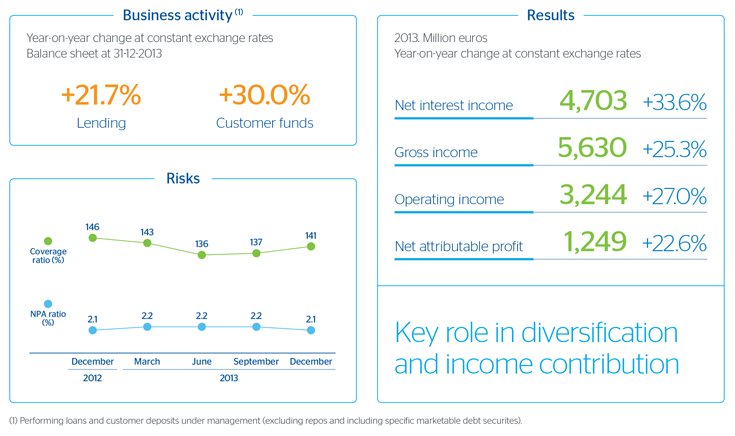

Banking activity in Spain

Highlights in 2013

- Management in a complex environment.

- Increases in market share of lending and customer funds.

- Risk indicators reflect impact of classifying refinanced loans and deleveraging.

- Reinsurance agreement on the individual life and accident insurance portfolio.

-

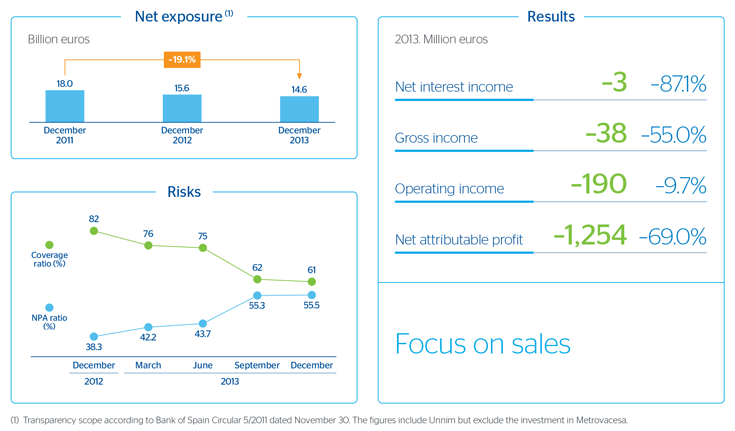

Real-estate activity in Spain

Highlights in 2013

- The improved economic climate has started to be reflected in the stabilization of sales and prices in the sector.

- Another reduction in BBVA’s net exposure to the real-estate sector.

- Increased rate of growth in sales of real-estate assets.

- Limited risks, but affected by refinanced assets.

-

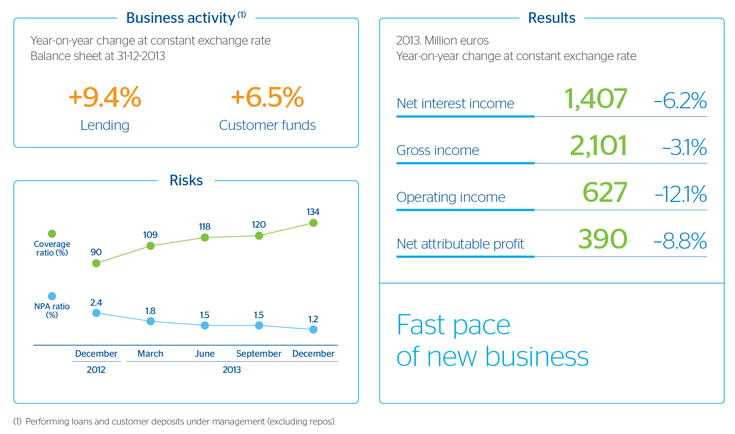

The United States

Highlights in 2013

- Growth of lending, particularly in the commercial and residential real-estate portfolios.

- Increase of lower-cost customer funds.

- Revenue significantly affected by the current interest-rate environment.

- Costs in check.

- Another improvement in risks indicators.

-

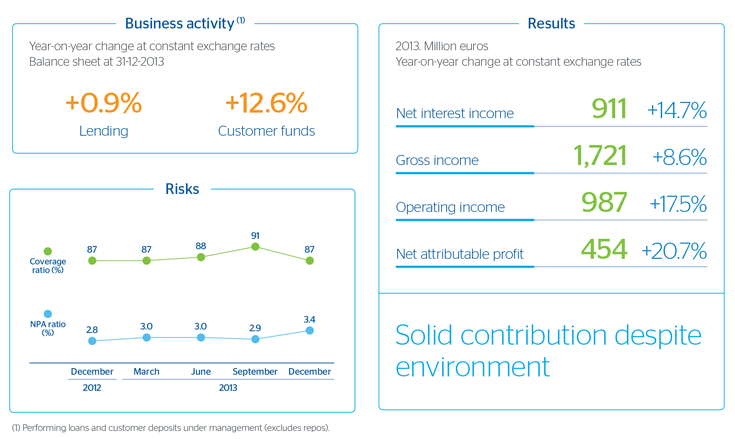

Eurasia

Highlights in 2013

- Customer lending at very similar levels to those reported at the end of 2012.

- Excellent performance of customer funds, both retail and wholesale.

- In Turkey, impacts stemming from the depreciation of the Turkish lira and interest-rate movements.

- Slight deterioration of the risk indicators.

- Signing of a new agreement with the CITIC group.

-

México

Highlights in 2013

- Buoyant activity transferred to revenues.

- Good management of customer spreads.

- BBVA Bancomer, one of the most efficient banks in the Mexican financial system.

- Stability in risk indicators.

- Sale of Afore Bancomer.

-

South America

Highlights in 2013

- Positive performance of activity, both in lending and customer funds, in almost every country in the region.

- Maintenance of spreads.

- Favourable performance of revenue.

- Stability of risk indicators.

- Sale of the pension business and BBVA Panama.