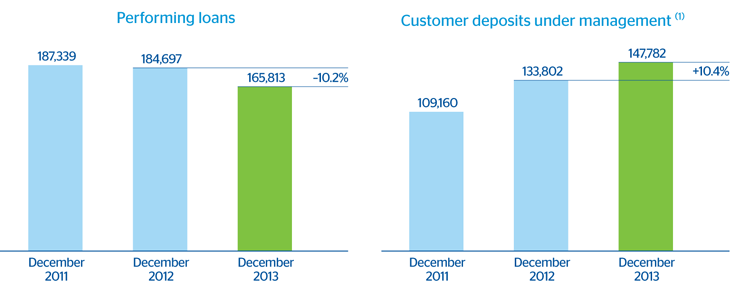

Banking activity in Spain has been largely conditioned by the country’s economic environment, which has led to a general deleveraging of the economy. Together with the early repayment in November under the Supplier Payment Fund, this has generated a reduction of performing loans in the area of 10.2% in the last 12 months to €165,813m at the close of the year.

Spain. Banking activity. Key activity data

(Million euros)

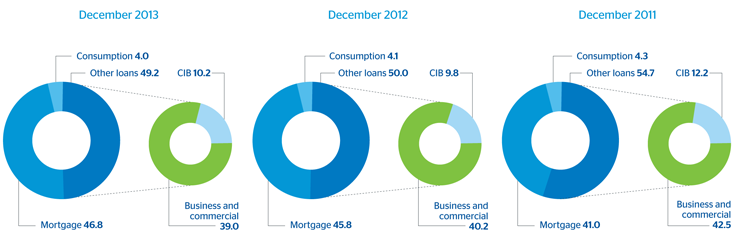

Spain. Banking activity. Performing loans breakdown

(Percentage)

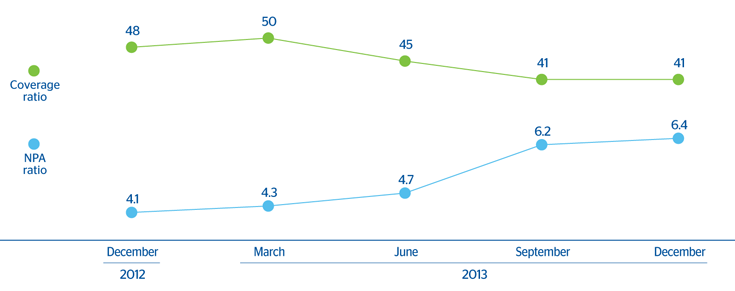

The main risk indicators have evolved as expected over the year. The NPA ratio has continued to rise, mainly due to the impact of the classification of refinanced loans on the volume of non-performing loans. In the third quarter of 2013, non-performing loans totaled €2,778m, although most of this amount (88%) corresponded to loans that are up-to-date with payments. Together with the decline in lending, this explains why the NPA ratio ended 2013 at 6.4%, with a coverage ratio of 41%.

Spain. Banking activity. NPA and coverage ratios

(Percentage)

From the standpoint of liabilities, the performance of customer funds is still very positive. As of 31-Dec-2013, BBVA managed a volume of €190,508m in customer deposits, promissory notes, mutual funds and pension funds, a rise of 11.1% year-on-year.

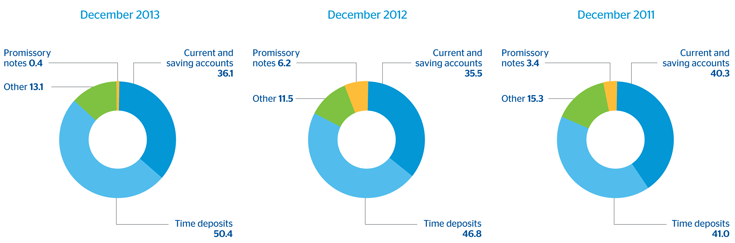

Customer deposits under management increased by 10.4% year-on-year. By type of product, time deposits have reported the highest growth over the last 12 months (up 18.9%). An adequate commercial strategy in the area and the high capillarity of the network, as well as the promotion of multi-channel banking, have enabled BBVA to cope with a very demanding year in terms of maturities, and achieve deposit renewal rates of over 80% every month, as commented above. It also gained 39 points in market share in customer funds over the year, according to the latest available information as of December 2013.

Spain. Banking activity. Breakdown of customer deposits under management

(Percentage)

These results in lending and on-balance-sheet customer funds have cut the loan-to-deposits ratio (1) in the domestic sector to 124%, according to data as of 31-Dec-2013, from 134% as of 31-Dec-2012. Including Spanish covered bonds, the ratio stands at 99%.

In off-balance-sheet funds, BBVA has performed well in both mutual and pension funds, which increased by 16.6% and 10.0%, respectively, over the year. In an environment of very low interest rates, BBVA is actively selling a diversified mutual fund catalog to customers with the right investor profile. In addition, the Bank continues committed to offer customers pension savings products with the aim of promoting long-term savings for retirement designed as a complement to retirement pensions. For this purpose, it has made available a wide range of pension funds and individual insurance savings schemes.

Lastly, the number of customers using alternative channels other than branches continues to increase significantly. This is part of an ambitious transformation plan designed to improve the value offer of products for customers, optimizing a multi-channel relational model that is a clear advance in operational processes and makes BBVA an easier bank that is close to customers and their needs.

(1) The ratio excludes securitizations and repos and includes all promissory notes