Against the background of a restructuring financial system, BBVA’s strategy in Spain has remained focused on strengthening the franchise and making the most of opportunities to gain market share and extend the customer base. In 2013, BBVA once more confirmed its leading position in the Spanish financial system. This leadership is once again demonstrated by the Bank’s competitive positioning, profitability, efficiency and asset quality.

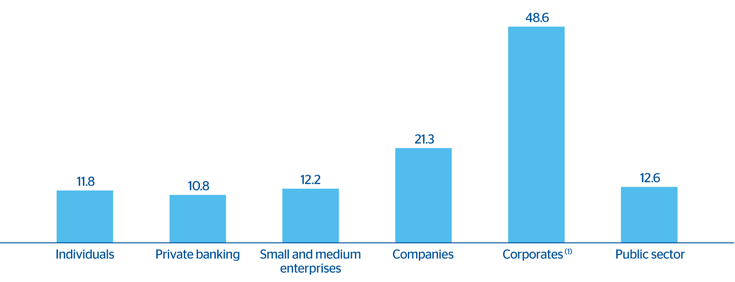

Spain. Banking activity. Competitive positioning. Leadership by segment

(Percentage)

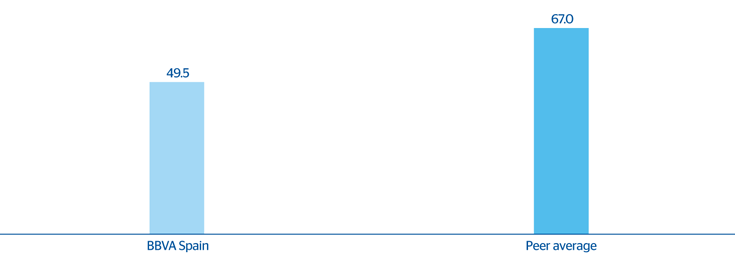

Spain. Banking activity. Operating income and business volume per branch versus peer group (1)

(Thousand euros)

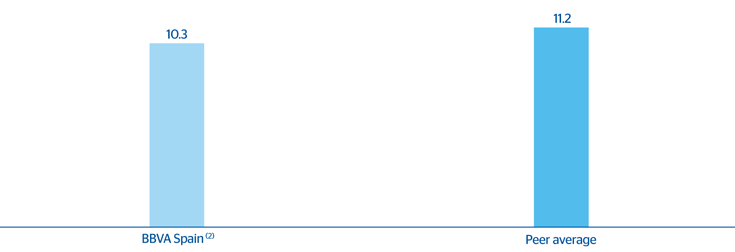

Spain. Banking activity.Evolution of efficiency ratio versus peer group (1)

(Percentage)

BBVA Spain NPA ratio versus peer group(1)

(Percentage)

(2) Including real-estate activity.

Four management keys are still at the root of the area’s performance in 2013:

- First, BBVA has maintained its strategy of increasing its customer base, using customer funds and transactional banking as key levers. Over €15,000m have been gathered in customer funds, consisting of deposits and promissory notes. BBVA has also continued to gain market share in payrolls and pensions and has increased the number of bundled customers by more than 150,000 in 2013. This strategy of growth in customers is very selective and focused on the highest-value sectors. Over two thirds of net new customers are Premium customers.

Spain. Banking activity. Market share gain

(Basis points from December 2012 to December 2013)

- Second, there has been good pricing management in the liability side and more than 80% of the deposits maturing each month have been renewed.

Spain. Banking activity. Time stock cost compared with the system

(Percentage)

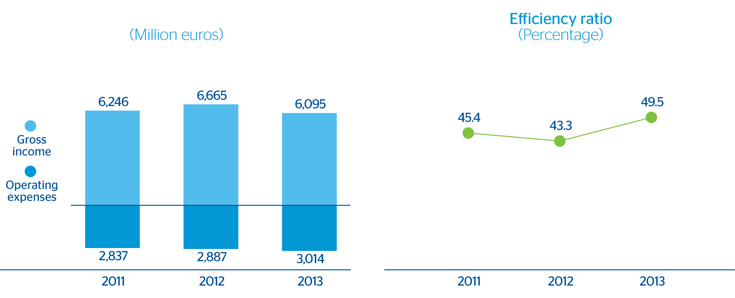

- Third, operating expenses have continued to be kept in check. Some years ago, BBVA moved ahead of times by reducing its branch network. Now, in an environment of high growth in the number of customers, it is continuing to develop its multi-channel distribution model with the aim of extending and facilitating contact with its customers.

Spain. Banking activity. Efficiency

- Fourth, despite the deleveraging underway and the accounting effect of classifying the refinanced loans (most of which are up-to-date with payments) and their consequent impact on the NPA ratio, BBVA is in an outstanding position compared with its competitors as a result of a risk policy that is characterized by an ongoing effort of transparency, anticipation and prudence. In this respect, it is worth noting that in the last quarter of the year, the balance of non-performing loans declined compared with the figure for previous quarters, as a result of a better performance of gross NPA entries.

Looking ahead to the future, and continuing with its strategy to set it apart from its peers, BBVA’s actions in Spain will continue to be focused on three fronts:

- The commercial strategy will continue to be focused on increasing the customer base, using fund gathering and transactional banking as key levers.

- Providing the best customer experience in the market through better quality service, and extension of BBVA’s lead on its competitors. BBVA looks for customers who arrive due to restructuring in the banking sector, or attracted by the solvency and security of the Bank, to remain because of the outstanding service it offers.

- Investment will continue in innovation and technology to offer customers an outstanding omni-channel experience that is more flexible, more accessible and more adapted to their needs. This will increase contact with customers and enable BBVA to be more efficient, as future improvements in efficiency will come about through changes in the Bank’s relationship and distribution models.

BBVA will continue to invest in the development of a franchise that maintains its differential strength within the country’s financial sector and its leadership in the technological transformation of the industry.