Customers are at the core of BBVA Group’s strategy

Quality and customer service

As customers are at the Group’s strategic core, BBVA’s main goal is to gain an insight into them, provide them with products and services they need and establish lasting relations of trust. With nearly 50 million customers around the world, the Group aims to provide an outstanding service for which it can be recognized worldwide. That is the task of the Quality and Customer Experience units in the banks that make up BBVA Group. They all make an effort to maintain ongoing dialog with their customers, while transmitting to employees the importance of providing service with a standout quality.

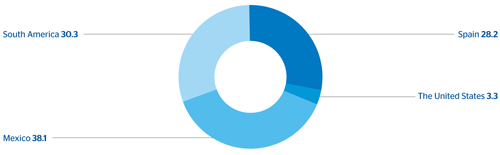

Customer breakdown

(31-12-2013. Percentage)

BBVA has its own architecture for measuring quality and customer experience in a harmonized way for the whole Group

Every year over 1.2 million customer contacts are carried out to discover opinions on the service received and the products and services offered. Since 2012, BBVA has had its own measurement architecture that provides it with harmonized information across the whole Group. The information obtained in this way forms the basis of many projects for transformation, developed at both local and global level, aimed at simplifying working methods and making life simpler for all customers.

Regarding to the professionals making up BBVA Group, specific programs have been developed for the sale networks, as they are the main point of contact with customers; but the rest of the employees have not been neglected. The most common tools for them are training and the development of a corporate customer-centric culture.

“Frontline Friday” is a program that has been in place since 2010 at BBVA Compass. Every quarter, a group of unit supervisors finds out about the daily work of branches and call centers to see how their decisions impact on the customer experience. Suggestions for improvements are made as a result of these visits, and many of them have led to improved response times and more efficient information flows between units.

Similar initiatives are being carried out in South America. One example is the “Un día en la Red” (A day in the network) program in BBVA Chile.

Customer insight

Our goal: being the most recommended Bank by our customers

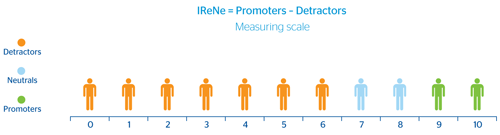

Our goal is to set the benchmark as a banking group in terms of customer experience, and so become the bank that is most recommended by its customers in all the geographical areas in which it operates. BBVA can do this using a global recommendation-based methodology called IReNe (Net Recommendation Indicator). It was launched in 2012 and has continued to develop in all the Group’s divisions this year. IReNe, inspired by global benchmark methodology Net Promoter ® Score (NPS), asks to what extent our customers would recommend BBVA’s products or services, classifying their willingness to recommend on a scale of 0 to 10. The level of recommendation provides a measure of how satisfied they are with us.

IReNe methodology

Since the level of customer recommendation began to be measured, the trend has been very positive in practically all the countries where BBVA operates

The customers’ replies are analyzed to infer what the reasons are for recommending us, their negative experiences and to what extent we are meeting their expectations. To understand them better, “listening workshops” are carried out with those responsible for the products or the segment, analyzing the most important drivers.

The promoting customers, in other words those who are inclined to recommend BBVA services, are a very important asset for the Group. Their opinions are of great value to the Bank so it can continue to offer them a service of quality. But the most relevant source of information is the detracting customers, because they indicate how BBVA needs to improve to comply with its aim of becoming an exemplary bank in terms of service quality.

Since the level of recommendation began to be measured and customer answers to be analyzed to find areas for improvement, the trend in the IReNe indicator has been positive in practically all the countries where BBVA works.

The IReNe indicator by bank

Download Excel

Download Excel

|

|

Spain | Mexico | The United States |

Argentina (1) | Chile | Colombia | Peru | Venezuela |

|---|---|---|---|---|---|---|---|---|

| Second half of 2013 compared with the second half of 2012 |

9 | 8 | (2) | (39) | 4 | 7 | 2 | 15 |

|

|

Spain | Mexico | The United States (1) |

Argentina | Chile | Colombia | Peru | Venezuela |

|---|---|---|---|---|---|---|---|---|

| Gap to the peer evolution. Second half of 2013 compared with the second half of 2012 |

+3 | +2 | –18 | –7 | +4 | +1 | +8 | +13 |

Thanks to this methodology, and taking into account the latest measurements made in 2013, the Bank has become a benchmark in customer valuations in Argentina, Peru and the United States, while progress has been made in Venezuela and Spain.

Success cases

Over 2013, BBVA has received the following recognitions for quality:

- BBVA Continental has been recognized as the best financial institution for quality of customer service, according to the analysis by Ipsos Apoyo in Peru.

- BBVA Frances has achieved leadership in quality of service in the Argentinean market, according to the consultancy Knack. Its study analyzes the level of willingness to recommend the bank and the level of satisfaction. BBVA is in first place in both rankings due to the “good service offered by staff in branches.”

- BBVA Provincial has been named “Best Bank in Venezuela” by the magazine Euromoney at the 2013 Excellence Awards. The award recognizes the solid leading position of BBVA Provincial in the Venezuelan financial system.

Omni-channel strategy

BBVA is working on a multi-channel distribution model to respond to its customers’ current demands

BBVA has worked in recent years to create a multi-channel distribution model, with a greater importance given to non-physical channels, mainly digital, thus responding to current demands by most of its customers. The new technological possibilities have made BBVA a pioneer in establishing new models of customer relations, taking advantage of all the channels of interaction. This transformation has had clear effects in 2013, with initiatives such as:

- Launch of new websites in the main markets (Spain, Mexico and the United States), with a more user-friendly contextual navigation that not only satisfies but exceeds customer needs and expectations, going beyond what is simply conventional.

- Launch of new mobile banking applications, with a very significant growth in the number of users, and incorporation of innovative functionalities. In 2013, BBVA Compass mobile application received first prize in the “Mobile Banking Functionality” award from the prestigious company Javelin Strategy & Research. In addition, American Banker has put it among the 10 best applications on the market based on its functionalities, design and ease of use. BBVA is making a firm strategic commitment to cell phones, as it considers this is the best way of connecting with customers and helping them in their day-to-day needs.

- Boost to new formats in branches that are more innovative, modular and adapted to customer needs.

BBVA has decided to extend this transformation with a plan for the period 2013-2016, with three main objectives:

- Being the best valued bank in customer experience, and specifically head up experience in digital channels (Internet and mobile), measured in terms of recommendations (IReNe methodology) provided by customers.

- Increasing the penetration of digital channels and lead our competitors.

- Achieving a real omni-channel system by increasing sales and transactions in different distribution formats that provide an alternative to branches, with particular emphasis on sales by digital channels.

Initiatives for quality

The quality plans are a very important part of BBVA’s customer strategy

The quality plans are prepared taking into account all the information gathered through IReNe. They are a very important part of the BBVA strategy, given that they contribute to the aim of being the most recommended bank by our customers.

In 2013 the different Quality and Customer Experience units have continued to develop quality programs for the branch network, training actions for the whole workforce and improvement projects. The following table sums up the most important of these:

| Spain | Improvement plans based on recommendation surveys. |

|---|---|

|

|

Technological improvements and training plans aimed at continuous improvement of service quality. |

|

|

Development of customer service and management protocols. |

|

|

|

| Mexico | Design of a model of service in sale networks. |

|

|

Specific training plan for employees in BBVA products, services and culture. |

|

|

Standardized and simple communication. |

|

|

Lean process and simplicity. |

|

|

Guarantee of continuous operation and user-friendliness in remote channels. |

|

|

|

| Argentina | "Elijo la Excelencia" (I choose excellence) quality program focused on improving the service provided by the sales force. |

|

|

Customer recommendations form part of the incentives for the Bank's professionals. |

|

|

|

| Chile | Development of quality models for the Bank's different units, with tools for measuring performance, and recognizing the best performers. |

|

|

|

| Colombia | New service model focused on the IReNe measurements, which directly affects the team's incentives. |

|

|

Network quality plan. CEVALE certification for branches. |

|

|

|

| Peru | 2.0 quality model, with the commitment to "make the lives of customers easier, with quality and simpler use." |

|

|

Training plans and specific programs for promoting a culture of quality. |

|

|

|

| Venezuela | Quality plan "Haz la mejor jugada con Calidad de servicio" (Make the best play with Service Quality) aimed at the branch network, and focused on the training of teams. |

|

|

"Migration and Extension of Claims to Alternative Channels", which allows customers to use a sophisticated digital platform to fill in claims easily and simply, while providing a swift response thanks to automatic scoring. |

|

|

|

| The United States | Strengthening the Customer Experience team. |

|

|

Incorporation of the IReNe methodology in all the business lines, with weighting in employee incentives. |

|

|

Setting up a Client Advocacy Oversight Committee. |

|

|

"Frontline Friday" program. |

|

|

|

Complaints and claims management

A complaint or claim is an important milestone in customer relations; it is when we have to make the greatest effort possible to provide customers with service, demonstrate our commitment to them and the importance they have for us.

The current economic situation, growth in the business in some regions and the changes to financial rules and regulations, which are more demanding for financial institutions, is forcing us to make a bigger effort to manage any request, suggestion or disagreement from customers.

Average resolution times

(Calendar days)

Download Excel

Download Excel

|

|

2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|

| Spain | 12 (1) | 7 | 5 | 8 |

| Mexico | 8 | 7 | 7 | 7 |

| Argentina | 19 | 12 | 14 | 18 |

| Chile | 8 | 9 | 12 | 7 |

| Colombia | 7 | 7 | 12 | 14 |

| Peru | 12 | 16 | 11 | 10 |

| Portugal | 6 | 6 | 10 | 12 |

| Venezuela | 6 | 6 | 7 | 16 |

Throughout BBVA Group management models are being revised and developed with an emphasis on swift and flexible response, and providing an immediate resolution, using more efficient channels for receiving and resolving the cases presented, and in general simplifying the processes. As a result of this work the average times for managing claims are being reduced and customer perceptions on the quality of the process are improving.

One of the most important landmarks in claims management has been the adoption of the First Contact Resolution (FCR) methodology, which means some kinds of claims are resolved at the time they are put forward by the customer. Initially implemented by BBVA Bancomer, it has been extended to all the Group’s divisions, and led to improved customer satisfaction.

Claims presented by our customers to supervisory bodies are handled by the Bank’s specialized units and monitored closely by claims management teams, to ensure they are resolved in as satisfying way as possible for all the parties involved.

The complaints and claims management models are considered a great opportunity for listening to the voice of customers and strengthening our service

By understanding that complaints and claims are a way of listening to the customers’ voice and strengthening the service, work has been done in 2013 to develop the corporate claims management model and achieve a greater level of optimization and transfer of knowledge between the different areas and units of the Group, with the aim of implementing it fully in 2014.

Claims resolved by First Contact Resolution (FCR) in 2013

Download Excel

Download Excel

|

|

Spain | Mexico | Argentina | Chile | Colombia | Peru | Venezuela |

|---|---|---|---|---|---|---|---|

| % of claims resolved by FCR | n.m. | 16 | 33 | 30 | 82 | 37 | 23 |

Note: FCR is applied in Spain to credit and debit cards’ complaints, not to claims. This kind of management is not applied in Portugal.

Number of claims filed at the Banking Supervisory Authority

(For each 1,000 million euros of activity)

Download Excel

Download Excel

|

|

2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|

| Spain | 4 | 1 | 2 | 3 |

| Mexico | 394 | 302 | 412 | 425 |

| Argentina | 160 | 96 | 85 | 100 |

| Colombia | 142 | 114 | 192 | 231 |

| Chile | 16 | 19 | 29 | 26 |

| Peru | 41 | 39 | 30 | 27 |

| Portugal | 21 | 15 | 12 | 5 |

| Venezuela | 88 | 60 | 69 | 209 |