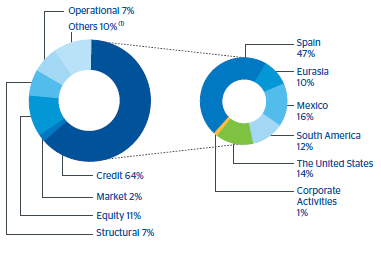

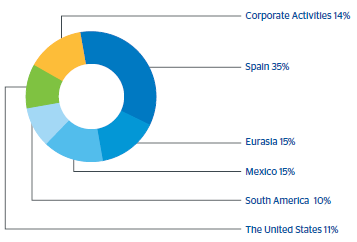

Attributable economic risk capital (ERC) consumption reached €29,145m as of December 31, 2011, an increase of 10.9% over 2011 figures, using com parable data (1).

The main risk continues to be credit risk on portfolios originated in the Group branch networks from its own customer base. This accounted for 64.2% of the total amount, with a year-on-year increase of 16.6%, due to the effect of the annual revision of the risk parameters in Europe, the inclusion of Garanti, and the increased exposure to euro depreciation. The ERC for equity increased by 28.2%. It includes the impact of the greater exposure in CNCB after its capital increase, and the effect of the exchange rate, due to the appreciation of the Hong Kong dollar. Structural interest-rate and exchange-rate ERC fell jointly by 30.2%, due to the conversion of preference shares and the impact of regulatory changes on the accounting of the exchange rate. The weight of ERC from market operations is reduced, due to a 13.9% decrease compared with the previous year. Finally, operational-risk ERC increased by 6.1%, due to the recalibration of the model at the end of the year.

In the breakdown by area, Spain registers an increase in ERC of 9.4% due to the above mentioned recalibration and revision of the models in the middle of the year. Eurasia (excluding Garanti) increased by 29.6%, also because of the recalibration and the impact of the exchange rate. In Mexico, ERC for credit risk went 17.7% up, mainly because of the implementation of new tools. The relative weight of the United States in global ERC remains similar, with a year-on-year increase of 5.1%. Finally, South America grew by 18%, basically because of the general and strong lending growth in every country.

Finally, the Group’s recurrent risk-adjusted return (RAR), i.e., that generated from customer business and excluding one-offs, stood at 20.1%, remaining at high levels in all business areas.

(1) The growth rates presented are calculated against the close as of the same time in December 2010 (€26,292m), which includes the annual effects of the updates carried out at the end of the year (Mexico, South America and United States) in the credit risk parameters and the revision of other risk models, as compared to the figure for 2011 (€29,145m).