In the difficult economic scenario described above, BBVA generated a net attributable profit of €3,004m. Excluding the one-off result from goodwill impairment in the United States, the figure would have been €4,015m.

By business area, Spain generated €1,363m, Eurasia €1,027m, Mexico €1,741m, South America €1,007m and the United States a negative €722m (a positive €289m excluding the goodwill impairment).

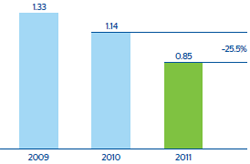

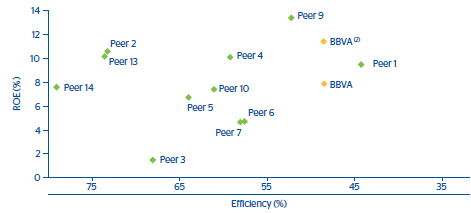

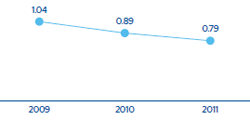

The annual earnings per share (EPS) were €0.64 (€0.85 excluding one-offs), compared with €1.14 in 2010, after correcting for the effects of the capital increase in November 2010, April 2011 and October 2011. The increase in the Group’s capital made the book value per share rise by 2.2% year-on-year to €8.35. ROE excluding one-offs stood at 10.6% (8.0% with one-offs) and return on average total assets (ROA) at 0.79% (0.61% with one-offs). These ratios make BBVA one of the most profitable banks in its peer group.