Policies

BBVA has always understood the need for teams specializing in the developer and real estate sector, given its economic importance and technical component. In addition, the Group has very clear criteria regarding the management of risk from this sector, including:

1. The avoidance of concentration in terms of customers, products and regions. Consequently, large-scale corporate transactions have been rejected, decreasing BBVA’s market share in the years of maximum lending growth.

2. Non participation in the second home market, standing behind public housing and participating in transactions on land with a high degree of urban security. As a result, BBVA’s collateral has a high quality, with 66% of loans to developers guaranteed with buildings (62% are dwellings, 89% of which are first homes or public housing) and 26% with land (of which 68% is urbanized).

3. In terms of home-buyer lending, the policy is to maintain a loan-to-value (LTV) under 80%, or otherwise, to require collateral or additional guarantees. Therefore, secured loans to households for the purchase of a home have an average LTV of 51%, and nearly 95% of this portfolio corresponds to the first residence.

4.In the case of real estate assets acquired by BBVA, distinction should be made between the types: completed, in progress and land. In the first type, the ultimate objective is their sale to individuals, fundamentally the Group’s customer base, using the Group’s various distribution channels. In the second type, the strategy is clearly focused on facilitating and promoting the completion projects. And in the third type, BBVA’s major presence on urban land simplifies work, though urban management and control of liquidity for the urbanization expenses are also subject to special monitoring.

Developer risk

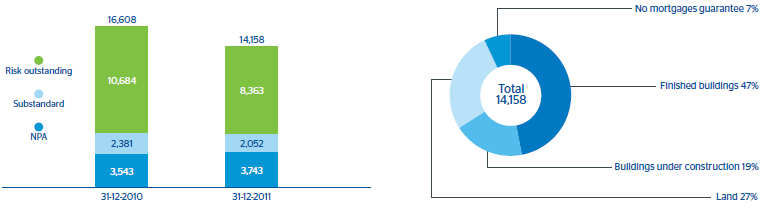

As of December 31, 2011, BBVA’s credit exposure in the developer sector amounted to €14.1 billion, 8% of the loans to other resident sectors in Spain (excluding the public sector) and barely 2% of the Group’s consolidated assets.

At the end of 2009, BBVA made an effort in transparency, and recognized €1,817 million as nonperforming loans mainly related with this sector. This stabilized the nonperformance ratio of this portfolio in Spain since then (5.0% as of December 2009 and 4.8% as of December 2011), compared to increases in this ratio incurred by competitors (+1.8 percentage points, approximately, in that period). Also, currently, 29% of the nonperforming assets are up-to-date on payments (subjective nonperforming). This percentage standouts as compared with the rest of the system.

According to Ministry of Economy and Competitiveness data, as of June 2011, the exposure of the Spanish banking system to this sector (developer and foreclosed) was €323 billion, which represents an approximate share of 6% for BBVA in this segment, as compared to the 11% share in the total loan-book in Spain. Of this amount, €176 billion were problematic assets of which BBVA only holds 6.2%.

Guarantees

The value of the guarantees covering developer risk, based on up-to-date appraisals, is €19,228 million, with an average LTV of 73.4%, which easily covers the portfolio value. In addition, specific recognized provisions are available, amounting to €1,241 million. Bank of Spain Circular 3/2010 requires the additional application, on the already-updated appraisal value of the guarantee, of several extremely strict regulatory coefficients ranging from 30% to 50%, depending on the type of asset. After applying the coefficient, the excess value above the guarantee value, which represents the amount to be provisioned, amounts to €1,725 million for nonperforming assets (with a coverage ratio of 65.1%, €1,123m), and €911 million for substandard assets (with a coverage ratio of 35%, €318m). Besides this specific provision, BBVA maintains an additional generic provision.

A total of 66% of loans to developers are guaranteed with buildings (62% are dwellings) and only 26% in land, of which 65% is urbanized. The figure for non-urbanized land is not significant.