The CR function is now entrusted to the Bank’s highest executive body

BBVA’s vision is “Working for a better future for people.” This slogan encompasses the Group’s Corporate Responsibility (CR) challenges. BBVA’s commitment in this area can be seen in the great progress made in the system of CR governance in 2011. It is the Group’s Management Committee itself that has exercised the functions of a Corporate Responsibility and Reputation Committee, thus entrusting these issues to the Bank’s highest executive body. This same model will be replicated locally in the major countries in which we are present.

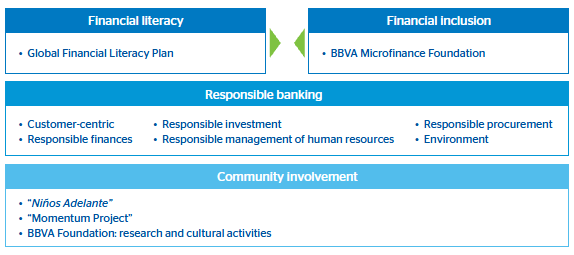

During 2011, other steps have been taken as part of the Strategic CR Plan approved in 2008. The plan comprises four core elements, consistent with the Group’s function in the community. On the one hand, financial inclusion makes it easier for the most disadvantaged segments of society to access financial services, thus helping to break the vicious circle of poverty. On the other hand, financial literacy ensures that this access is based on informed, and therefore responsible, decisions. Together with the integration of CR into the Group’s management system, these measures result in benefits for individuals and the community, and thus for the Group itself.

The core elements of the Strategic CR Plan are consistent with the Group’s role in society

1. Financial inclusion

This commitment was materialized by the creation of the BBVA Microfinance Foundation in 2007. At the close of 2011, the Foundation is present in six countries in Latin America, and it has 359 branches, 4,963 employees and 948,508 customers. It manages a volume of €737m in microcredits, with the average microcredit being €1,052. The focus on productive microfinance adopted by the Foundation is the most useful instrument for giving the most disadvantaged people access to the financial system.

2. Financial literacy

BBVA believes that informed decision-making helps improve personal financial situation, makes risk management for financial institutions easier, encourages saving and strengthens the overall financial system. This is why the Global Financial Literacy Plan was launched in 2009, benefiting 814,483 people in 2011.

3. Responsible banking

To create a credible CR policy, BBVA is working to integrate responsible management across the value chain, from the design of the product, its marketing and sale, to the management of its risks; and from customer advising (where we are committed to quality, customer satisfaction and service), to the Group’s human resources (where we promote diversity and fair opportunities), its suppliers (through the Responsible Procurement Program) and the environment (with a policy focused on sustainable environmental management and against climate change). BBVA’s approach to sustainability is based on the creation of value proposals for its stakeholders. It is important to note that the volume of funds managed with socially responsible investment (SRI) criteria accounts for 2.42% of the total amount this year, while the number of transactions financed under the Equator Principles has been 91, up to a volume of €5,404m.

4. Community Involvement

The aim of this commitment is for BBVA to contribute to the development of the communities in which it is present. One outstanding program in this area is the Community Investment Plan for Latin America, which consists of primary and secondary education scholarships for children from the most disadvantaged groups. In 2011, the Group invested €74.24m in community involvement. Finally, the launch of the Momentum Project is worth mentioning: an initiative created to promote social entrepreneurship in Spain and Portugal, and that aims to be extended to the rest of the regions in which the Group operates.

For more information about the CR activities in 2011, please refer to:

The Annual Report 2011 http://accionistaseinversores.bbva.com

and the website www.bancaparatodos.com