BBVA Group Highlights

(Consolidated figures)

|

|

31-12-11 | Δ% | 31-12-10 | 31-12-09 |

|---|---|---|---|---|

| Balance sheet (million euros) | ||||

| Total assets | 597,688 | 8.1 | 552,738 | 535,065 |

| Customer lending (gross) | 361,310 | 3.7 | 348,253 | 332,162 |

| Deposits from customers | 282,173 | 2.3 | 275,789 | 254,183 |

| Other customer funds | 144,291 | (1.3) | 146,188 | 135,632 |

| Total customer funds | 426,464 | 1.1 | 421,977 | 389,815 |

| Total equity | 40,058 | 6.9 | 37,475 | 30,763 |

| Shareholders’ funds | 40,952 | 11.6 | 36,689 | 29,362 |

| Income statement (million euros) | ||||

| Net interest income | 13,160 | (1.2) | 13,320 | 13,882 |

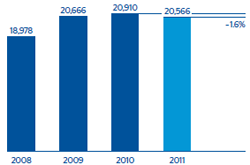

| Gross income | 20,566 | (1.6) | 20,910 | 20,666 |

| Operating income | 10,615 | (11.1) | 11,942 | 12,308 |

| Income before tax | 3,770 | (41.3) | 6,422 | 5,736 |

| Net attributable profit | 3,004 | (34.8) | 4,606 | 4,210 |

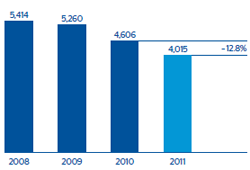

| Net attributable profit excluding one-offs (1) | 4,015 | (12.8) | 4,606 | 5,260 |

| Data per share and share performance ratios | ||||

| Share price (euros) | 6.68 | (11.6) | 7.56 | 12.73 |

| Market capitalization (million euros) | 32,753 | (3.5) | 33,951 | 47,712 |

| Net attributable profit per share (euros) | 0.64 | (44.1) | 1.14 | 1.07 |

| Net attributable profit per share excluding one-offs (euros) (1) | 0.85 | (25.5) | 1.14 | 1.33 |

| Dividend per share (euros) | 0.42 | - | 0.42 | 0.42 |

| Book value per share (euros) | 8.35 | 2.2 | 8.17 | 7.83 |

| P/BV (Price/Book value; times) | 0.8 |

|

0.9 | 1.6 |

| PER (Price/Earnings; times) | 10.9 |

|

7.4 | 11.3 |

| Yield (Dividend/Price; %) | 6.3 |

|

5.6 | 3.3 |

| Significant ratios (%) | ||||

| ROE (Net attributable profit/Average equity) | 8.0 |

|

15.8 | 16.0 |

| ROE excluding one-offs (1) | 10.6 |

|

15.8 | 20.0 |

| ROA (Net income/Average total assets) | 0.61 |

|

0.89 | 0.85 |

| ROA excluding one-offs (1) | 0.79 |

|

0.89 | 1.04 |

| RORWA (Net income/Average risk-weighted assets) | 1.08 |

|

1.64 | 1.56 |

| RORWA excluding one-offs (1) | 1.40 |

|

1.64 | 1.92 |

| Efficiency ratio | 48.4 |

|

42.9 | 40.4 |

| Risk premium | 1.20 |

|

1.33 | 1.54 |

| NPA ratio | 4.0 |

|

4.1 | 4.3 |

| NPA coverage ratio | 61 |

|

62 | 57 |

| Capital adequacy ratios (%) | ||||

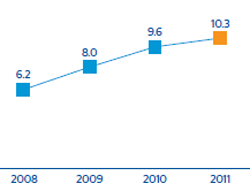

| Core capital | 10.3 |

|

9.6 | 8.0 |

| Tier I | 10.3 |

|

10.5 | 9.4 |

| BIS Ratio | 12.9 |

|

13.7 | 13.6 |

| Other information | ||||

| Number of shares (millions) | 4,903 | 9.2 | 4,491 | 3,748 |

| Number of shareholders | 987,277 | 3.6 | 952,618 | 884,373 |

| Number of employees (2) | 110,645 | 3.4 | 106,976 | 103,721 |

| Number of branches (2) | 7,457 | 1.3 | 7,361 | 7,466 |

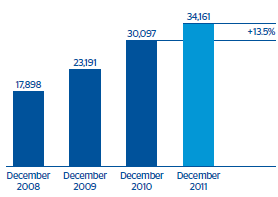

| Number of ATMs (2) | 18,794 | 10.2 | 17,055 | 15,716 |

General note: The consolidated accounts of the BBVA Group have been drawn up according to the International Financial Reporting Standards (IFRS) adopted by the European Union and in conformity with Bank of Spain Circular 4/2004, together with the changes introduced therein.

(1) In the fourth quarter of 2011 a charge was booked for goodwill impairment in the United States. The third quarter, both for 2009 and 2010, includes capital gains from the sale-and-leaseback of retail branches which have been allocated to generic provisions for NPA, with no effect on net attributable profit. And in the fourth quarter of 2009, there was an extraordinary provision and a charge for goodwill impairment in the United States. (2) Excluding Garanti.