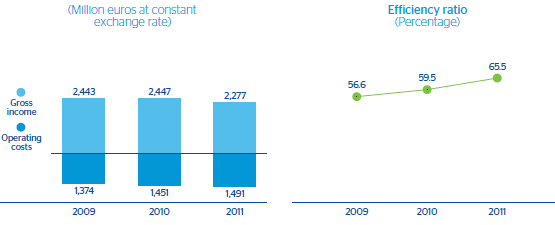

In 2011 the United States franchise showed a high resilience in quarterly net interest income. This is very significant, taking into account the gradual shift in composition of the loan portfolio toward lower-risk products with narrower spreads. This resilience is the result of good customer spread management. Net interest income for the year amounted to €1,590m, 7.4% below the 2010 figure. Annual income from fees and commissions was up 1.1% year-on-year to €632m, despite the enforcement of new regulations limiting them. All the above, together with lower NTI (down 8.1% year-on-year) caused by the market turmoil, and a greater contribution to the Federal Deposit Insurance Corporation (FDIC), brought gross income to €2,277m in 2011 (down 7.0% year-on-year).

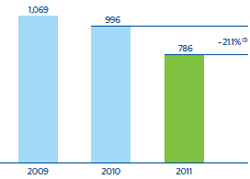

Operating expenses in the area increased modestly, despite the investment made in both people and technology. They grew by only 2.8% on the 2010 figure to €1,491m. The result was an operating income of €786m, down 21.1% over the year.

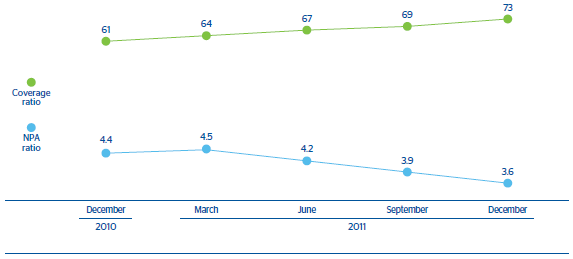

The gradual improvement in the loan-book mix, with additional increases in the weight of target portfolios (residential real estate and commercial) has had a clear impact on asset quality in the area, with NPA and coverage ratios continually improving from the previous year, and the risk premium also falling significantly. The NPA ratio fell by 81 basis points on the figure of 31-Dec-2010, and closed 31-Dec-2011 at 3.6%. The coverage ratio was 73% (61% at the end of December 2010). The cumulative risk premium in 2011 fell once more over the previous 12 months by 76 basis points to 0.93%, while impairment losses on financial assets for the year fell 48.7% on the 2010 figure to €346m.

The value of goodwill in the United States was adjusted in the fourth quarter of 2011 by €1,011m after taxes. Despite the positive performance of the franchise in 2011, the slower-than-expected economic recovery, a low interest-rate outlook and growing regulatory pressure, all imply a slowdown in expected earnings growth in this area. This goodwill adjustment has an accounting nature and does not have any negative impact on the liquidity or capital adequacy of either the area or the Group.

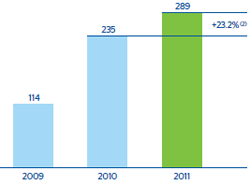

To sum up, the recurring revenue resilience, tight expense control and reduced need for loan-loss provisions explain the net attributable profit for 2011 of €289m (excluding the goodwill impairment), 23.2% up on the figure for 2010. Including the effect of the goodwill adjustment, the figure was a loss of €722m.

BBVA Compass Banking Group

The BBVA Compass banking group (BBVA Compass) basically includes the retail, commercial and corporate banking and wealth management businesses in the United States, excluding Puerto Rico.

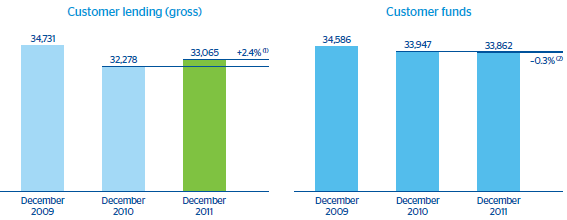

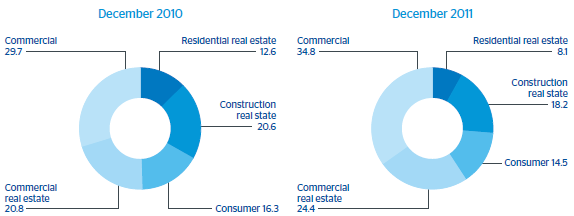

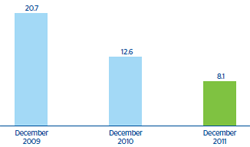

Gross customer lending in this unit was €33,065m as of 31-Dec-2011, a year-on-year rise of 2.4%, BBVA Compass continues to reduce its highest-risk portfolios and increase its exposure to the target segments. Thus lending to the residential real-estate sector, which currently amounts to 24.4% of the total, increased by 24.0% over the year. Loans to the commercial and industrial sector, which account for 34.8% of the total, were up 22.9% year-on-year. In contrast, construction real estate loans reduced its weight to 8.1%, decreasing over the year by 32.3%. This shift toward the commercial and industrial sector and residential real estate contributes to enhance the diversification of the entity’s loan portfolio, with greater weight of products with highest loyalty.

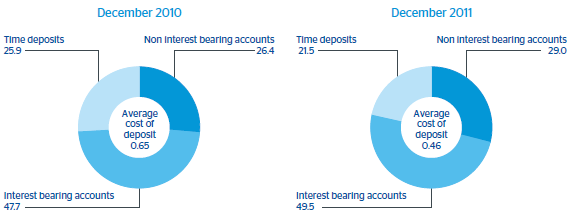

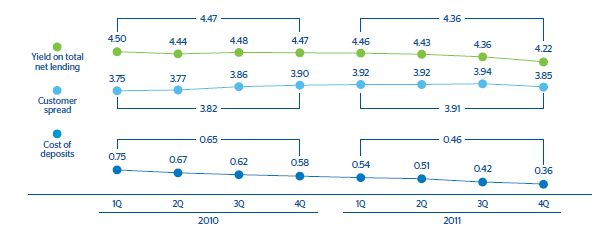

Customer funds remained stable in year-on-year terms and amounted to €33,862m. The performance of non-interest-bearing deposits (current and savings accounts) was particularly positive, with an increase over the same period of 6.2%. This had a positive impact on cost of deposits in the area.

From the results point of view, recurring revenue (net interest income plus income from fees and commissions) was resilient thanks to an adequate customer spread management and the success of actions taken to mitigate the effects of regulatory changes. It is important to stress that BBVA Compass maintained its profitability over the year in terms of net interest income over ATA, and at higher levels than its competitors. Fees and commissions closed 2011 at practically the same level as 2010, €525m (up 0.3%). This was achieved despite new regulations enforcing cuts. The above, combined with stable NTI and a greater contribution to the FDIC, resulted in a year-on-year fall of 6.3% in gross income to €1,936m.

Operating expenses increased modestly over the year by 0.9% to €1,300m, despite the ongoing investment plans in people and technology. As a result, the operating income amounted to €636m (down 18.2% year-on-year).

The most significant aspect in the year was once more the improvement in asset quality, which is an essential factor in the profitability of BBVA Compass. Moreover, impairment losses on financial assets fell back significantly to €332m (a year-on-year fall of 41.2%).

As a result, the unit contributed a net attributable profit, excluding the effect of the goodwill impairment, of €197m, up 39.3%. Taking into consideration the accounting impact on earnings of this goodwill impairment, the result was a negative €814m.

BBVA Compass continues to have sound solvency indicators, as shown by the level of its Tier 1 Common Ratio as of 31-Dec-2011 of 11.5% (according to local accounting criteria).

Below are the highlights of each of the units making up BBVA Compass:

Commercial Banking

Is the unit that handles business with SMEs. In 2011 it launched a series of highly successful products and services, such as: 1) Dealer Financial Services (DFS), which combines the services of a number of different departments with the aim of catering to the overall financial needs of car dealers. This initiative aligns local efforts in the United States with those of the global BBVA Group, thus increasing the capacity of BBVA Compass. In addition, the range of products and services offered to this segment increases; 2) New Healthcare Receivables Solution, a new payment collection service for the health sector. The healthcare industry is a broad sector that is constantly changing. It features rapid growth, difficult collection management, high loss provisions, exhaustive information requirements and strict privacy regulations. The sector is potentially an extensive market for BBVA Compass, and this new service allows the bank to meet its needs, basically in terms of payment and collection management. It is also an on-line service that converts explanation of benefits (EOB) forms into electronic files, manages payment and collection, organizes information into an on-line file compatible with the industry’s regulatory framework, HIPPA, and alerts the customer electronically of any payments or collections made.

Corporate Banking

Which specializes in large corporations, increased the size of its loan portfolio by 8.8% in 2011, while deposits remained stable.

Retail Banking

The unit that serves retail customers. In 2011 it had an excellent year, thanks to the positive performance of its residential real-estate portfolio. Customer funds fell due to the drop in higher-cost funds, while more liquid funds performed very positively. As is the case with the other units, it is highly customer-centric. This year it continued to make progress along this direction, paying particular attention to the individual customer and small business and SME segments with the aim of meeting the specific needs of each of them. The unit has played a significant role in BBVA’s commitment to make the most innovative interactive technology available to customers. In 2011 BBVA Compass won more than 630,000 new on-line customers, with a market penetration of 43% (36% at the end of December 2010). It is important to note that these customers have been shown to be extremely loyal: their retention rate is high, at 87% of active users (95% in the case of those customers who are also active users of the on-line bill payment service). Two of the unit’s strategic priorities are development of alternative channels other than branches, such as mobile or on-line banking, and the improvement of the customer experience.

Wealth Management

In 2011, this unit offered four MarketLink CDs and obtained USD 22m from the sale of new CDs. It also adopted SmartPath® discretionary wrap products for local customers (who have a broker and a dealer), and in the second half of the year launched SmartPath® Diversified Portfolios for international customers.

New York

Finally, the New York business follows the same pattern as the rest of the Group’s WB&AM units: a focus on higher added-value and more loyal customers, price management and stronger cross-selling.