Solid BBVA performance against a backdrop of maximum stress

The year 2011 has been one of maximum stress levels in terms of liquidity and sovereign risk in the euro area. In this context, the Group continues to demonstrate its recurrent earnings and structural strength. This standout performance is due to BBVA’s banking approach developed around four pillars:

1. A portfolio model characterized by its:

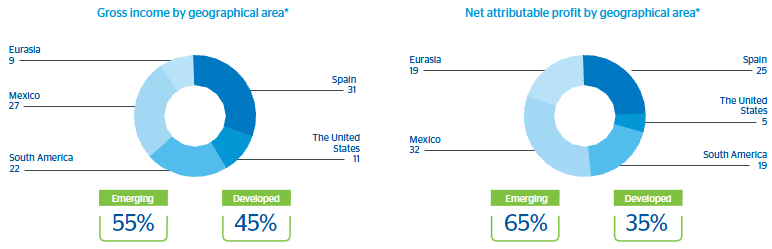

- Well-balanced diversification in terms of geographical areas, businesses and customers. This diversification continued to add value in 2011, showing BBVA’s resilient earnings. In this regard, almost 55% of gross income originated in emerging countries.

- Franchises with a sufficient critical customer base, holding leading positions (1st/2nd in Spain, market leader in Mexico, 1st/2nd in South America, leadership position in the US Sunbelt) and with important holdings and strategic alliances in Turkey and China.

2. A business model based on three elements:

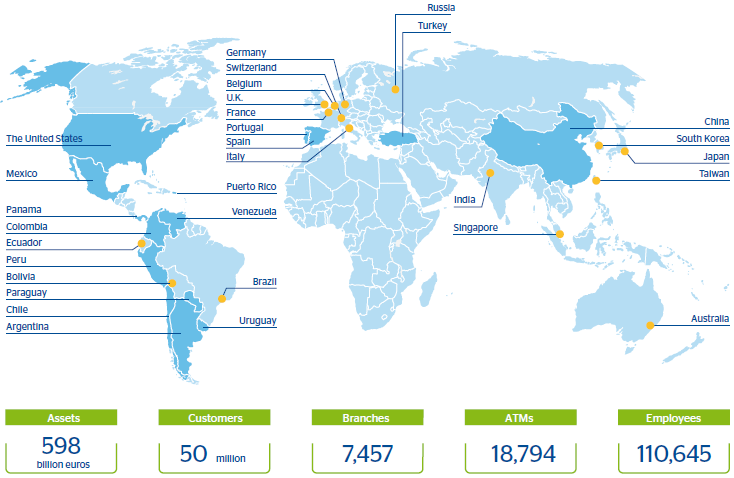

- A retail banking model focused on lasting relationships (customer-centric approach) with a very broad customer base (50 million customers worldwide). This ensures highly recurrent earnings and very stable financing in the form of client deposits.

- A broad distribution network that leads the market in terms of efficiency. It should be mentioned that BBVA business share is greater than the network share in every franchise.

- Technology, a pillar that has been markedly supported by BBVA in these last years to improve efficiency. The size and scale of the Group have allowed it to take on important investments in global technology projects, especially in the fields of transformation and innovation

3. A management model in which decisions are always made under two premises: prudence and anticipation. Prudence is used when making decisions on governance, structural and credit risks, capital and M&A transactions, while anticipation refers to the priority that BBVA gives to decisions made in response to relevant changes with medium term impact in the environment, competition and customers. These are some examples:

- The network share limitation strategy implemented by the Group in Spain in the context of the Innovation and Transformation Plan launched at the end of 2006 resulted in standout performance in terms of revenue, expenses and risks as compared to the local competitors during the crisis.

- The portfolio structure change in Mexico. On the one hand, towards mortgage business with the purchase of Hipotecaria Nacional. This acquisition tripled BBVA Bancomer’s share in the segment in 2004. And, on the other hand, towards SMEs with the creation of the “SME Network” in 2008. This action placed the Bank in the leading position for SME lending with a major advantage over its competitors.

4. A governance model founded on the absolute principles of integrity, prudence and transparency, whose primary objective is to create value for its shareholders. This always holds true when achieving results is subject to the essential corporate principles of integrity, prudence and transparency. All in all, the Group works to create value for its stakeholders (basically shareholders, employees, providers, customers and society). The current financial crisis exposed the unsustainability of models focused exclusively on short-term financial earnings, and BBVA firmly believes that putting principles first in the Group’s governance management is a competitive advantage in itself.

This banking model based on the four pillars explained above translates into two distinguishing advantages: recurrence and structural strength.

1. Recurrence because BBVA continues to demonstrate a strong capacity to generate recurrent and sustainable earnings year after year. In bullish periods, BBVA already recorded better performance than its competitors, and it has continued to do so during the crisis.

2. Structural strength, because the Group maintains a healthy, balanced, well-capitalized balance sheet with well-known and under-control risks, and with an adequate financing structure relying on its broad customer base. BBVA has the lowest leverage of its peer group. Furthermore, its capacity to generate capital organically is one of the most solid of its reference group, as explicitly demonstrated in the stress tests published by the European Banking Authority (EBA).

And this banking model has made it possible for BBVA, not only to record outstanding performance during the crisis but also to be prepared to successfully address the coming changes in the industry in both the short and long-term.

Expectations

There are three fundamental strengths that will transform the financial sector and, therefore, will define the new financial industry that will have to operate against a backdrop of great uncertainty.

In the short-term, compliance with new regulatory and supervisory demands will be required, and coping with a very complicated macroeconomic and financial situation will still be necessary.

As far as regulation is concerned, new capital and liquidity standards were designed to reinforce the financial system and improve risk measurement in the European Union. The transposition of Basel III in the proposal of the European Capital Requirements Directive (CRD IV) to be approved by European institutions throughout 2012 is a clear example.

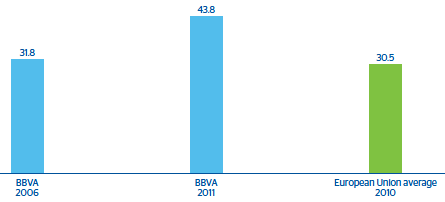

Furthermore, the EBA took several measures designed to restore the markets’ trust in the financial sector (i.e. the stress test and the recapitalization plan). The results of the European stress test highlighted that BBVA is one of the most solvent banks in the world, with a core capital ratio of 9.2% in the adverse scenario and capital quality that is far above the average of its competitors. Regarding the recapitalization plan, BBVA will comfortably achieve the 9% core capital temporary requirement of the EBA as of June 2012, thanks to the Group’s recurrent capacity to generate capital organically, a lower leverage ratio than its peers and a prudent risk management background.

Finally, international regulation is boosting the technological development of optimal, efficient market infrastructures. In this regard, BBVA is at the financial sector’s forefront, and technological innovation is one if its key competitive advantages.

Furthermore, there is a macroeconomic transformation underway characterized by elements such as: a duality between emerging and developed economies, reduced economic growth on at a global level, deleveraging, financing and recalibration of risks, etc.

Moreover, looking beyond the short-term is also essential. As a result of the crisis, technological advances and social changes, the industry will suffer a transformation process in supply and demand in the medium term. On the demand side, the way in which customers are approached is evolving and BBVA continues to be determined to anticipate their needs, so that they may choose where, when and how to access the Bank. On the supply side, the sector as a whole is faced with an outlook of greater pressure in terms of profitability, liquidity, growth, reputation and innovation. This pressure will encourage entities to carry out innovative actions, break with the established standards and radically transform the way in which banking is understood today.

This situation of uncertainty and continuous transformation represents a great opportunity for BBVA to lead the change of the banking system. The Group will definitely continue to meet the regulatory, financial and macroeconomic demands, as it has to date. Moreover, the Bank is also working to reinforce its positioning and strategy in the medium term, in response to the pressures faced by the sector. BBVA will thus maintain the essence of its model intact, by taking actions in each of the four pillars above and setting clear objectives for each of them.

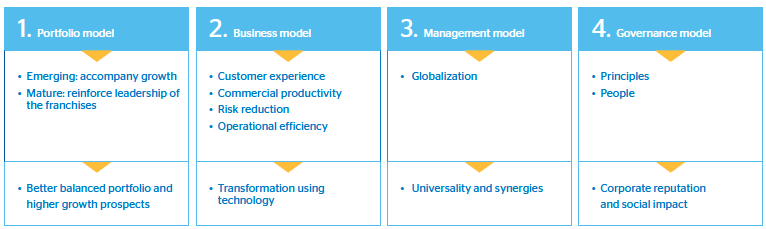

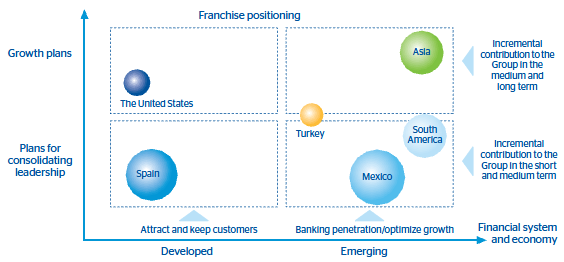

1. A better balanced business portfolio and higher growth prospects. That is, to make the most of every business and customer, and of BBVA’s current footprint. This will be achieved by acting on two fronts:

- Developing those franchises where BBVA has most recently begun to operate. This would imply taking steps in the development of the United States, China and Turkey business units into the Group.

- In the rest of the franchises, the focus will be placed on consolidating their leadership within their respective geographical areas, on profiting from growth in emerging markets and on gaining market share in developed areas. This would require taking a step forward in service quality and living up to customers’ expectations, being able to widen the financial offering according to their increasing sophistication.

2. Transformation using technology, that is, taking advantage of the opportunities technology presents to build a more innovative, more efficient, more customer-centric, better-quality model. BBVA has made an important investment effort in technology over the past years, aiming to lead the financial sector transformation. Specifically, there are currently four core investment initiatives in the Group:

- First, BBVA is investing in improving the customers’ experience in order to achieve a service model that meets their preferences and needs through any distribution channel. And this involves investing in two key capacities. On the one hand, customization of the range of products offered based on quality, simplicity, ease of use and innovation. On the other hand, integration of the physical and virtual world, which translates into an efficient, collaborative and multi-channel distribution model.

- The second aim is to increase commercial productivity. There is a dual purpose in this regard: reinforce our leadership in efficiency and our ability to adapt to new clients’ demands. To do so, an investment has to be made in customizing management, with an integrated commercial vision to increase sales, productivity and service quality, and on the ubiquity of managers to be able to provide a more flexible, agile and global service.

- The third objective is to continue investing in risk control tools, with the intend to widen BBVA’s competitive advantage in terms of risk quality.

- Finally, the Group is investing in improving operational efficiency; that is, in streamlining processes and strengthening infrastructure.

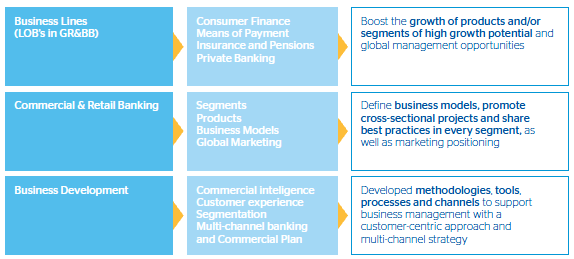

3. Universality and synergies, making the most of every business area and customer and BBVA’s footprint. This also implies homogenizing the Bank where it makes sense and reinforcing and promoting cross-sectional management of business and support units, which will generate significant synergies in coming years.

In 2011, the Global Retail & Business Banking unit was created. This unit is responsible for launching new global business lines, servicing (also globally) some segments and ensuring that best practices are being applied throughout the Group. Thus, the Group is moving towards greater globalization of the retail business, as this globalization has been implemented in the Group’s wholesale business for several years. As well in 2011, an ambitious transformation plan was launched for all central services to make their management more cross-sectional and, as a consequence, more efficient.

4. Involving the stakeholders. BBVA undertakes an absolute commitment before every one of its stakeholder groups: employees, customers and society in general. In a crisis situation like today, in which the reputation of the sector has been more negatively impacted than ever, acting and communicating are essential.