In 2011, the climate of uncertainty with respect to economic recovery maintained interest rates low and led to falls in long-term rates in Europe, the United States and Mexico. In contrast, in South America there was a steady upswing in interest rates as a result of the growth rates observed in the region.

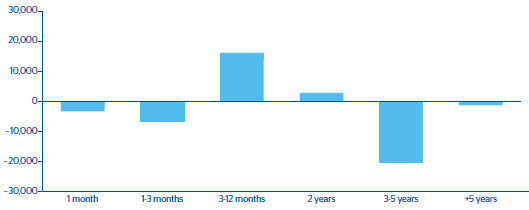

Movements in interest rates lead to changes in a bank’s net interest income and book value, which constitutes a key source of asset and liability interest-rate risk. The extent of these impacts will depend on the bank’s exposure to changes in interest rates. This exposure is mainly the result of the time difference between the repricing and maturities of the different products on the banking book. The accompanying chart shows the gaps in BBVA’s structural balance sheet in euros.

A financial institution’s exposure to adverse changes in market rates is a risk inherent in the banking business, while at the same time representing an opportunity to generate value. This is the reason why asset and liability interest-rate risk management takes on particular importance and moreover in the current environment. This function is handled by the Balance-Sheet Management unit, within the Financial Management area. The Asset and Liability Committee (ALCO), it is in charge of maximizing the Bank’s economic value, preserving the net interest income and guaranteeing the generation of recurrent earnings. In pursuance of this, the ALCO develops various strategies based on its market expectations. These strategies are developed within the risk profile defined by the BBVA Group’s management bodies and balancing the expected results and the level of risk assumed. BBVA has a transfer pricing system, which centralizes the Bank’s interest-rate risk on ALCO’s books and is designed to facilitate proper balance-sheet risk management.

The Global Risk Management (GRM) corporate area is responsible for controlling and monitoring asset and liability interest-rate risk, acting as an independent unit to guarantee that the risk management and control functions are properly segregated. This policy is in line with the Basel Committee on Banking Supervision recommendations. It constructs the asset and liability interest-rate risk measurements used by the Group’s management, as well as designing models and measurement systems and developing monitoring, information and control systems. At the same time, the Risk Management Committee (RMC) carries out the function of risk control and analysis reporting to the main governing bodies, such as the Executive Committee and the Board of Director’s Risk Committee.

BBVA Group has a sophisticated structural interest-rate risk model made up of a set of metrics and tools that enable its risk profile to be monitored precisely. For accurately characterizing the balance sheet, analysis models have been developed to establish assumptions dealing fundamentally with early loans amortization and the behavior of deposits with no explicit maturity. As well as risk with respect to parallel movements from cash-flow mismatch, the model includes other additional sources of risk such as changes in the slope and curvature of the interest rate curve. The Risk area does this by applying a simulation model of interest-rate curves that quantify risks in probabilistic terms and takes into account the currencies and business units diversification. This model calculates the Group’s earnings at risk (EaR) and economic capital, defined as the maximum adverse deviations in net interest income and economic value, respectively, for a particular confidence level and time horizon. The model is subjected periodically to internal validation, with backtesting of the simulation model and the assumptions.

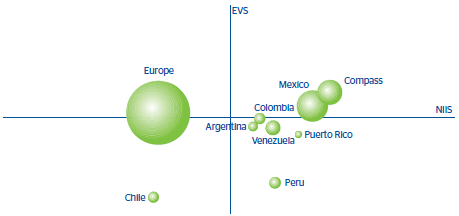

In addition, sensitivity is measured to a standard deviation of 100 basis points for all the market yield curves. Chart 32 shows the asset and liability interest-rate profile of the main entities in the BBVA Group, according to their sensitivities.

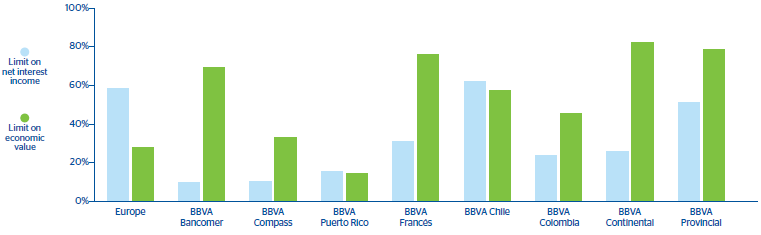

The risk appetite of each entity is determined by the Executive Committee and is expressed through the limits structure, which is one of the mainstays in control policies. Thus, the maximum negative impacts, in terms of both earnings and value, are controlled in each of the Group’s entities through this limits policy. Active balance-sheet management in 2011 has enabled the Group’s exposure to be maintained in keeping with its target risk profile, as presented in Chart 33, which shows average limits used in each of the Group entities.

The risk measurement model is supplemented by analysis of specific scenarios and stress tests. Stress tests have taken on particular importance in recent years. Progress has therefore been made in the analysis of extreme scenarios in a possible breakthrough in both current interest-rate levels and historical correlations and volatility. At the same time, the evaluation of scenarios forecast by BBVA Research has been maintained. In addition, monitoring the contribution to risk by portfolios, factors and regions, and its subsequent integration into joint measurements, continued during the year.