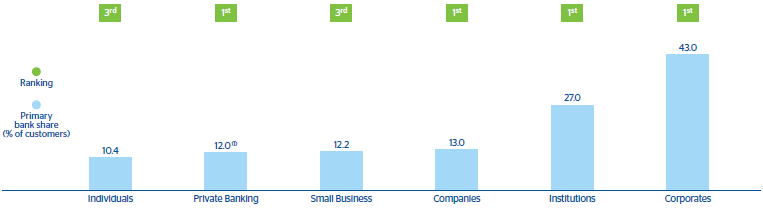

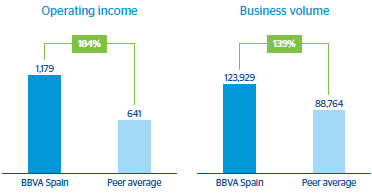

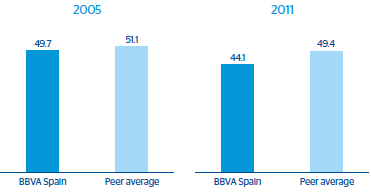

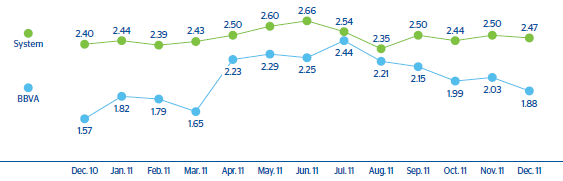

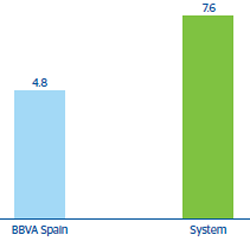

Against this backdrop, which is especially trying from the management standpoint, BBVA continues to consolidate its leading position among the rest of its competitors in the system. This leadership is clearly reflected in terms of profitability, efficiency, asset quality, funding structure and competitive positioning.

Three management keys are at the root of the area’s strong performance in 2011:

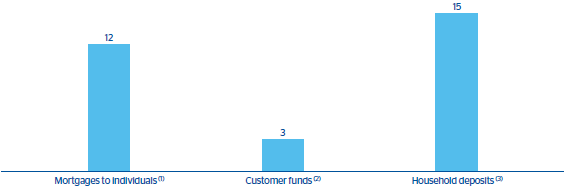

- First, in a context of lending weakness, BBVA has been able to increase its business share selectively in those products that are essential to customer-loyalty, such as the mortgage portfolio and customer funds.

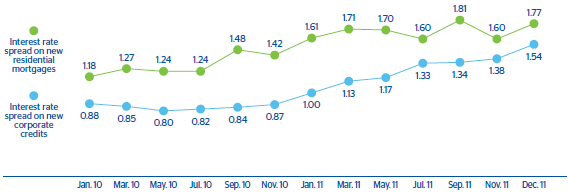

- Secondly, the solid management of prices and spreads carried out was also noteworthy. On the one hand, credit has been repriced and, on the other, a significant defensive strategy has been carried out for the balance and cost of retail funding in a very difficult period in which there still has been a liability war within the system.

- Thirdly, at a time in which asset quality in the system continues to deteriorate, BBVA kept its risk indicators in Spain contained. For another year, the area benefitted from its strategy of anticipation and risk selection implemented during the years of the credit boom.

Specifically, the area’s strategy is based primarily on two management capacities that are widely recognized by the market.

1. On the one hand, its network management capacity, which allows the distribution structure of BBVA in Spain to lead in efficiency and productivity.

2. On the other, its risk management capacity, which is defined by constant anticipation and control efforts.

Looking towards the future, BBVA Spain’s action will focus on three axes:

First, commercial strategy will be focused on capturing new customers and increasing customer loyalty. BBVA would like to become the first provider of financial services for a larger number of individuals and companies. To do so, the Entity will continue to invest in developing a service of higher quality, with a closer and more personalized approach for each one of its customers.

Second, BBVA is taking major steps in the technological evolution of its distribution model, in the development of its technological channels and in the integration of physical and virtual banking. Along these lines, “BBVA Contigo” was launched in 2011. This is an innovative, personalized, remote management service geared towards customers who do not wish to physically go to their branch.

Third, and also in the sphere of technology, the area would like to continue increasing the automation and digitalization of its processes in order to reduce operating costs while encouraging quality and reliability.

These three axes of action will continue to reinforce the Group’s presence in Spain and BBVA’s leadership in the technological transformation of the industry.

In conclusion, due to its positioning, standout strength and anticipation, BBVA is one of the best positioned players to take advantage of the opportunities that may arise in the financial system restructuring.