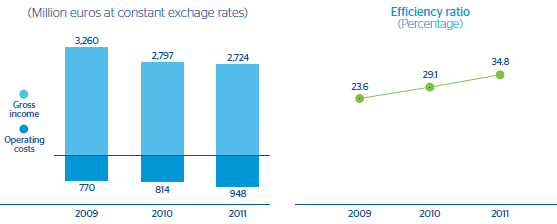

In a particularly difficult environment in 2011, when most of the European banks announced significant deleveraging plans and there was a notable reduction in activity in wholesale business, BBVA managed to recover competitiveness. This is due to the Group’s superior business model based on customer relations (source of most of revenues), which produces high quality recurrent earnings, as well as reduced leverage. Gross income for the year to December was negatively affected by trading results and went down 3.9% on 2010 to €2,724m (–2.6% at constant exchange rates). By geographical areas, there was significant growth in Asia, at 6.4% year-on-year, and Europe (excluding Spain), which was up 3.3%.

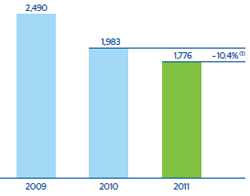

Operating expenses ended the year 15.6% up on the previous year, mainly due to investment plans in IT systems and the various growth plans implemented in the different geographical areas. As a result, the operating income was €1,776m, 11.8% down on the figure for the previous year (–10.4% at constant exchange rates).

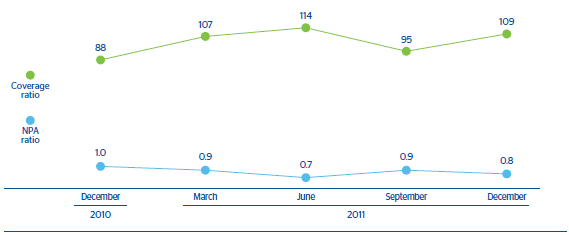

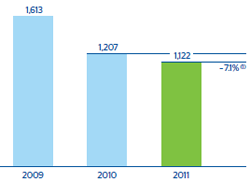

The different business units in this area continue to show high asset quality, and thus, a low NPA ratio, a high coverage ratio and loan-loss provisions that represent 5.1% of operating income. The net attributable profit for the year was €1,122m, down 8.3% on the figure for 2010 (–7.1% at constant exchange rates).

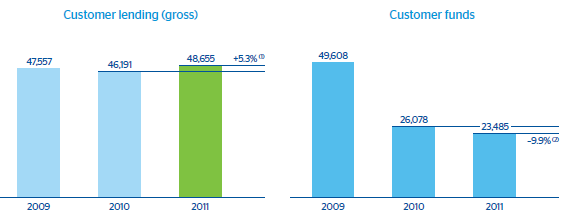

The Corporate and Investment Banking unit of WB&AM managed gross lending to customers of €48,655m and customer funds of €23,485m. Adding these figures to the balances in Global Markets, which were significantly affected by developments in financial markets over 2011, WB&AM ended the year with a loan book of €58,618m and customer funds of €39,644m.

Corporate and Investment Banking

This unit coordinates the origination, distribution and management of a complete catalogue of corporate banking, investment banking and global transactional services products.

The main transactions carried out in 2011 are summarized below:

Within the Corporate Lending activity in Spain, the most remarkabletransactions included are those with Amadeus, Iberdrola, Red Eléctrica and Ferrovial; BBVA thus ended the year in first place in the Dealogic and Thomson Reuters rankings. In the European market, it stands out the acquisition of Foster by Sab Miller and of Parmalat by Lactalis. In Latin America it has been led numerous transactions with Bimbo, Mexichem, America Movil, Pexem and Votorantimreaching the first place in number of syndicated transactions, according to Dealogic, was achieved.

The activity carried out by the Project Finance unit in Europe set BBVA as the leader in sectors like renewable energy and environment, in which more than 20 deals were closed in Spain, Italy and the United Kingdom. These includewind farms and small hydroelectric power stations pertaining to Acciona. In social and transportation infrastructures, the activity was concentrated in France, Spain, Germany and the United Kingdom, with projects like the Tours-Bordeaux and Brittany-Pays de la Loire high-speed rail lines, the stadium in Nice and the A8 and A9 highways. In Latin America, it stands up the North Ring highway and the acquisition of Altamira LNG in Mexico, and the financing for Transportadora de Gas del Perú, S.A.. In Asia, the presence of BBVA in the region was consolidated by leading transactions in transportation, water and energy sectors. Likewise, the opening of the Taiwan and South Korea offices allowed reinforce the coverage in those. Finally, in North America, it participated in the financing of four gas generation plants for Edison Mission Walnut Creek and Los Esteros, in California, and in renewable energy should be mentioned the 250 megawatt Nextera project Genesis Solar Thermal Power. As recognition for the project finance activity of its powerful franchise in United States, BBVA obtained the “Best Finance House in Renewables 2011” award from Environmental Magazine.

Structured Trade Finance has maintained a positive course in 2011, with increases in both the number of deals closed and in volume. The above demonstrates, once again, the Group’s global capacity for origination. Moreover, the rapid generation and optimization of synergies should be mentioned. These are reflected in the signing of the finance of the extension of the primary refinery in Turkey with the backing of Cesce that, with a €3,000m investment, is the biggest venture capital operation in the history of Turkey. This transaction is being carried out with the collaboration of Garanti. Finally, BBVA was awarded with the GTR prize for “Best Trade Finance Bank in Latin America 2011” for the third consecutive year.

In the Corporate Finance unit, BBVA closed the year, for the third consecutive time, as market leader in Spain in mergers and acquisitions (M&A) according to Thomson Reuters, with 16 deals announced in 2011 and a clear cross-border focus (10 deals), and as advisor of choice in the American continent (5 deals). Thanks to its customer-centric business model, the quality of the advisory services and recurrent leadership in the Spanish market in M&A, BBVA has been recognized as Best M&A Advisor in Iberia in 2011 by Financial Times - Mergermarket. Of the transactions carried out, the following are worth highlighting: 1) advisory services for Cepsa for the takeover bid of IPIC, the largest corporate transaction in mergers and acquisitions in Spain in the year and the biggest-ever made by a Middle Eastern buyer in Spain, 2) the spin-off of Saba (Abertis) and 3) advisory about the share capital increase subscribed by Sinopec in Galp’s Brazilian subsidiary, which was the biggest operation by a Portuguese group, and also the largest M&A transaction in the Brazilian energy market in the year.

In Equity Capital Markets, the instability and volatility of the financial markets caused decreased in the world equity activity, but mainly in Europe. In Europe, it participated in Bankia’s initial public stock offering and Commerzbank’s share capital increase. In Asia, BBVA participated, as joint lead-manager, in the international tranche of CITIC Securities going public on the Hong Kong stock exchange. In Mexico, BBVA Bancomer maintains its leadership position, after having participated in the initial public stock offering of Banregio and Aeroméxico and in the share capital increase of Banorte.

In 2011, the structures of Global Transactional Banking were reorganized in all geographical areas, with the unification of Global Transaction Services, Transactional Trade Finance and Transactional Bankers into a single area. Relevant operations include the bid bond regarding the tender for the assignment of broadband frequencies in Italy, technical guarantees issued as coverage for an export of aircrafts from Italy to Mexico and, in trade finance, the heightened level of activity achieved with the issue of silent guarantees in the oil operations. Various products that were launched, reinforce BBVA’s interest in innovation as a means of offering increasingly improved benefits to its customers. These include the launch of “Bancomer net cash” in Mexico and “BBVA net cash” in Puerto Rico, both as a result of the PIBEE project (Integral Electronic Banking Project for Companies); in Argentina, the “Servicio de Pago a Proveedores” Supplier Payment Service; in Spain and Portugal, “BBVA net cash mobile” and “BBVA net advance”, the new online channel accessible for non-customers, the digital reader for the depositing of checks of “BBVA net cash” and the “3SKey” service, that improves the security of global connections through the SWIFT and host-to-host channels. BBVA has been named the “Best Supplier of Cash Management Services” for companies and public institutions in Colombia by Euromoney, and the “Best Internet Bank” in the category of corporate and institutional banking in Puerto Rico by Global Finance. It has also received the “Recommended” category in the Agent Banks survey for Major Markets by Global Custodian and “Top Rated” in the Sub-Custody Survey by Global Investor. Also worth mentioning is its award as Best Trade Finance Bank in Latin America from Global Trade Review, which reflects the opinions of customers in relation to its Transactional Trade Finance services, and first prize in the World’s Best Trade Finance Banks 2012 for BBVA in Spain from the magazine Global Finance.

Global Markets

This unit handles the origination, structuring, distribution and risk management of market products, traded through markets in Europe, Asia and the Americas.

Despite the complicated market environment, Global Markets was able to increase its revenues from customers by 6.6%, thanks to the good performance of those from retail and corporate customers. This meant that the Group’s customers still support the products and services of this unit, which continue to receive acknowledgements from specialized publications. In its 2011 survey, FX Week considered BBVA the fourth most valued bank among customers, the second most recognized by corporate customers and the fourth among investors in Latin American currencies. BBVA also appears for the first time in FX Week’s ranking of banks at a global level, in 26th place.

As recognition for the excellent work with customers, Global Markets received numerous awards in 2011, including “Derivatives Dealers 2011” from the Risk magazine, winning in the categories of risk management advisory and operations with derivatives, organized derivatives, exotic currency derivatives, derivatives research and best structured product for the retail market. It was also honored as the best equity house in Spain and Portugal in 2011, and the annual survey conducted by Extel, leading in the categories of “leading brokerage,” “country analysis,” and “corporate access” of said survey, and taking second place in “equity sales” and “small&mid caps sales”.

By underlying assets, the advance of interest, credit and currency rates stand out. And by region, growth in Europe is outstanding, despite the complicated macroeconomic situation in the region. Global Markets reinforced the cross-border business thanks to the global nature of the products and closer cooperation achieved between the different teams.

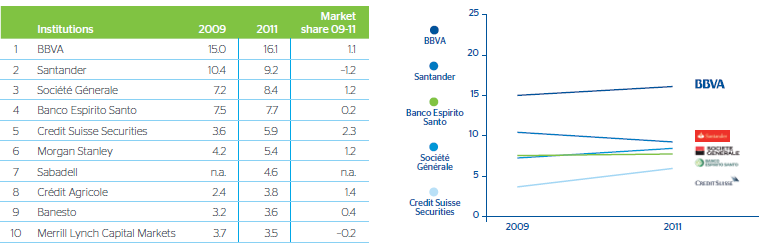

In 2011, the results of Global Markets in Spain were affected by limited economic activity and market uncertainty. Despite these, revenue from customers has grown, particularly in strategic businesses such as credit, where income increased by 38% on the previous year. By type of customer (institutional investor, corporates, global public finance, SMEs and retail) there was a notable positive development in global public finance, with revenue up 22% respectively on 2010 figures. Trading activity was affected by high market volatility, the sovereign debt crisis in a number of euro zone countries, and uncertainty associated with regulatory changes. Despite these, BBVA improved its results on 2010 in equity, exchange rate and interest rate products. In Spain, BBVA consolidated its leading position in equity brokerage, with a market share of 16.1% at the end of 2011, 6.9 percentage points above its nearest competitor.

In the rest of Europe and Asia, revenues from customers also increased 25% in the last twelve months, thanks to the good performance of practically all of the products. The biggest revenue still comes from interest rates (up 37% year-on-year) and equity (up 26% year-on-year) products.

In Global Markets Mexico, revenue from customers has continued the excellent trend begun some months early, with a rise of 25% in year on year as a result of a positive performance in practically all products. By type of customer, there was a notable increase in revenue from corporates. In contrast, trading income in 2011 was affected by the turmoil in the markets. Despite this, revenue from exchange rate products was positive (up 23%).

In South America, Global Markets customer revenue grew 7% year-on-year. By product, the biggest increases were in interest rates and exchange rates (up 33% year-on-year).

In Global Markets United States, the outstanding performers were interest-rate and credit products. By type of customer, there was an increase in corporates, SME’s and retail.

Asset Management

Asset Management is the BBVA’s provider of asset management and incorporates the design and management of mutual funds in Spain, Mexico and South America, the pension fund business in Spain and the third-party funds platform of Quality Funds.

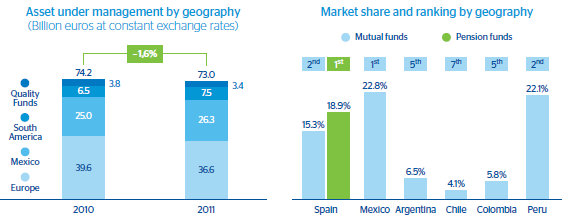

This unit, with global assets under management of €72,998m, continues to be a key player in mutual fund and pension fund management in the geographical areas in which it operates. In Spain it has a market share of 15.3% of assets under management in mutual funds and is still the clear leader in pension fund management. In Mexico, it maintains its leading position in the management of mutual funds, with a market share of 22.8%, and in the rest of Latin American countries it has continued to grow, with a year-on-year increase in assets of 12.5% as of 31-Dec-2011.

In BBVA Asset Management, there has been a growing commitment to socially responsible investment, which incorporates new extra-financial, environmental, social, ethical and corporate governance variables (ESG variables) into management, with the aim of obtaining greater returns on portfolios through a correct management of ESG risks.