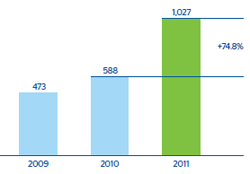

Given this background, Eurasia continues to perform well overall, generating an accumulated net attributable profit of €1,027m in the year, which represents 25.6% of the Group’s total earnings excluding one-offs. Therefore, it is an area with a growing contribution in terms of both earnings and balance sheet weight. This franchise shows a very positive performance, contributes to a significant level of geographical diversification, and is a reflection of the Group’s commitment to emerging countries with economic growth potential.

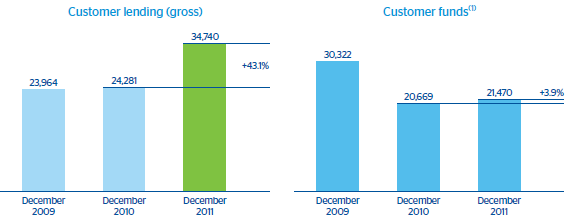

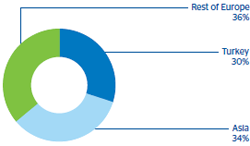

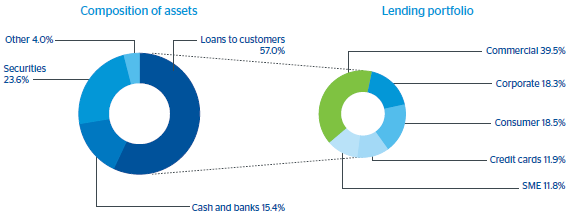

In terms of business activity in the area, gross lending to customers as of 31-Dec-2011 amounted to €34,740m. This represents a year-on-year increase of 43.1%, due to the incorporation of Garanti. Excluding the contribution from the Turkish bank, the loan book remained very stable, with an increase of 3.2%.

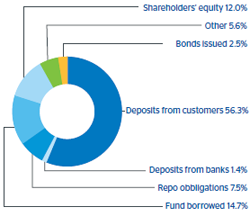

Furthermore, customer funds totaled €21,470m, a rise of 3.9% year-on-year, thanks to the good performance of deposits in Turkey.

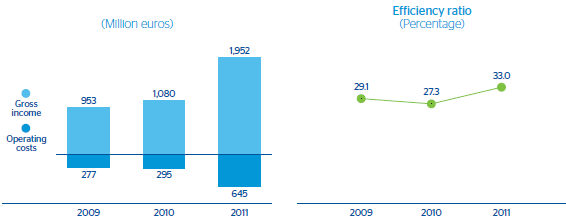

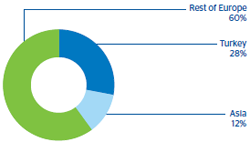

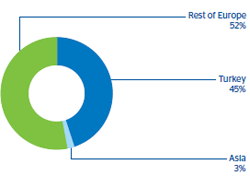

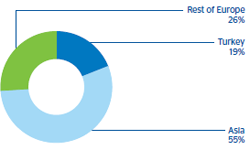

By business unit, Europe accounts for 45% of the net attributable profit. Its positive growth can mainly be explained by the consolidation of Garanti, and to a lesser extent by the good performance of the rest of the local businesses. It is worth noting the positive performance of gross income, which amounted to €1,283m, 95.1% up on the previous 12 months. Excluding Garanti, gross income growth was 6.9%, despite the unfavorable situation of the financial markets. As a result, the net attributable profit rose 86.1% to €464m, or 8.7% excluding Garanti.

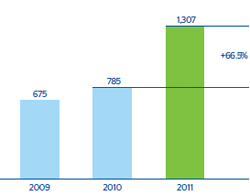

Asia accounts for 55% of results in the area. The net attributable profit was up by 66.4%, mainly due to the growing contribution from CNCB, whose activity and earnings continue to rise. According to the latest available figures to September 2011, the loan book increased by 9.4% on the figure for the close of 2010, customer deposits grew by 8.0% and the accumulated net attributable profit for the year was up 40.9% year-on-year. Additionally, the success of CNCB’s capital increase in July and August of 2011, in which BBVA took part in order to maintain its 15% stake, also merits mention. Two factors have influenced the decision to undertake this operation: on the one hand, the need for it, due to the dynamism of banking activity; and on the other hand, the Chinese supervisor’s desire to maintain a highly solvent partner such as BBVA with the same weight as before the operation. Overall, Asia generated gross income of €669m (up 58.3% year-on-year) and a net attributable profit of €563m.

In 2011, BBVA continued to make progress in its strategic alliance with CNCB aimed at exploring new business opportunities. In addition, the Bank has been recognized as the Best Trainer of Chinese Professionals by the prestigious association China Club. The award recognizes the Group’s work to attract talent in the Asian country.

As of March 22, 2011 BBVA executed the acquisition of 24.9% of Garanti, a bank holding a leading position in Turkey. This is an excellent franchise with 10.7 million customers, a network of 918 branches and over 3,268 ATMs. The most notable aspects of this entity in 2011 are as follows (data for Garanti Bank):

- The lending activity maintains solid growth (up 29.6% year-on-year), which even exceeded that recorded by the sector (up 29.3%). More specifically, the retail portfolio showed outstanding growth across the board (consumer finance, mortgages and credit cards).

- Customer deposits have maintained their upward trend (up 17.5% over the year), with growth also above that of the sector (up 12.5% in the year).

- The bank’s gross income rose to €1,807m, a rise of 6.6% over the last 12 months. This performance is explained by the appropriate mix in the loan book and customer funds, the positive price management with repricing of the loan portfolio, and the favorable trend in business activity.

- Garanti continues to be an example in the Turkish banking sector in terms of efficiency, with operating expenses rising below inflation.

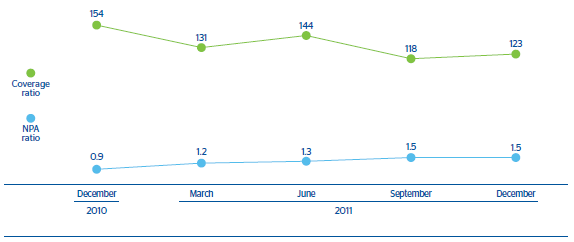

- It also has an excellent asset quality, with NPA and coverage ratios of 1.8% and 82%, respectively, significantly better than those of the rest of the sector.

- Garanti generated a net attributable profit of €1,313m.

Finally, it is worth highlighting that the Turkish bank and BBVA have started to collaborate. Specific working teams have been set up with members from both banks to identify and implement projects that can help increase the value of the Group’s franchises. One of the projects in place is the identification of corporate customers with a presence or interest in Turkey. Work is already underway with these customers on specific new financial transactions. With regard to technology, given Garanti’s sound technological and operational platform, plans have been implemented to exchange know-how between Garanti, BBVA Bancomer and BBVA Spain.