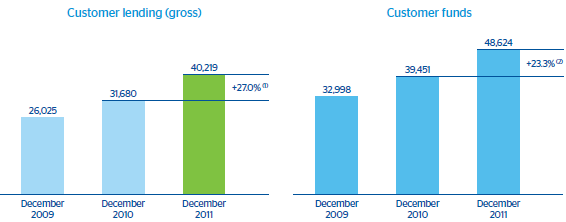

In 2011, the area maintained its growth levels in both business activity and earnings. The loan book amounted to €40,219m as of the end of December, a year-on-year increase of 27.0% and a gain of 10 basis points in market share over the last 12 months (November figures, the latest available). This increase in lending has been accompanied by a significant rise in customer deposits (up 25.7%), focused on lower-cost transactional current and deposit accounts, which increased by 32.0% over the year. Including the assets under management by mutual funds, customer funds managed by the banks closed December at €48,624m, 23.3% up on the same date in 2010.

From the point of view of earnings, the cumulative net interest income was €3,164m, 31.6% up on the figure for 2010. This reflects the significant growth in business and the good management of spreads, despite strong competitive pressure. Net income from fees and commissions was up 15.7% on the previous year, to €1,077m. Net trading income (NTI) was down 3.4% year-on-year to €477m. It was strongly affected by the value of US dollar positions in Banco Provincial in Venezuela and by the turmoil on the markets. As a result of the above, gross income stood at €4,457m, a rise of 21.4% on the figure for 2010.

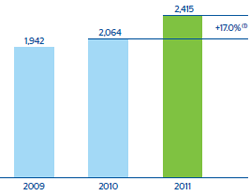

Expenses in the area were strongly influenced by the expansion and differentiation projects carried out in most of the units. As a result, they grew by 27.1% year-on-year to €2,042m, but the efficiency ratio stood at 45.8% thanks to the positive trend in revenues. As a result, operating income went up 17.0% to €2,415m.

Growth in business activity has been accompanied by a rigorous policy of risk admission and an outstanding management of recoveries. This led to a clear improvement in asset quality in the area. The NPA ratio closed at 2.2% on December 31, 2011, with a reduction of 26 basis points over the previous 12 months. The coverage ratio improved considerably to 146%. The increase in lending in the area explains the 10.5% year-on-year rise in impairment losses on financial assets to €449m.

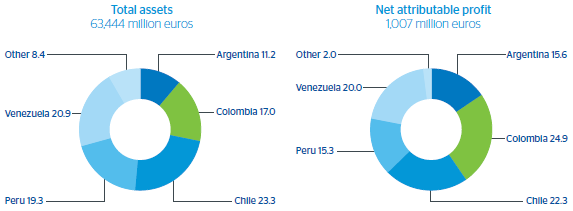

In short, the excellent growth of revenues thanks to the boost provided by business combined with good price management has enabled the Bank to continue with its investment effort in the area, increase loan-loss provisions due to the growing lending volumes and achieve a net attributable profit of €1,007m, a rise of 16.2% over the year.

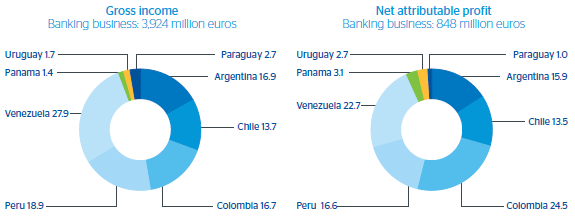

Banking Business

The area’s banking business generated a net attributable profit of €848m, 19.3% up on the figure for the previous year. The most significant aspects for each of the banks are detailed below.

Argentina

The Argentinean economy grew by around 8% over the year (according to the latest available figures), despite the difficult global situation, and without the traditional volatility associated with the electoral cycle.

The Argentinean financial system once more demonstrated a high level of soundness, liquidity, asset quality and profitability. Trading volumes expanded and there was an improvement in the ratio of deposits and loans over GDP.

In 2011, BBVA Francés continued to develop its management model based on creating value for customers, accompanying them at each stage of their lives, and, above all, searching for excellence in the services it provides. It closed the year with a significant growth in its market share. Lending gained 15 basis points over the last 12 months, mainly thanks to progress in consumer finance (up 85 basis points) and corporate lending (up 84 basis points), while the share of customer funds rose by 8 basis points (all with November data, the latest available). This explains the year-on-year increase of 21.3% in net interest income. Growing net fees and commissions (29.1%) and NTI (83.3%) led to a year-on-year increase in gross income of 28.3%. This, together with the increase in expenses (as a result of inflation and the expansion plans underway) and moderation in loan-loss provisions, led to a year-on-year increase of 32.9% in the net attributable profit to €135m. It is worth noting that this higher activity was combined with an outstanding management of asset quality, thus enabling the bank to maintain its leadership position in the system in terms of risk administration.

Chile

The Chilean economy posted significant GDP growth in 2011 (5.3%, according to the latest figures). The factors that contributed to this include the high level of domestic demand, which in turn was boosted by higher commodity prices, in particular copper. Inflation remained within the target range of 3%. Given this situation, the Central Bank gradually increased its monetary policy rate in the first half of the year from 3.25% to 5.25%. Nevertheless, as a result of the uncertainty generated by the international situation and the high volatility in the financial markets, a slowdown could be observed in the last quarter of the year, combined with slight tension in the local financial markets. Although this has led to a rise in Chile’s sovereign risk premium, it is still the lowest of the region, thanks to the fact that Chile’s fiscal accounts are in good order, it has a structural fiscal surplus, high foreign-currency reserves and sufficient financial stability to cope with adverse scenarios.

The financial system was also very dynamic over the year, with growth rates of more than 15% (discounting the currency effect) in commercial lending, 9% in mortgage lending and 18% in consumer finance. Furthermore, the NPA ratio, capital adequacy and profitability levels have also performed well.

BBVA Chile continued to make progress on its Differentiation Plan focused on the individual segment, as well as on expanding its branch network to attract new segments (premium and SME) and on improving the value offered in its products and services. The Differentiation Plan is attracting more high-value added customers, with a higher level of loyalty. As of 31-Dec-2011, the number of higher-value added customers rose to 255,000 (217,000 as of the close of 2010), which means an increase of over 100,000 since the launch of the Plan in 2008. The level of customer loyalty has reached 3.5 products per customer (2.8 products per customer as of the close of 2007). BBVA Chile is also the bank with the sharper increase in market share in new consumer loans over the last four years.

Forum, the consumer finance unit specializing in auto-financing, maintains its clear leadership position in its market, favored by the strength of new car sales in the country. In fact, in 2011 Forum’s successful business model was exported to the Peruvian market in partnership with Holding Continental, in which BBVA holds a 50% stake.

BBVA and Forum generated a net attributable profit of €114m in 2011. Particularly outstanding was net interest income, which went up 30.1% thanks to significant growth of lending to individuals, particularly in consumer finance, with a year-on-year gain of 104 basis points in market share, and mortgage lending, which went up 29 basis points (both figures also to November). Transactional customer funds also performed well, with an increase in market share of 10% on the figure for 2010. NTI fell back in year-on-year terms due to the high gains from the sale of securities in the portfolio in 2010, while expenses continued to rise due to the expansion plans carried out over the year.

Colombia

2011 was a good year for the Colombian economy, not only because its GDP continued to grow above its historical average, but also because of a climate of stability that favored business. This factor has been recognized by the international rating agencies, which have once more rated the country’s debt as investment grade. As a result, the economy as a whole has grown, unemployment has fallen to single–digit rates, exports have increased while diversifying their traditional destinations, and the public-sector deficit has fallen substantially. At the same time, firm foundations have been laid for sustaining this rate of growth in the medium and long term.

In this environment, BBVA Colombia continued to improve its market share in the individual segment thanks to significant growth in lending, particularly consumer finance (up 42.0% year-on-year) and credit cards (up 51.7%), where it gained 119 and 128 basis points in market share respectively from November 2010 to November 2011 (latest figures available). As a result, net interest income went up 10.7% in 2011, despite the strong competitive pressure, and gross income increased by 6.7%, slightly below former levels, due to lower NTI resulting from the markets situation. The significant rise in lending activity (up 22.9% year-on-year) did not prevent loan-loss provisions from falling year-on-year by 35.9%, improving risk indicators. The net attributable profit was €208m, rising 15.3% on the figure for 2010.

BBVA Colombia has made substantial investments in technological infrastructure and its distribution capacity in order to ensure the recurrence of its earnings. As a result, the customer satisfaction level reached the highest level of the last 10 years, above the industry average, and leading 5 of the most important categories of this survey.

Peru

The Peruvian economy grew by around 7% in 2011, above the average figure for the last decade. This was possible thanks to the implementation of prudent macroeconomic policies and the effort to reduce the levels of poverty in the country. This good performance has been recognized by the rating agencies Fitch and Standard & Poor’s, which upgraded their ratings of Peruvian government debt in the second half of 2011.

The financial sector has also made its contribution to growth through the expansion of private-sector lending: mortgage loans have been particularly outstanding.

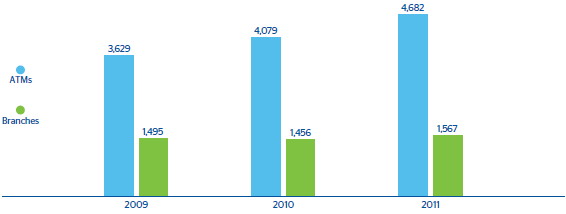

In 2011, BBVA Continental focused on improving the customer experience from a customer-centric perspective through three lines of action: 1) network expansion; 2) segment-based management; and 3) service quality, aimed at projecting an image of simplicity and modernity. In line with this strategy, the Bank continued with its Expansion Plan, increasing its branch network and, above all, its alternative distribution channels. There was an outstanding increase of 55% in the number of transactions that migrated from the traditional window to alternative channels. BBVA Continental has made a major effort in quality to offer customers an image of a simple and flexible bank. The commercial actions undertaken, change of brand and improved customer service levels have all led to a noteworthy rate of referrals (84% of customers recommend BBVA Continental) and a high level of public notoriety (79%).

From the point of view of earnings, Banco Continental continues to perform well in its business, with a rise of 14.2% in net interest income. It gained 72 basis points year-on-year in market share in its loan book, boosted by credit cards (up 131 basis points) and corporate lending (up 100 basis points), and with customer funds up 93 basis points (all using November figures). There was also a significant rise in revenues from fees and commissions (up 9.8%), leading to gross income of €743m (up 9.8%). The expansion plans carried out over the year have boosted this rise in business and led to higher expenses in the unit. As a result, and combined with a slight fall in loan-loss provisions, the net attributable profit was up 7.7% to €141m.

In 2011, and for the eighth year in a row, BBVA Continental received the “Best Bank in Peru” award from Global Finance and the “Award for Excellence” from Euromoney. The bank was also chosen as the best bank in the country and is considered among the five best banks in the region in the ranking drawn up by América Economía. Finally, BBVA Banco Continental was given third place in the annual ranking of the most sustainable banks in Latin America by the consultancy Management & Excellence and the magazine Latin Finance.

Venezuela

According to the latest available figures, the Venezuelan economy showed signs of recovery throughout 2011, with increased public spending made possible by high oil revenues. In addition, other non-oil businesses expanded, according to the latest available information for the third quarter. They were mainly focused on the financial, construction, communications and retail trade sectors.

The banking activity confirmed the industry’s positive performance in 2011. Its average annualized profitability measured in terms of return on equity (ROE) was 36.1% as of the close of November, an outstanding increase of 1,606 basis points on the figure for December 2010.

In 2011, BBVA Banco Provincial focused on cultivating the loyalty of its retail customers, on becoming a national reference in terms of innovation and technology and on offering the broadest range of products and services in the Venezuelan financial system. With respect to infrastructure, progress continued to be made on the refurbishment plan for branches. Their structure was remodeled to optimize space and create self-service areas called “express zones”, designed to offer customers a comfortable and secure place to carry out their transactions quickly. The bank has also developed strategies to maintain its leadership in auto-finance in the Venezuelan banking system, renewing its 2010 alliances with some vehicle manufacturers and securing new ones.

All these efforts and initiatives meant a significant contribution to lending growth, above all to individuals and corporations. Credit cards gained 354 basis points in market share over the last 12 months, consumer finance, 192 basis points, and corporate lending 203 basis points (according to November figures). Banco Provincial recorded notable growth in its net attributable profit (up 77.5% year-on-year) to €192m, thanks to its progress in revenue lines. Net interest income went up 60.5%. NTI rose by 43.4%, as a result of the revaluation of US dollar positions upheld by the bank (a very similar effect occurred in 2010 following the devaluation of the bolivar). The high inflation rate and expansion plans continue to weigh on expenses, together with greater generic provisions.

In 2011, BBVA Provincial was once more chosen by Global Finance, Euromoney and Latin Finance as the “Best Bank in Venezuela”, and by Global Finance as the “Best Internet Bank.” It was in 10th place in the “Great Place to Work 2010” list and first among the companies in the financial sector. It also obtained an award from the National Advertisers’ Association (ANDA) for the advertising campaign on its social integration scholarship program.

Panama

The Panamanian economy continued to be strong throughout 2011, with an estimated growth rate of 9.1%. This resulted in positive economic activity indicators, including a significant reduction in the unemployment rate.

BBVA Panama ended the year with increases in both lending and funds, and cumulative net attributable profit of €26m.

BBVA Panama obtained a rating of BBB– with a stable outlook form Standard & Poors. The agency highlighted the bank’s adequate solvency and prudent risk management.

Paraguay

The Paraguayan economy is expected to grow by 3.6% in 2011, boosted mainly by the agricultural sector. Inflation is forecasted to close 2011 at around 4.4%, under control thanks to the measures adopted by the Central Bank throughout the year. Exports were affected by the outbreak of foot-and-mouth disease in the last quarter of the year, and will end the year up around 20%, while imports will go up 25%.

Over the year, and thanks to the launch of sales campaigns in the second half of 2011, BBVA Paraguay recovered its business activity levels, generating a net attributable profit of €23m.

The rating agency Feller-Rate (a strategic subsidiary of Standard & Poor’s) maintained its AA rating for BBVA Paraguay, with a stable outlook. This is the highest rating granted to a bank in the country’s financial system. At the international level, Standard & Poor’s upgraded the bank from B+ to BB–, with a stable outlook, after raising the rating of the country’s sovereign debt.

Uruguay

The favorable performance of the Uruguayan economy, fueled by the strength of every economic activity sector, particularly consumption, led to GDP growing by more than 6% in 2011 (according to the latest available figures).

The most notable event in the year for BBVA Uruguay was the operational merger with Crédit Uruguay Banco, which had been acquired the previous year. The two banks now operate as one, following the unification of processes, systems and brand image at all points of contact with customers.

After the merger, BBVA Uruguay is now the second biggest private bank in the country, with €1,966m of assets. Apart from the operational success of the merger, the bank has become market leader in products such as auto finance and mortgage lending. It is worth noting that during the period of the merger the number of customers increased by 2% year-on-year. The net attributable profit generated by BBVA Uruguay in 2011 was €9m.

Pensions and Insurance

The Pensions & Insurance business in South America contributed with a net attributable profit of €195m in 2011, 3.6% up on the figure for 2010. Out of this total, €106m were generated by the pensions business (down 16.1%) and €89m by the insurance business (up 44.0%).

Pensions

In 2011, the increase in employment rates and wages and the progress made on formal employment levels had a positive effect on the rise in contributions to private pension funds. However, this business was severely affected by financial markets high volatility, with a resulting negative impact on NTI. Nevertheless, the positive performance of commercial activity led to an increase in fund subscriptions of 16.0% year-on-year and thus a positive effect on net fee income (up 6.9%). Funds under management remained at practically the same levels as in 2010 (€47,818m).

AFP Provida in Chile continued to transform its customer model by focusing on the loyalty of corporations and servicing. The result was the further strengthening of its leadership position in the Chilean pension system, where it has the biggest portfolio of investments in the industry. As a result, it obtained an annual net attributable profit of €74m, 17.2% down on the figure for 2010. This can be explained by the worse figures for NTI. Conversely, recurrent revenues performed very favorably thanks to growth in subscriptions (up 4.7%). There was moderate growth of expenses, 3.7% over the year. In Peru, AFP Horizonte generated earnings of €13m (down 16.4% year-on-year). The good management by the company enabled it to improve its market indicators. In particular, there was a significant increase in subscriptions (up 16.3%), and it maintained its first place in share of pension savers and leadership in the returns on two of its three managed funds. The above had a very positive effect on the firm’s fee income (up 20.4%). Finally, AFP Horizonte Pensiones in Colombia had a net attributable profit of €21m and its managed funds increased by 12.9%, with the number of pension savers increasing by 8.4% and subscriptions by 25.6%.

Insurance

The insurance business had a very favorable year and continued to show notable strength. In 2011, significant actions were undertaken to increase business activity, extend the product catalogue and ensure adequate risk management and business profitability. Additionally, new distribution and sales channels were opened, and new brokers set up in Uruguay and Paraguay, with new agreements concluded with major distributors in various economic sectors. This effort was rewarded, as BBVA is now leader in the bank assurance rankings by total written premiums in those countries in the region where the Group operates. BBVA also leads the rankings by net income in the life insurance branch. The increased activity and improved product catalogue resulted in a year-on-year rise of 9.7% in the volume of written premiums by all the companies as a whole. As a result of the above, and combined with the good level of claims and a reduction in expenses, the insurance business contributed a net attributable profit of €89m, 44.0% up on the figure for 2010.

Grupo Consolidar in Argentina had a net attributable profit of €26m, 6.8% up on the figure for 2010, while the insurance companies in Chile generated €33m, Seguros Provincial in Venezuela €8m and the companies in Colombia €22m.