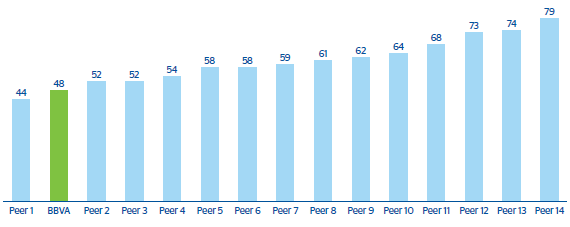

Operating expenses in 2011 amounted to €9,951m, a year-on-year increase of 11.0%. The rise is due to the change in the scope of consolidation (incorporation of Garanti), to the investment underway in BBVA and to the personnel training efforts in place for promoting talent in the Bank. In fact, BBVA has been recognized as the best European company in developing the leadership skills of its teams by the magazine Fortune. Despite the increased investment, the efficiency ratio closed December at an outstanding level of 48.4%, one of the lowest in the banking sector worldwide.

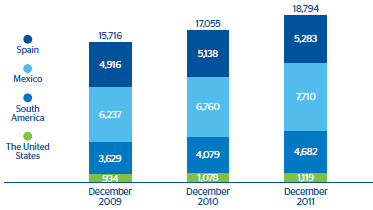

As of 31-Dec-2011, the Bank’s employees numbered 110,645 people, a year-on-year growth of 3.4%. Its branch network numbered 7,457 units, with 96 more branches than at the close of 2010. The figure is stable in Spain at a time when the sector has just begun a process of reducing branch numbers. BBVA began this process in 2006 and completed it over 2009. In contrast, branches in emerging countries are increasing (basically in Mexico and South America) as a result of the expansion processes underway in these countries, aimed at taking advantage of the growth opportunities offered by their markets. Finally, the number of ATMs continues to grow. It closed December 2011 at 18,794, 1,739 more than in 2010. As is the case with branches, the increase is focused mainly in emerging countries, while developed countries continue with no significant changes; in the latter, investment is focused on their renewal and modernization.

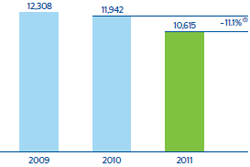

To sum up, the changes mentioned above in revenue and expenses have resulted in operating income of €10,615m in 2011 (€11,942m in 2010).