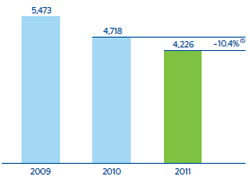

Impairment losses on financial assets totaled €4,226m in 2011, a fall of 10.4% on the figure for the previous year. In the fourth quarter there was an increase in the level of the Group’s loan-loss provisions, aimed at taking advantage of the higher revenue over the last three months of the year. As a result, BBVA’s coverage ratio closed at 61% as of December 31, 2011 and the Bank’s risk premium improved by 14 basis points over the year to close at 1.20%.

Provisions amounted to €510m in 2011, 5.7% up on the figure for the previous year. They basically cover early retirement, other allocations to pension funds and provisions for contingent liabilities.

The heading other gains (losses) reported a negative €2,109m in 2011. This can be explained almost entirely by two concepts: a negative €665m corresponding to real estate provisions and assets from recoveries with the aim of maintaining coverage above 30%; and a negative €1,444m for goodwill impairment in the United States. In 2010 the figure was a negative €320m, mainly from the adjustment of the value of foreclosed or acquired assets in Spain.

In general, 2011 income taxes were reduced because of tax-exempt or low-tax revenues (especially dividends and income accounted by the equity method) and the growing weight of earnings from Mexico, South America and Turkey, where effective tax rates are low.