The risk functions in the insurance and mutual and pension fund administration activities are integrated into the Retail Banking GRM unit in order to assist the business in managing its risks, while supporting its strategy and development. Therefore, Retail Banking GRM centralizes the management of these risks through the Insurance & Prevision and Asset Management & Fiduciary Risk corporate units, whose main task is to establish the risk strategy for these activities.

Management of these risks is carried out according to the general principles of GRM: unique, independent and global function following the relationship model between the corporate area and the risk units of the business areas. Therefore, Insurance & Prevision and Asset Management & Fiduciary Risk are global risk units responsible for determining the risk policies, methodologies and tools. They also monitor risks in close cooperation with the business units, with whom they collaborate and coordinate risk-related activities. The risk units of the business areas develop the procedures aligned with the established corporate policies, but adapted to the specific nature of the local markets and the characteristics of their own activity. They also execute the processes and controls needed to verify their implementation and the effectiveness in mitigating and controlling the risks.

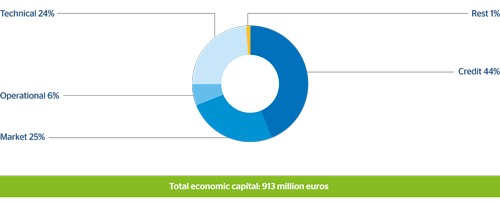

Economic capital is the standard metric for estimating risk in BBVA Group and the basis for calculating attributable profit and risk-adjusted return.

The economic capital of the insurance activity in 2012 stood at €913m. Of this amount, credit risk accounts for 44%, market risk for 25% and technical risk for 24%.

44 Insurance companies. Economic capital breakdown by type of risk

(31-12-2012)

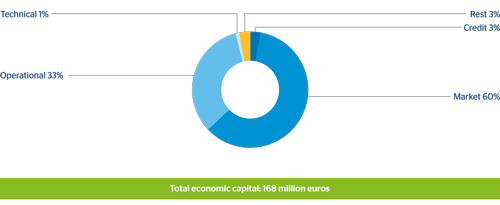

The economic capital of the Pensions business in the Americas is estimated at €168m. Market risk, essentially resulting from the regulatory reserve requirement (related to the volume of assets under management), accounts for 60% of total economic capital, and as second in relevance, operational risk accounts for 33%. The BBVA Group is currently undergoing a divestiture process in these businesses.

45 Pensions in the Americas. Economic capital breakdown by type of risk

(31-12-2012)

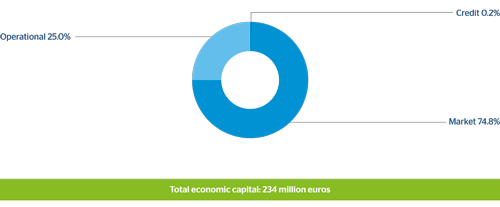

In mutual fund administration, the economic capital at the end of 2012 stood at €234m, guarantee risk being the main component.

46 Asset Management. Economic capital breakdown by type of risk

(31-12-2012)