Global Markets closed 2012 with revenue growth in its main products and geographical areas (except for rest of Europe and Asia). Gross income in 2012 stood at €1,152m, up 18.0% year-on-year. These good earnings figures are the result of an adequate strategy of geographical and customer diversification.

The business model of Global Markets continues to reinforce customer focus as the core element of its value proposition. This has been recognized by the specialized media. BBVA was chosen best bank in Spain in exchange rates at the IAIR Awards, and tops the Bloomberg ranking for the best exchange rate forecasts of Latin American currencies against the dollar.

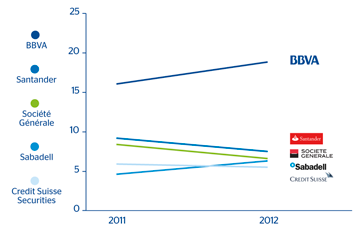

In Spain, revenue from customers is up 5% year-on-year, with growth, above all, in strategic businesses such as exchange rates and lending, where the increases are over 15%. Revenue from SMEs and retail customers rose by more than 50%, thanks to the close collaboration of Global Markets with the commercial network. By products, exchange rates and lending have grown at double-digit rates year-on-year. In equity, BBVA continues to hold first place in stock market brokerage, with an 18.9% market share according to December 2012 data, more than 11 percentage points above the nearest competitor. In bond issues, BBVA tops the ranking with all types of customers in Spain.

65 CIB. Market shares evolution in Spanish equities brokerage

(Percentage)

Download Excel

Download Excel

|

|

Institutions | 2011 | 2012 | Market share 11-12 |

|

|

|---|---|---|---|---|---|---|

| 1 | BBVA | 16.1 | 18.9 | 2.8 |

|

|

| 2 | Santander | 9.2 | 7.5 | –1.7 | ||

| 3 | Société Générale | 8.4 | 6.6 | –1.8 | ||

| 4 | Sabadell | 4.6 | 6.3 | 1.7 | ||

| 5 | Credit Suisse Securities | 5.9 | 5.5 | –0.4 | ||

| 6 | Banco Espirito Santo | 7.7 | 5.0 | –2.7 | ||

| 7 | Morgan Stanley | 5.4 | 4.9 | –0.5 | ||

| 8 | Merrill Lynch Capital Markets | 3.5 | 4.5 | 1.0 | ||

| 9 | Intermoney | n.d. | 3.7 | n.d. | ||

| 10 | UBS | n.d. | 3.6 | n.d. | ||

In the rest of Europe and Asia, revenue from customers in Lisbon and Milan rose by more than 25%. London consolidated its position in 2012 as the strategic hub of the credit business, a product that has doubled the earnings posted in the previous year.

Geographical diversification has enabled Global Markets to ensure recurrent earnings in Mexico and South America, offsetting the slowdown and volatility seen in developed markets.

In Mexico, Global Markets maintains a clear leading position in the following products: leader as bond market maker, number one bank by currency volume, first place in equity notes and number one in the MXN bond origination ranking, well above its competitors. Revenue from customers continues to grow at a fast pace, with gross income growing by 47.1% over the previous year.

In South America, Global Markets continues to develop its local capabilities to make the most of the region’s growth and increased activity. This effort can be seen in the 27% year-on-year increase in gross income. Revenue from customers is up 21%. By countries, practically all franchises have performed well.

Lastly, in the United States, revenue from customers has grown by around 2% year-on-year. Revenue from retail customers has increased significantly, strongly supported by BBVA Compass distribution network. By type of product, interest rates maintain their positive trend. Of particular note is the performance of revenue from exchange rates, which more than doubles the figure for the same period the previous year.

Main Debt Capital Markets transactions in 2012