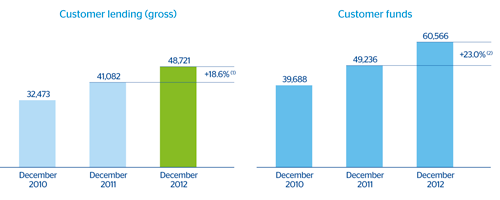

At the close of 2012, both the loan book and customer deposits in the area show high growth rates. Gross customer lending closed December with a balance of €48,721m, a year-on-year growth of 18.6%. The biggest increases have been posted in the retail segment (up 38.6%), thanks to the positive trend in lending to small businesses (up 105.8%) and consumer loans and credit cards (up 29.5%).

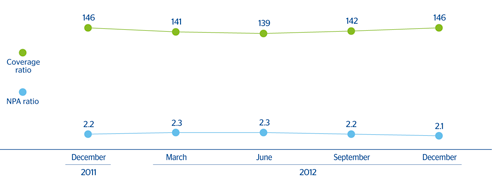

As regards risk indicators in the area, the NPA ratio has improved to 2.1% as of December 2012 (from 2.2% on the same date of the previous year), thanks to the rigorous risk admission and recovery policies applied in the region, in line with corporate guidelines. The coverage ratio remains at the same levels as the previous year, at 146%.

41 South America. NPA and coverge ratios

(Percentage)

On-balance-sheet customer deposits (excluding repos) have grown 24.1% year-on-year to €56,937m. This has resulted in a market share gain of 15 basis points over the last 12 months (according to the latest information available as of November 2012). Lower-cost transactional items (current and savings accounts) rose 30.6% and have seen their market share increase by 53 basis points from the end of November 2011 to the close of November 2012. Customer funds managed by the banks in South America, including the assets under management in mutual funds and repos, stood at €60,566m, up 23.0% on the figure as of 31-Dec-2011.

42 South America. Key activity data

(Million euros at constant exchange rates)

(2) At current exchange rates: +24.9%.