In 2012

The slowdown has intensified in 2012

The global economy has grown just over 3%, a year-on-year rate which is slightly lower than the average for the last three decades (3.5%). This slowdown in world growth is largely due to further flaring up of financial tensions in Europe. The rest of the slowdown has been caused by the contagion from Europe to other geographical areas, limited support from demand policies in emerging markets and uncertainties about how to define such policies in the United States.

12 Global GDP growth

(Percentage)

Europe is on the road toward closer economic and monetary union

Many events have occurred in 2012 in Europe which have triggered unease in the markets. Firstly, uncertainties about how to reach fiscal austerity targets without hampering growth. Secondly, uncertainties arising from the state of the financial system in certain countries, which is subject to pressure due to lack of growth and suspicion spreading about the solvency of the public sector. Lastly, the degree of commitment of certain countries toward the common European project, which at some points during 2012 has prompted fears of a break-up of the euro (fears which were later dispelled).

However, 2012 has also been a year marked by essential steps taken to resolve the financial crisis in Europe. The commitment toward the euro has been reinforced, once the Greek elections led to the formation of a government which took a responsible view of the adjustments needed for it to remain in the common monetary area. Secondly, peripheral countries have carried out major structural reforms. Thirdly, significant process has been made in restructuring the financial systems which were hardest hit by the crisis that began in late 2008 -such as Spain’s- with the approval of a credit facility for the recapitalization of the most vulnerable institutions. Lastly, Europe has also worked on its governance, with the establishment of a fiscal agreement, the setting-up of the European Stability Mechanism (ESM), the first steps taken toward banking union, and (a decisive factor) the commitment of the ECB to do whatever is necessary to eliminate the risk of euro convertibility by announcing the launch of a sovereign public debt repurchase program on the secondary market of those countries which request assistance from the ESM. Financial tensions have eased considerably in the latter part of 2012 thanks to the adoption of these measures. Nonetheless, these measures have not been enough to prevent the European economy from gradually slowing over the course of the year to the point of stagnation. Overall, the GDP of the Eurozone has decreased by 0.5%, compared with the positive growth of 1.5% it posted in 2011.

Spain has been the focus of financial tensions, though important steps forward have been taken

Meanwhile, the Spanish economy has been the focus of financial tensions, at their highest in spring 2012, when spreads were at their widest, while access to wholesale funding from the different sectors was severely restricted. However, important steps forward have also been taken. On the one hand, measures have been taken to reach fiscal targets, through a combination of tax hikes and reduced public spending. Evident progress has been made in the latter part of 2012, though probably not sufficient to offset the accumulated deviations. Secondly, the Spanish financial restructuring map is almost complete. For that purpose, the Spanish economy has obtained an advantageous credit facility from the ESM, enabling it to recapitalize institutions with solvency problems in stress scenarios. Critical structural reforms have also been implemented, such as in the labor market, thereby increasing the growth capacity of the Spanish economy. Spain has also benefited from decisions taken within the European framework, particularly the start-up of the ESM and the ECB’s commitment toward supporting the financing of Spanish sovereign debt through the purchase of Spanish public debt once the authorities agree to request funds from the ESM. Overall, with the measures taken by the Spanish authorities and the support from Eurozone measures, there has been a partial easing of financial tensions, despite the contraction in the economy in 2012 (-1.3%), following on growth of a mere 0.4% the previous year.

Advances in recovery in the United States

Economic recovery has continued in the United States throughout 2012, albeit at a slower pace than that reported in similar cyclical stages in the past. In fact, although GDP has grown in the region by just over 2%, there has been a marked slowdown in the latter part of the year. Private demand has remained feeble throughout the period, due to the high levels of uncertainty abroad and also to how the question of the so-called fiscal cliff would be resolved: the automatic activation of a tax hike and spending cuts program which might be on a sufficient scale to push the US economy into recession. However, there has been a certain degree of recovery in some sections of economic activity, such as the housing market, for example. At the same time, monetary policy has helped to keep expectations through a new quantitative easing program and the commitment toward continuing with a low interest rate scenario for the time it takes to reduce the unemployment rate.

Emerging markets are not immune to the global deterioration, but they continue to report significant growth rates

Emerging markets in both Latin America and Asia have also felt the effects of the global financial tensions and the stagnation in the European economy, even though domestic demand in these countries has remained sound. Exports, however, have been adversely affected. As a result, growth in Latin America has slowed to 2.8% in 2012 (due particularly to the poor performance in Brazil), while Asia (not including China) has grown a few tenths of a point below 4%.

Despite the weakness shown by its main foreign market (the United States), the Mexican economy has reported above-average growth rates in the region and has also outstripped its own average for the last decade. In fact, growth has continued close to 2011 levels, at around 4%. This is largely due to sound domestic demand, underpinned by the rise in employment and the availability of credit, but also to the greater foreign competitiveness of the Mexican economy. As for inflation in Mexico, although it stands above the target set by the Central Bank, this is due to temporary factors affecting the prices of certain products.

In South America, growth has been hampered by Brazil, which has hovered around stagnation during most of 2012. In most South American countries, however, growth has been even higher than expected, despite the deterioration abroad, given that commodity prices have remained high and financial tensions have eased. In this context, both consumption and investment have continued to be shored up by the strength of the labor and credit markets and by still expansive monetary policies.

Turkey has been affected by European tensions, not only in its financial markets, but also from the knock-on effect of lack of external demand. Activity has also slowed down due to the measures taken to correct imbalances accumulated on Turkey’s current account balance and in inflation. In any event, Turkey grew by 2.6% in 2012. The authorities continue to push through measures designed to reduce the economy’s traditional imbalances (such as energy dependence). In fact, there are clear signs of improvement in the external deficit.

Lastly, the gentle slowdown in which China has been immersed for some time, largely due to the economic policy measures taken to minimize the risks of overheating, has been heightened as the foreign setting has weakened. This has sparked fears of a hard landing of the Chinese economy. Nevertheless, activity has stabilized in the latter part of 2012 and the authorities have stated that they will continue to use both monetary policy and fiscal stimulus measures to keep China’s growth at acceptable levels. Even though GDP has slowed to 7.7% in 2012 (from rates of between 9% and 10% in the three preceding years), there have been signs of an upturn in activity at the tail end of 2012.

Outlook for 2013

Brighter outlook for the global economy thanks to the emerging markets

Measures taken by central banks in the United States and in the Eurozone have brightened the outlook, reducing the likelihood of an extreme scenario, but have been unable to prevent the advanced world economies from being mired in adjustment processes and low growth. In 2013, the Eurozone is only expected to grow 0.3%, while the United States should grow 1.8% (as long as the fiscal cliff is avoided, at least partially). Spain, meanwhile, is expected to undergo a contraction similar to that observed in 2012. Emerging markets are expected to be on a firmer footing. In China, growth is expected to rise a few tenths (to 8.0%), fueled by stimulus policies. The rest of the emerging markets in Asia and in Latin America are expected to see similar levels of growth. Latin America should grow by 3.5% in 2013. Lastly, the Turkish economy is expected to quicken in 2013 to 4.4%. Consequently, the world economy is expected to grow 3.6%.

Global GDP growth and inflation rate in 2012 and perspectives for 2013

(Percentage real growth)

Download Excel

Download Excel

|

|

2012 | 2013 e | ||

|---|---|---|---|---|

|

|

GDP | Inflation | GDP | Inflation |

| Global | 3.2 | n.a. | 3.6 | n.a. |

| Euro Zone | (0.5) | 2.5 | 0.3 | 1.6 |

| Spain | (1.3) | 2.4 | (1.1) | 2.0 |

| The United States | 2.2 | 2.1 | 1.8 | 2.1 |

| Mexico | 3.9 | 4.1 | 3.1 | 3.5 |

| Latin America (1) | 2.8 | 7.5 | 3.5 | 8.1 |

| China | 7.7 | 2.6 | 8.0 | 3.3 |

| Turkey | 2.6 | 8.5 | 4.4 | 5.3 |

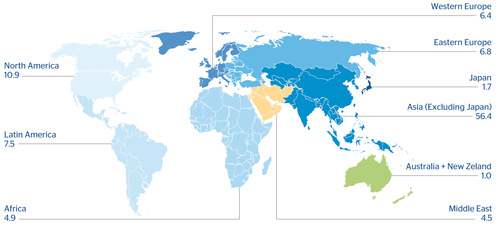

13 Contribution to world growth between 2011 and 2021

(Percentage of the total)

Exchange rates

In the currency markets, the euro depreciated significantly against the dollar in the first half of the year due to the heightened perception of risk regarding the European debt crisis. Nonetheless, the steps taken by the ECB during the summer designed to reduce fragmentation in the Eurozone’s financial markets helped strengthen the euro in the second half of the year. In sum, the dollar gained 8.3% against the euro. Currency movements against the dollar in the emerging markets have also been determined by perceived risk. Given that the problems were focused on the Eurozone, however, global liquidity has continued to rise and, as a result, the perception in these economies is of a sounder macro-economic environment. Thus, relatively speaking, their currencies have been less affected by episodes of risk, resulting in favorable overall performance of the currencies with the greatest weight in BBVA’s financial statements. As a result, exchange rates had a positive impact on the year-on-year comparison of the Group’s financial results.

Regarding year-end exchange rates, the dolar lost 1.9% against the euro over the last twelve months. The Chilean peso has also appreciated against the euro (6.5%), as have the Colombian peso (7.8%), the Mexican peso (5.0%), the Peruvian nuevo sol (3,6%) and the Turkish lira (3.7%). However, the Argentinean peso and the Venezuelan bolivar fuerte have depreciated. To sum up, the exchange-rate effect is also positive on the balance sheet and activity.

In 2013, the dollar is expected to continue appreciating slightly against the euro, while the currencies of emerging economies will have some room for appreciation against the dollar.

Exchange rates

(Expressed in currency/euro)

Download Excel

Download Excel

|

|

Year-end exchange rates | Average exchange rates | ||||||

|---|---|---|---|---|---|---|---|---|

|

|

31-12-12 | Δ% on 31-12-11 |

31-12-11 | Δ% on 31-12-10 |

2012 | Δ% on 2011 |

2011 | Δ% on 2010 |

| Mexican peso | 17.1845 | 5.0 | 18.0512 | (3.7) | 16.9033 | 2.3 | 17.2906 | (1.0) |

| U.S. dollar | 1.3194 | (1.9) | 1.2939 | 1.3 | 1.2850 | 8.3 | 1.3916 | 3.2 |

| Argentinean peso | 6.4768 | (14.0) | 5.5679 | (15.3) | 5.8434 | (1.7) | 5.7467 | (9.8) |

| Chilean peso | 633.31 | 6.5 | 674.76 | (1.3) | 625.00 | 7.5 | 672.04 | 8.1 |

| Colombian peso | 2,331.00 | 7.8 | 2,512.56 | 9.7 | 2,309.47 | 11.3 | 2,570.69 | 9.1 |

| Peruvian new sol | 3.3678 | 3.6 | 3.4890 | 11.4 | 3.3896 | 13.1 | 3.8323 | 10.5 |

| Venezuelan bolivar fuerte | 5.6616 | (1.9) | 5.5569 | 1.4 | 5.5187 | 8.3 | 5.9765 | 1.9 |

| Turkish lira | 2.3551 | 3.7 | 2.4432 | (12.1) | 2.3139 | 1.1 | 2.3383 | (13.7) |

| Chinese yuan | 8.2207 | (0.8) | 8.1588 | 7.3 | 8.1063 | 10.9 | 8.9932 | 10.7 |