Exposure at default (EAD) is another of the inputs required to calculate expected loss and capital. It is defined as the outstanding debt at the time of default.

The exposure of a contract tends to be the same as its balance, although for products with explicit limits, such as cards or credit lines, exposure should include the potential increase in the outstanding balance from a reference date to the time of default. The EAD is therefore obtained by adding the risk already drawn on the transaction to a percentage of undrawn risk. This percentage of the undrawn balance that is expected to be used before default occurs is known as the CCF. Thus, the EAD is estimated simply by calculating this conversion factor. In addition, the relevance of adding to EAD the possibility of using an additional percentage of the limit for transactions that exceed it on a reference date is assessed, according to the risk policy for each product.

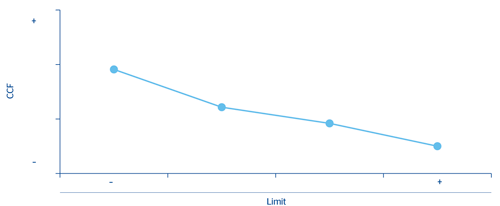

The estimate of these conversion factors also includes distinguishing factors that depend on the characteristics of the transaction. For example, in the case of BBVA Spain company credit cards, the conversion factor is estimated based on card activity, the amount of its limit, and the initial usage percentage, which is defined as the ratio between current risk and limit. Chart 15 shows the CCF for active company credit cards based on their limit, in such a way that a reverse relationship can be seen between the limit and the conversion factor.

15 CCFs for BBVA Spain company credit cards (active cards by limit)

In order to obtain CCF estimates for low-default portfolios, the LDPs, external studies and internal data are combined, or behavior similar to other portfolios is assumed and their CCFs are assigned in this way.

The portfolio model and concentration and diversification effects

Credit risk for the global portfolio of the BBVA Group is measured through a portfolio model where the effects of concentration and diversification are considered. Its purpose is to study the entire loan book as a whole, by analyzing and capturing the effect of interrelations between the various portfolios.

In addition to enabling a more comprehensive calculation of capital needs, this model is a key tool for credit risk management, as it establishes loan limits based on the contribution of each unit to total risk in a global, diversified setting.

The portfolio model considers that risk comes from various sources (it is a multi-factor model). This feature implies that economic capital is increasingly sensitive to geographic diversification, a crucial aspect in a global entity like BBVA. These effects have become more apparent against the current backdrop in which, despite the stress undergone by the markets and the different rates of recovery in the countries where the Group operates, they have contributed to lessening the impact of this situation on BBVA.

The tool is also sensitive to the concentration that may exist in certain credit exposures, such as the Institution’s large customers. Apart from geography, industry factors are now key to business concentration analyses.