The main highlight in 2012 with respect to the capital base was compliance with the EBA capital recommendations without having to sell any strategic assets, with no public aid and without any change in the current dividend policy.

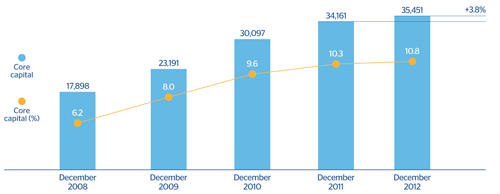

In December 2012, core capital ratio reached 10.8% under Basel II. It means 45 basis points up on the figures at the close of 2011.

Other notable aspects with respect to the capital base are as follows:

- BBVA comfortably passed the theoretical stress test carried out by Oliver Wyman, once again underlining its capacity to generate capital, even in very adverse economic scenarios.

- The generation of operating income has enabled the Bank to absorb loan-loss provisions aimed at addressing the impairment of assets related to the Spanish real-estate sector.

- Risk-weighted assets (RWA) have declined as a result of the sale of the business in Puerto Rico, lower activity in Spain and the reduction in portfolios with CIB customers. These effects have not been offset by the incorporation of Unnim or the growth of business in Latin America.

- The impact of the inclusion of Unnim has been practically neutral in terms of core capital. The negative effect of 10 basis points has been offset by the exchange of hybrid capital instruments in the hands of Unnim customers offered in October.

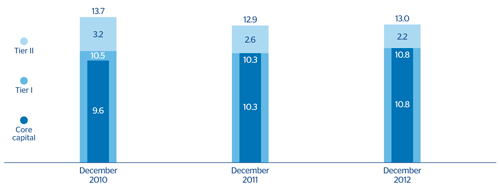

- Tier II capital has decreased, due to the repurchase of subordinated debt carried out by the Group.

Capital base (BIS II Regulation)

(Million euros)

Download Excel

Download Excel

|

|

31-12-12 | 31-12-11 | 31-12-10 |

|---|---|---|---|

| Core capital | 35,451 | 34,161 | 30,097 |

| Capital (Tier I) | 35,451 | 34,161 | 33,023 |

| Other eligible capital (Tier II) | 7,386 | 8,609 | 9,901 |

| Capital base | 42,836 | 42,770 | 42,924 |

| Risk-weighted assets | 329,033 | 330,771 | 313,327 |

| BIS ratio (%) | 13.0 | 12.9 | 13.7 |

| Core capital (%) | 10.8 | 10.3 | 9.6 |

| Tier I (%) | 10.8 | 10.3 | 10.5 |

| Tier II (%) | 2.2 | 2.6 | 3.2 |

At the close of 2012, the Group’s capital base was at practically the same level as at the close of 2011, at €42,836m. The main factor to take into account is the aforementioned repurchase of subordinated debt in the fourth quarter of 2012, which affects Tier II.

RWA totaled €329,033m, a year-on-year decline of 0.5%. The deleveraging process in Spain, reduced activity with wholesale customers and the sale of the Puerto Rico subsidiary have countered the positive effects on this heading, such as the strength of the banking business in emerging countries and the incorporation of Unnim.

24 BBVA Group. RWA evolution

(Million euros)

By the different components of the capital base, core capital amounts to €35,451m, an increase of 3.8% on the figure 12 months previously. The core and Tier I capital ratios thus increased by 45 basis points on the figure at the close of 2011 to 10.8%.

25 BBVA Group. Core capital evolution (BIS II Regulation)

(Million euros and percentage)

Finally, Tier II amounted to €7,386m as of 31-Dec-2012, with a decline of €1,223m on the figure as of 31-Dec-2011 due to the aforementioned repurchase of subordinated debt, closing the year at 2.2%.

To sum up, the BBVA Group’s BIS II ratio closed 2012 at 13.0%.

26 BBVA Group. Capital base. BIS II ratio

(Percentage)