The most significant aspect of earnings in the area in 2012 is the resilience of income, in an environment marked by very low activity and fierce competition to attract customer funds, strict cost control and a significant increase in provisions to cover the impairment of assets related to the real-estate sector in Spain.

Cumulative net interest income stands at €4,836m, which confirms the high resilience shown from quarter to quarter, resulting in a 10.1% year-on-year growth in this heading. Good price management, and the protection of the residential mortgage portfolio against changes in interest rates, have contributed to this positive trend. Fees and commissions have also performed well, growing by 10.0% year-on-year. This, together with negative NTI (though it improved in the fourth quarter) and a lower amount of other income/expenses compared with the figure for the previous year, has resulted in a year-on-year increase of 7.2% in gross income to €6,784m. This trend is very significant given the economic context in which it has taken place.

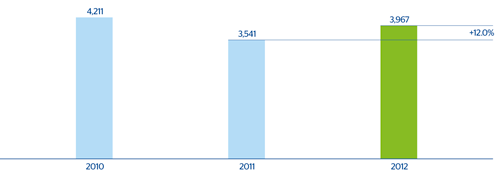

Operating expenses are up 1.1% over the previous year due to the incorporation of Unnim. Even so, their rate of increase has been below inflation as a result of continued strict control. The efficiency ratio thus improves on the figure posted in 2011, thanks to the better performance of revenue. It closed 2012 at 41.5% (44.0% in 2011). As a result, operating income has risen 12.0% to €3,967m.

10 Spain. Operating income

(Million euros)

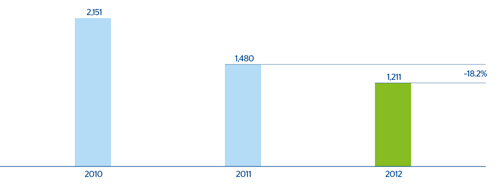

The strength of operating income mentioned above has made it possible to absorb the increase in loan-loss provisions. In 2012, significant provisioning was made against impairment losses on financial assets and provisions to offset the deterioration in assets related to the real-estate sector in Spain, thus complying with the requirements of Royal Decree-Laws 02/2012 and 18/2012. These increased provisions have enabled an improvement of the coverage ratio in the area, as mentioned above, resulting in a negative net attributable profit of €1,267m (a positive €1,211m not taking into account the higher loan-loss provisions resulting from the scope of the aforementioned Royal Decree-Laws).

11 Spain. Net attributable profit (adjusted)

(Million euros)