Throughout the first half of 2013, global economic growth has remained largely unchanged. Two factors are worth mentioning in this period. Firstly, the slowdown in emerging economies and the modest growth in some of the most advanced economies. And secondly, tightening financial conditions at global level, mainly as a result of the plans unveiled by the Federal Reserve to start reversing the exceptional liquidity injection measures in the United States. The main result has been an upturn in risk aversion that has above all affected emerging markets and led to net capital outflows and currency depreciation in those countries.

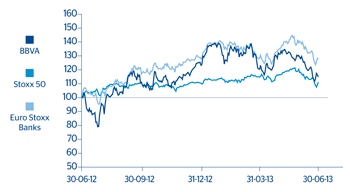

Against this backdrop, global financial markets have been extremely volatile during the period. The general European Stoxx 50 index registered a 3.5% quarterly decline at the close of June. Likewise, the Ibex 35 and the euro zone banks index Euro Stoxx Banks both posted declines, although slightly lower (down 2.0% and 1.0%, respectively). In the first half of the year, the Ibex 35 and Euro Stoxx Banks indexes were down 5.0% and 9.8%, respectively, compared to a 1.0% increase of the Stoxx 50.

As for earnings in the first quarter of 2013 reported by Spanish banks in general and by BBVA in particular, analysts continue to focus on the sector’s performance and the solvency of the banks. The main concern in the short term is focused on the income statement, specifically business activity and net interest income. The decline in lending and the environment of low interest rates have been two of the main factors that have reduced revenue in the first quarter. In addition, the high level of provisions in Spain remains a concern. However, analysts agree that BBVA can cope with this situation thanks to its balanced diversification, the resilience of its revenue and its organic generation of capital quarter after quarter. The market considers that the Group will be able to fulfill the requirements of Basel III, despite the difficult and complex environment, without having to resort to one-off transactions. In addition, it recognizes that BBVA is uniquely positioned in Spain to make the most of the opportunities afforded by the restructuring of the financial sector and the eventual recovery of economic growth.

Despite this, the BBVA share closed the second quarter of 2013 with a 4.7% decline at a price per share of €6.45, equivalent to a market capitalization of €36,893m. This represents a price/book value ratio of 0.8, a P/E ratio of 9.5 (calculated on the average profit for 2013 estimated by the consensus of Bloomberg analysts) and a dividend yield of 6.5% (also obtained according to the average dividend per share forecasted by analysts compared with the share price at June 28). The average daily volume traded from April to June was down 28.6% to 49 million shares compared with the figure for the first quarter of 2013, and down 33.7% in terms of average daily amount to €342m.

With respect to shareholder remuneration, and in line with the same periods of previous years, on June 24 the Board of Directors approved payment of an interim dividend against 2013 of €0.10 per outstanding share. This payment was made on July 10 and has implied a total payout of €572m.

The BBVA share and share performance ratios

|

|

30-06-13 | 31-12-12 |

|---|---|---|

| Number of shareholders | 1,019,346 | 990,113 |

| Number of shares issued | 5,724,326,491 | 5,448,849,545 |

| Daily average number of shares traded | 49,308,275 | 69,017,977 |

| Daily average trading (million euros) | 342 | 515 |

| Maximum price (euros) | 7.62 | 7.86 |

| Minimum price (euros) | 6.19 | 6.60 |

| Closing price (euros) | 6.45 | 6.76 |

| Book value per share (euros) | 8.28 | 8.55 |

| Market capitalization (million euros) | 36,893 | 36,851 |

| Price/Book value (times) | 0.8 | 0.8 |

| PER (Price/Earnings; times) | 9.5 | 8.7 |

| Yield (Dividend/Price; %) | 6.5 | 6.2 |

Share price index

(30-06-12=100)