The most relevant aspects with respect to the Group’s capital base in the second quarter of 2013 are:

- USD 1,500m issuance of contingent convertible securities into ordinary shares. BBVA is the first European bank to strengthen its Tier I capital position through this type of operation. This issuance, which was placed entirely among institutional investors, is eligible as additional Tier I capital under Basel III (CRDIV) and as core capital for the Bank of Spain.

- Quarterly increase in core capital, according to Basel II, of €572m, which includes earnings generation over the quarter and the elimination of the floor that limited core capital over Tier I capital thanks to the aforementioned issuance. This has offset the dividend payment in cash and the negative impact of currencies in the period.

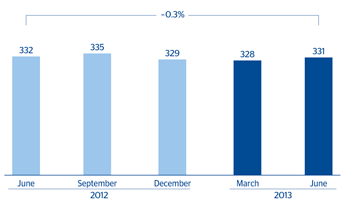

- Risk-weighted assets (RWA) have remained stable over the last 3 months. They closed June at €331,098m, with a slight quarterly increase of 0.9%. The increase in activity in emerging economies has offset the decline in lending in Spain and in the CIB portfolios, mainly in the developed world, and the negative impact of the evolution of exchange rates in the quarter.

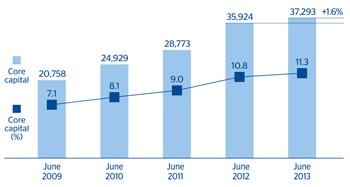

In short, the Group’s capital base at the end of June 2013 stands at €44,557m, up 0.6% over the quarter. Core capital amounts to €37,293m, up 1.6% on March. Tier I capital rose to €37,531m, including the aforementioned issuance of contingent convertible securities into ordinary shares. Tier II capital as of 30-Jun-2013 reached €7,026m and the change over the reported figure at the close of March 2013 is explained basically by the impact of exchange rates.

As a result, the BBVA Group’s capital ratios continue to show a sound solvency position. The core capital ratio ended the first half of the year at 11.3% and the Tier I ratio also at 11.3%, while the Tier II ratio closed at 2.1%. The BBVA Group’s BIS II ratio thus stands at 13.5% as of June 30, 2013.

Core capital evolution (BIS II Regulation)

(Million euros and percentage)

RWA evolution

(Billion euros)

Capital base (BIS II Regulation)

(Million euros)

|

|

30-06-13 | 31-03-13 | 31-12-12 | 30-09-12 | 30-06-12 |

|---|---|---|---|---|---|

| Core capital | 37,293 | 36,721 | 35,451 | 36,075 | 35,924 |

| Capital (Tier I) | 37,531 | 36,721 | 35,451 | 36,075 | 35,924 |

| Other eligible capital (Tier II) | 7,026 | 7,584 | 7,386 | 8,393 | 6,841 |

| Capital base | 44,557 | 44,305 | 42,836 | 44,467 | 42,765 |

| Risk-weighted assets | 331,098 | 328,002 | 329,033 | 335,203 | 332,036 |

| BIS ratio (%) | 13.5 | 13.5 | 13.0 | 13.3 | 12.9 |

| Core capital (%) | 11.3 | 11.2 | 10.8 | 10.8 | 10.8 |

| Tier I (%) | 11.3 | 11.2 | 10.8 | 10.8 | 10.8 |

| Tier II (%) | 2.1 | 2.3 | 2.2 | 2.5 | 2.1 |