The key factors behind the earnings figures are:

- The strength and quality of gross income has been maintained, with a figure of €1,552m, a rise of 18.3% in year-on-year terms. This positive performance is supported by the greater contribution from the Global Transactional Banking, Global Markets and Corporate Finance units, as well as the balanced geographical diversification of the Bank’s wholesale businesses, all of them with a growing weight of revenue from the customer franchise.

- Cumulative operating expenses in the half-year increased by 3.8% over the last 12 months to €449m, a moderate increase taking into account that the area operates in geographical areas with high inflation, and a sign of the major effort underway to keep costs in check.

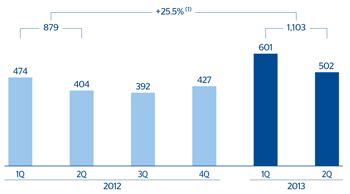

- As a result, the efficiency ratio has improved to 28.9% and operating income amounts to €1,103m, 25.5% more than in the first half of 2012.

- Impairment losses on financial assets over the first half of the year stand at €107m, clearly higher than those recorded 12 months earlier, due to the provisioning of various one-off operations. Despite this, CIB still shows a moderate NPA ratio of 1.6% as of 30-Jun-2013, with a stable trend.

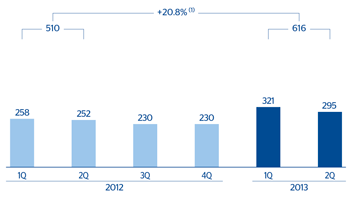

- Due to the above, the net attributable profit in the first half of 2013 amounts to €616m, up 20.8% in year-on-year terms. This shows how CIB has been capable of adapting to the new environment, with an appropriate business mix, balanced and diversified by geographical areas and businesses, and responding to current market needs.

CIB. Operating income(Million euros at constant exchange rates) |

CIB. Net attributable profit(Million euros at constant exchange rates) |

|---|---|

(1) At current exchange rates: +21.4%. |

(1) At current exchange rates: +18.0%. |