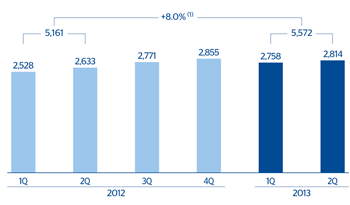

In the second quarter, operating expenses stood at €2,814m, totaling €5,572m for the first half of the year, up 8.0% on the first six months of 2012. In line with previous years, this increase is primarily the result of the investment plans undertaken in the emerging geographical regions, while the Group continues to apply a cost control policy in developed countries. Examples of this in the quarter include the work being carried out in the business plan for Latin America to promote value generation in the region, the technological progress being made in customer service in Chile and the investment in new corporate headquarters in Mexico City and Houston. Lastly, BBVA and the Professional Soccer League (LFP) recently announced the extension of their strategic agreement for the next three years.

Operating costs

(Millones de euors)

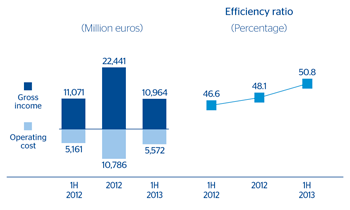

Breakdown of operating costs and efficiency calculation

(Million euros)

|

|

1H13 | Δ % | 1H12 | 2012 |

|---|---|---|---|---|

| Personnel expenses | 2,912 | 6.2 | 2,743 | 5,662 |

| Wages and salaries | 2,203 | 4.6 | 2,107 | 4,348 |

| Employee welfare expenses | 454 | 11.5 | 408 | 819 |

| Training expenses and other | 254 | 11.5 | 228 | 495 |

| General and administrative expenses | 2,105 | 7.8 | 1,952 | 4,106 |

| Premises | 471 | 4.8 | 449 | 916 |

| IT | 405 | 18.0 | 343 | 745 |

| Communications | 154 | (5.5) | 163 | 330 |

| Advertising and publicity | 204 | 12.2 | 181 | 378 |

| Corporate expenses | 52 | 7.5 | 48 | 102 |

| Other expenses | 602 | 7.1 | 562 | 1,201 |

| Levies and taxes | 218 | 6.3 | 205 | 433 |

| Administration costs | 5,017 | 6.9 | 4,695 | 9,768 |

| Depreciation and amortization | 555 | 19.3 | 465 | 1,018 |

| Operating costs | 5,572 | 8.0 | 5,161 | 10,786 |

| Gross income | 10,964 | (1.0) | 11,071 | 22,441 |

| Efficiency ratio (Operating costs/Gross income, in %) | 50.8 |

|

46.6 | 48.1 |

Efficiency

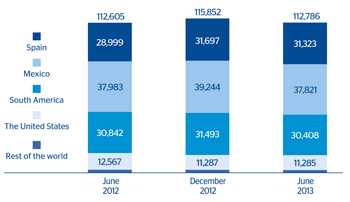

The following is worth mentioning as regards the number of employees, branches and ATMs:

- New workforce reduction in the quarter to a new total of 112,786 employees, basically as a result of the sale of the pension business in Colombia and Peru and the integration of Unnim.

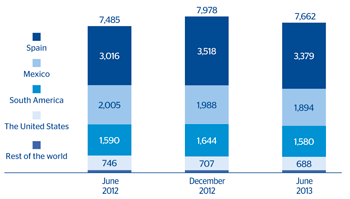

- There was also a reduction in the total number of Group branches, which stood at 7,662 units as of the close of June (7,895 as of 31-Mar-2013). By geographical area, the number of branches increased in the banking business in Latin America as a result of the expansion plans underway, while the number remained stable in Mexico and is down in the United States and in Spain, in the latter case as a result of the Unnim integration plan.

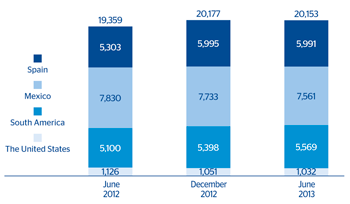

- As of 30-Jun-2013, the number of ATMs was 20,153 units. The increases continue to be concentrated in South America.

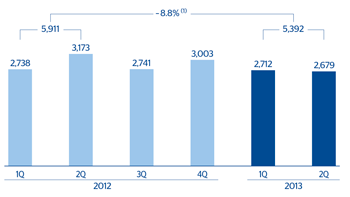

As a result, operating income of €2,679m was generated in the second quarter, slightly lower than the figure posted in the first quarter. The cumulative figure as of June stands at €5,392m, down 8.8% on the previous year. The efficiency ratio in the first half of 2013 closed at 50.8%.

Number of employees (1)

Number of branches (1)

Number of ATMs (1)

Operating income

(Million euros)