As mentioned earlier, one of the relevant events in the first half of the year has been the devaluation of the Venezuelan bolivar in February this year. It has had an impact on each of the items in the area’s financial statements, although there has been no material impact on the net attributable profit.

Earnings performed well once more during the first half of the year, despite the adjustment for hyperinflation in Venezuela, which has been more negative than in previous periods. Cumulative gross income was €2,611m in the first six months of the year, up 15.4% on the same period in 2012. Strong activity, outstanding price management and favorable NTI explain this positive performance.

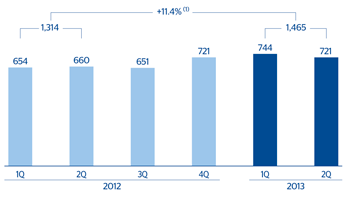

Cumulative operating expenses amounted to €1,147m, a year-on-year rise of 20.9%. The main factors behind this rise have been the technological expansion and transformation plans underway, together with the high rate of inflation in some countries in the region. One example of these plans during the quarter is the business plan being implemented in South America to boost the generation of value in the area. Its main objectives are growth in activity, increased market share and improved service quality. This is being done through investment to deploy mobile banking services and expand the branch network, particularly in Colombia, Chile and Peru. At the same time, Chile is undertaking a major project that represents a significant technological advance in customer service. Also in Chile, the Group’s first “flagship” branch in the region has just been opened (this is a new type of large and technologically advanced branch with a specialized sales force that brings together personalized advice skills). This growth in revenue and expenses has resulted in an efficiency ratio of 43.9% in the first half of the year and operating income for the six-month period of €1,464m, up 11.4% on the same period in 2012.

Impairment losses on financial assets stood at €320m, with a significant year-on-year increase, due largely to the recovery of provisions made in the first half of last year. Discounting this effect, this heading would register a rise similar to that of the loan book. However, the cumulative risk premium for the first half of the year remains at the same levels as at the close of the previous quarter and is now the best among the banks in the region (using local accounting figures to ensure the data are comparable).

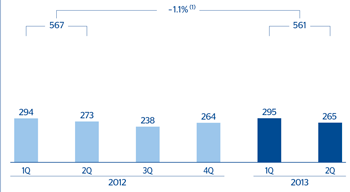

In conclusion, the cumulative net attributable profit in the first half of the year in South America totaled €561m, very close to the figure a year earlier.

This can be broken down by country as follows:

- Argentina has generated €94m in the first half of the year. Recurring revenue remains strong, and has offset the increase in expenses and loan-loss provisions (the latter due to a significant increase in activity).

- Chile has been able to cope with market volatility and the negative impact of reduced inflation rates in the first half of the year, and generated a net attributable profit of €50m, which is supported by growth in income from fees and commissions and the good performance of NTI.

- Colombia has increased its net interest income significantly thanks to the boost to activity and stable spreads. Expenses have increased moderately, as have loan-loss provisions. As a result, the net attributable profit for the six-month period is €148m.

- In Peru, the rise in net interest income and NTI has driven the net attributable profit to €81m, despite the increase in expenses and loan-loss provisions. Also remarkable has been the impact on income from fees and commissions of the coming into force on January 1 of the new regulations on transparency in the banking system, which limits banks from charging certain fees.

- Venezuela has continued to perform strongly in terms of net attributable profit, which amounted to €139m in the half-year. The strength of activity and the revaluation of the bank’s US dollar positions due to the devaluation announced by the Venezuelan government in February are the main reasons for this positive performance.

- Lastly, BBVA Panama reported a net attributable profit of €13m, BBVA Paraguay €11m and BBVA Uruguay €13m.

South America. Operating income(Million euros at constant exchange rates) |

South America. Net attributable profit(Million euros at constant exchange rates) |

|---|---|

(1) At current exchange rates: -1.2%. |

(1) At current exchange rates: -10.8%. |

South America. Data per country

(Million euros)

|

|

Operating income | Net attributable profit | ||||||

|---|---|---|---|---|---|---|---|---|

| Country | 1H13 | Δ % | Δ % at constant exchange rates | 1H12 | 1H13 | Δ % | Δ % at constant exchange rates | 1H12 |

| Argentina | 223 | (2.0) | 15.8 | 228 | 94 | (12.8) | 3.0 | 108 |

| Chile | 149 | (7.7) | (9.2) | 161 | 50 | (43.9) | (44.8) | 89 |

| Colombia | 262 | 1.2 | 4.3 | 259 | 148 | (3.9) | (0.9) | 154 |

| Peru | 326 | 11.0 | 10.0 | 294 | 81 | 1.9 | 1.0 | 79 |

| Venezuela | 445 | (8.4) | 25.4 | 486 | 139 | (13.0) | 19.2 | 160 |

| Other countries (1) | 60 | 8.7 | 6.8 | 55 | 49 | 25.5 | 23.8 | 39 |

| Total | 1,465 | (1.2) | 11.4 | 1,482 | 561 | (10.8) | (1.1) | 629 |