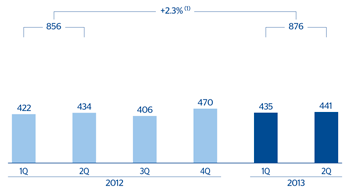

BBVA’s earnings in Mexico in the first half of the year show a favorable trend in a moderately positive macroeconomic environment and greater volatility on the financial markets. Overall, the Mexico area generated €876m of net attributable profit, 2.3% more than in the same period in 2012.

Over the first six months of the year, net interest income amounted to €2,228m, up 5.8% on the figure 12 months earlier. This rise has been due to the aforementioned increase in banking activity, as well as the maintenance of spreads, which has enabled BBVA to preserve a level of profitability (measured as the net interest income over ATA) that compares favorably with the sector average. Income from fees and commissions performed well and totaled €582m for the first six months of 2013 (up 6.3% year-on-year). It was supported by the improvement in fees from the investment banking business and the optimization of charges for maintenance and administration of accounts. The half-year was also positive for NTI, which increased by 6.6% in year-on-year terms, and the heading of other income/expenses, which rose by 29.3%, thanks basically to improved earnings from the insurance business. Overall, cumulative gross income for the half-year was €3,100m, up 7.1% on the same period in 2012.

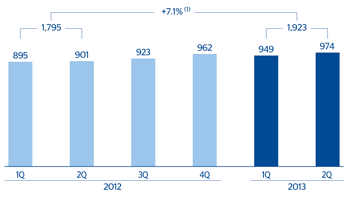

Operating expenses still show rates of growth similar to those in the previous quarter. Expenses in the first half of the year totaled €1,177m, with a year-on-year growth of 7.0%. As mentioned in previous quarterly reports, the bank has an investment plan underway for opening new branches and modernizing existing ones and for boosting technological innovation, together with the construction of new corporate headquarters. This largely explains the increase in expenses. In contrast, the most recurring items continue to grow in line with the country’s inflation rate. With these revenue and expenditure figures, the efficiency ratio remains stable and closed June at 38.0%, one of the best in the Mexican banking system. Operating income amounted to €1,923m from January to June 2013, up 7.1% on the same period in 2012.

Lastly, impairment losses on financial assets reduced earnings by €727m in the half-year, 13.3% more than in the last 12 months. This is partly due to the growth in lending, but also to the greater deterioration in the consumer finance portfolio. In any case, the risk premium remains stable and closed the half-year at 3.62%.

Mexico. Operating income(Million euros at constant exchange rate) |

Mexico. Net attributable profit(Million euros at constant exchange rate) |

|---|---|

(1) At current exchange rate: +11.6%. |

(1) At current exchange rate: +6.5%. |