In the second quarter of 2013 there were no significant changes in the balance sheet and business activity of the BBVA Group, where trends in general were similar to those seen in previous periods. The most noteworthy aspects are listed below:

- Overall currency depreciation relative to the euro impacting the Group’s financial statements, which had a negative impact on the year-on-year changes in the main variables.

- Gross lending to customers was down in the quarter, as lending activity in Spain and the CIB portfolios, particularly in the developed economies, continued the downward trend of previous periods. This is despite the increase that continues to be registered in emerging countries.

- Customer deposits are up in both quarterly and year-on-year terms, highly focused on the retail business.

- Thanks to this more positive performance of deposits, the commercial gap in Spain has continued to improve, as has the Group’s general liquidity situation and funding structure.

- Non-performing loans are up, due to a large extent to the impairment in the commercial segment of the domestic business.

- There has been an increase in total equity in the quarter. This was due to the ordinary generation of earnings in the period and the conversion of the outstanding Subordinated Mandatory Convertible Bonds issued in December 2011, which was completed on June 30, 2013, and the issue of contingent convertible securities into shares done during the second quarter.

- Lastly, all headings of off-balance sheet funds continued to perform well, as in the previous quarter, in all the geographical regions where the Group operates.

Consolidated balance sheet (1)

(Million euros)

|

|

30-06-13 | Δ % | 31-03-13 | 31-03-13 | 31-12-12 |

|---|---|---|---|---|---|

| Cash and balances with central banks | 24,926 | 3.8 | 24,011 | 30,208 | 37,434 |

| Financial assets held for trading | 72,833 | (7.6) | 78,792 | 75,750 | 79,954 |

| Other financial assets designated at fair value through profit or loss | 2,937 | (12.9) | 3,371 | 3,079 | 2,853 |

| Available-for-sale financial assets | 75,492 | 14.7 | 65,834 | 74,135 | 71,500 |

| Loans and receivables | 382,208 | (2.2) | 390,654 | 387,551 | 383,410 |

| Loans and advances to credit institutions | 27,401 | (4.7) | 28,764 | 26,383 | 26,522 |

| Loans and advances to customers | 350,071 | (2.3) | 358,332 | 357,490 | 352,931 |

| Other | 4,736 | 33.1 | 3,559 | 3,678 | 3,957 |

| Held-to-maturity investments | 9,755 | (4.0) | 10,157 | 9,734 | 10,162 |

| Investments in entities accounted for using the equity method | 6,962 | 5.4 | 6,604 | 6,991 | 6,795 |

| Tangible assets | 7,678 | 2.7 | 7,477 | 7,831 | 7,785 |

| Intangible assets | 8,612 | (3.5) | 8,927 | 8,952 | 8,912 |

| Other assets | 27,101 | 2.1 | 26,533 | 28,843 | 28,980 |

| Total assets | 618,503 | (0.6) | 622,359 | 633,073 | 637,785 |

| Financial liabilities held for trading | 50,280 | (10.7) | 56,296 | 54,894 | 55,927 |

| Other financial liabilities at fair value through profit or loss | 2,865 | 36.1 | 2,105 | 3,001 | 2,516 |

| Financial liabilities at amortized cost | 490,018 | (0.3) | 491,717 | 499,038 | 506,487 |

| Deposits from central banks and credit institutions | 80,053 | (33.1) | 119,709 | 91,277 | 106,511 |

| Deposits from customers | 312,162 | 13.8 | 274,285 | 304,574 | 292,716 |

| Debt certificates | 80,604 | 3.0 | 78,277 | 83,813 | 87,212 |

| Subordinated liabilities | 10,197 | (13.6) | 11,801 | 12,009 | 11,831 |

| Other financial liabilities | 7,003 | (8.4) | 7,645 | 7,364 | 8,216 |

| Liabilities under insurance contracts | 10,038 | 24.6 | 8,054 | 10,314 | 9,032 |

| Other liabilities | 17,913 | (15.3) | 21,138 | 19,253 | 20,021 |

| Total liabilities | 571,114 | (1.4) | 579,309 | 586,500 | 593,983 |

| Non-controlling interests | 2,205 | 5.0 | 2,100 | 2,362 | 2,372 |

| Valuation adjustments | (2,922) | 3.0 | (2,835) | (1,005) | (2,184) |

| Shareholders’ funds | 48,106 | 9.9 | 43,785 | 45,216 | 43,614 |

| Total equity | 47,388 | 10.1 | 43,050 | 46,573 | 43,802 |

| Total equity and liabilities | 618,503 | (0.6) | 622,359 | 633,073 | 637,785 |

| Memorandum item: |

|

|

|

|

|

| Contingent liabilities | 37,098 | (5.9) | 39,407 | 38,195 | 39,407 |

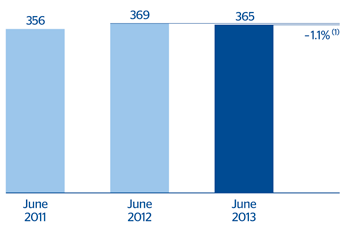

Customer lending (gross)

(Billion euros)

Customer lending

(Million euros)

|

|

30-06-13 | Δ % | 30-06-12 | 31-03-13 | 31-12-12 |

|---|---|---|---|---|---|

| Domestic sector | 186,513 | (3.5) | 193,358 | 192,543 | 190,817 |

| Public sector | 26,057 | (5.3) | 27,501 | 25,799 | 25,399 |

| Other domestic sectors | 160,456 | (3.3) | 165,856 | 166,744 | 165,417 |

| Secured loans | 99,123 | 2.7 | 96,546 | 103,373 | 105,664 |

| Other loans | 61,333 | (11.5) | 69,311 | 63,371 | 59,753 |

| Non-domestic sector | 156,491 | (1.7) | 159,243 | 158,640 | 156,312 |

| Secured loans | 63,229 | 0.3 | 63,032 | 64,809 | 61,811 |

| Other loans | 93,263 | (3.1) | 96,211 | 93,831 | 94,500 |

| Non-performing loans | 21,810 | 34.3 | 16,243 | 21,448 | 20,287 |

| Domestic sector | 16,645 | 44.4 | 11,531 | 16,184 | 15,159 |

| Non-domestic sector | 5,165 | 9.6 | 4,713 | 5,263 | 5,128 |

| Customer lending (gross) | 364,815 | (1.1) | 368,844 | 372,630 | 367,415 |

| Loan-loss provisions | (14,744) | 40.2 | (10,513) | (15,140) | (14,484) |

| Customer lending (net) | 350,071 | (2.3) | 358,332 | 357,490 | 352,931 |

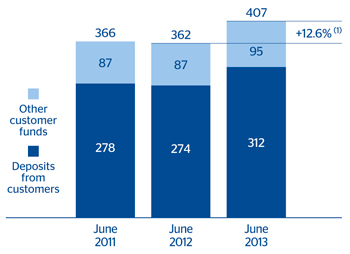

Customer funds

(Billion euros)

Customer funds

(Million euros)

|

|

30-06-13 | Δ % | 30-06-12 | 31-03-13 | 31-12-12 |

|---|---|---|---|---|---|

| Deposits from customers | 312,162 | 13.8 | 274,285 | 304,574 | 292,716 |

| Domestic sector | 156,780 | 23.1 | 127,356 | 146,359 | 141,169 |

| Public sector | 22,609 | 5.4 | 21,448 | 21,646 | 21,807 |

| Other domestic sectors | 134,171 | 26.7 | 105,908 | 124,713 | 119,362 |

| Current and savings accounts | 50,296 | 8.9 | 46,190 | 48,290 | 48,208 |

| Time deposits | 68,006 | 40.9 | 48,278 | 66,789 | 61,973 |

| Assets sold under repurchase agreement and other | 15,868 | 38.7 | 11,440 | 9,634 | 9,181 |

| Non-domestic sector | 155,382 | 5.8 | 146,929 | 158,215 | 151,547 |

| Current and savings accounts | 98,688 | 7.6 | 91,706 | 97,419 | 98,169 |

| Time deposits | 49,794 | (0.5) | 50,021 | 53,514 | 48,691 |

| Assets sold under repurchase agreement and other | 6,899 | 32.6 | 5,203 | 7,282 | 4,688 |

| Other customer funds | 95,232 | 8.9 | 87,445 | 96,699 | 91,774 |

| Spain | 53,762 | 10.4 | 48,709 | 53,095 | 52,179 |

| Mutual funds | 19,651 | 5.1 | 18,694 | 19,259 | 19,116 |

| Pension funds | 19,272 | 12.1 | 17,192 | 19,019 | 18,577 |

| Customer portfolios | 14,839 | 15.7 | 12,823 | 14,817 | 14,486 |

| Rest of the world | 41,470 | 7.1 | 38,736 | 43,605 | 39,596 |

| Mutual funds and investment companies | 22,354 | 1.1 | 22,113 | 23,808 | 22,255 |

| Pension funds (1) | 3,973 | 23.5 | 3,216 | 3,761 | 3,689 |

| Customer portfolios | 15,142 | 12.9 | 13,408 | 16,036 | 13,652 |

| Total customer funds | 407,394 | 12.6 | 361,731 | 401,274 | 384,491 |

|

|

|||||