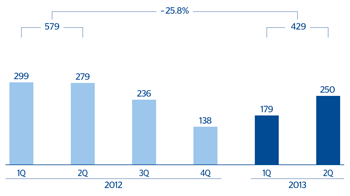

The Eurasia area has generated a net attributable profit for the half-year of €429m, of which 45% is from Garanti’s contribution.

- The cumulative gross income of €1,104m for the half-year is slightly higher than in the previous year (up 0.7%). There has been a notable increase in net interest income and a greater contribution from NTI as a result of the good performance of the Global Markets unit in the last six months.

- Net interest income closed the period at €490m, with a year-on-year rise of 26.9%. The influence of Garanti has been highly significant, both in terms of the strength of its activity and its good management of customer spreads. It should be pointed out that the reduction in the cost of liabilities in liras applied by the bank (down an average of 350 basis points with respect to the first six months of 2012) has offset the decline in the average yield on loans deriving from the successive interest rate cuts made by the CBT.

- In contrast, income from fees and commissions is down 12.1% year-on-year to €206m as a result of the limited volume of operations with the wholesale segment, although also due to some accounting reclassifications between headings in Garanti.

- High levels of NTI were generated in the first half of the year, with a good performance by the Global Markets unit, which offset the decline in the other income/expenses heading due to a lower contribution in the half-year from BBVA’s stake in the CNCB Group. As mentioned in the previous quarter, this is because of a year-on-year increase in loan-loss provisions in the Chinese bank as a result of stricter demands by the local regulator.

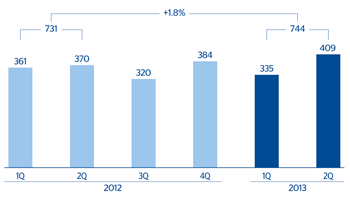

Expenses continue to be held in check, with a year-on-year decline of 1.5% in the operating expenses heading giving a cumulative €360m for the first six months of the year. In Garanti, expenses have risen by 9.9%, reflecting the process of expansion underway in the bank. In all, operating income in the area has risen by 1.8% in the last 12 months to €744m.

Garanti. Significant data 30-06-13 (1)

|

|

30-06-13 |

|---|---|

| Financial statements (million euros) |

|

| Attributable profit | 794 |

| Total assets | 70,278 |

| Loans to customers | 42,282 |

| Deposits from customers | 38,174 |

| Relevant ratios (%) |

|

| Efficiency ratio | 41.1 |

| NPA ratio | 1.9 |

| Other information |

|

| Number of employees | 18,431 |

| Number of branches | 961 |

| Number of ATMs | 3,605 |

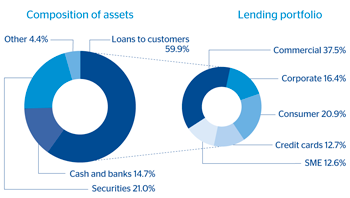

Garanti. Composition of assets and lending portfolio (1)(June 2013) |

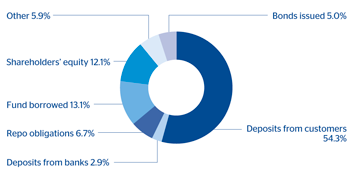

Garanti. Composition of liabilities (1)(June 2013) |

|---|---|

(1) Garanti Bank only. |

(1) Garanti Bank only. |

Lastly, impairment losses on financial assets amounted to €191m, significantly higher than in the first six months of 2012, due to their increase in Garanti. This increase is mainly due to the greater generic needs derived from the strong growth in lending and an additional provision for regulatory reasons, which has now been settled.

Eurasia. Operating income(Million euros) |

Eurasia. Net attributable profit(Million euros) |

|---|---|

|

|

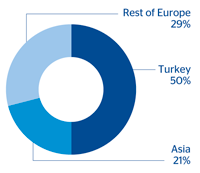

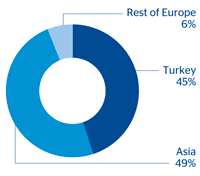

Eurasia. Gross income breakdown by geography(30-06-13) |

Eurasia. Net attributable profit by geography(30-06-13) |

|---|---|

|

|