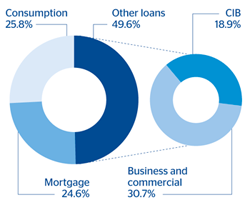

At the close of June 2013, performing loans managed by the area amounted to €38,579m, equivalent to a year-on-year growth of 8.0%.

Within the retail segments, loans to small businesses have posted the strongest growth year-on-year (up 20.5%), followed by credit cards (up 10.7%). In contrast, residential mortgages have been practically flat year-on-year (up 1.2%).

In the wholesale portfolio, which includes lending to corporations, SMEs and the government, it is lending to SMEs that maintains the highest growth rates (up 12.2% year-on-year at the close of June 2013), while corporate lending continues to be affected by the bank disintermediation process underway in recent quarters. BBVA Bancomer continues to support its customers by placing debt on the capital markets, for a total value of USD 2,417m in the first half of 2013. BBVA still has a significant presence in Mexico in this business.

As mentioned at the start of the chapter, asset quality is evolving as expected, and the risk premium remains steady (a cumulative 3.62% to June 2013), despite the slight rise in the NPA ratio over the quarter, which closed at 4.0% as of 30-Jun-2013, with a coverage ratio of 109%.

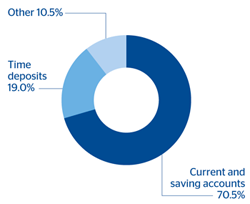

Customer funds, which include on-balance-sheet deposits, repos, mutual funds and other off-balance sheet funds, picked up their pace of year-on-year growth to 5.8% (up 6.3% in the quarter) to €62,950m. There has been a positive trend in demand deposits in the retail customer segment, with a rise of 11.0% on the figure at the close of March, thanks to a very favorable quarter in new production in the retail network. Time deposits are heavily influenced by the bank’s policy in the last few quarters of improving the profitability of liabilities. The balance of time deposits declined year-on-year by 4.1%, in part due to transfers to mutual funds and investment portfolios, which have risen by 4.0% (both in the quarter and over the last 12 months), to €17,958m as of 30-Jun-2013.

Finally, the insurance business in the area has performed very well, thanks to increased activity (4,0% increase year-on-year in premiums written by the retail network; automobile insurance was best in class with a 35% increase) and limited claims, in line with previous years, with the resulting favorable effect on earnings in the area.

Mexico. Performing loans breakdown(June 2013) |

Mexico. Deposits from customers breakdown(June 2013) |

|---|---|

|

|