The following are the most important figures related to earnings in the first six months of 2013 in this area:

- Net interest income for the six-month period totals €2,053m, down 13.3% in year-on-year terms. This heading continues to be pressured by declining volumes, the current environment of low interest rates and, since May, the elimination of floor clauses from residential mortgages following the aforementioned ruling by the Supreme Court. One positive element is the steady reduction in the cost of new deposits, which will improve net interest income over the coming quarters.

- Income from fees and commissions for the first half of the year reached €703m, up both in year-on-year terms (5.9%) and compared to the previous quarter (3.4%), due largely to the integration of Unnim and the greater contribution from mutual and pension funds.

- There was a high volume of NTI again in the quarter, mainly as a result of good management of the structural risks on the balance sheet in a low interest rate environment, which has had a positive effect on capital gains obtained from the rotation of the ALCO portfolios. This heading posted €416m for the first half of the year, compared with €232m in the first six months of 2012.

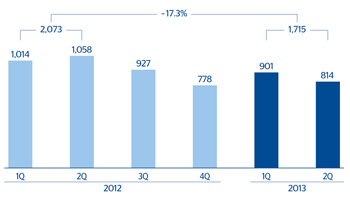

- As a result, gross income for the first half of the year totals €3,249m, down 6.1% on the same period in 2012. This figure should be assessed taking into account the unfavorable environment in which it was achieved: reduced volumes of activity, pressure on margins due to low interest rates and the elimination of the floor clauses.

- Operating expenses in the quarter were similar to the figure for the first three months of the year, with a six-month volume of €1,534m and a year-on-year increase of 10.7%. The figure was affected by the incorporation of Unnim in the second half of 2012.

- Impairment losses on financial assets declined by €71m compared to the previous quarter. They totaled €1,166m in the first half of the year and were adversely affected by the impairment of the commercial portfolio.

- The provisions (net) and other gains (losses) heading basically includes the gains from the reinsurance operation undertaken in the previous quarter. For the first half of the year, this heading stands at €517m (gains).

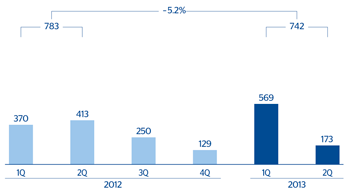

- As a result of the above, the net attributable profit generated in the first half of the year was €742m, down 5.2% on the same period in 2012.

Spain. Banking activity. Operating income(Million euros) |

Spain. Banking activity. Net attributable profit(Million euros) |

|---|---|

|

|