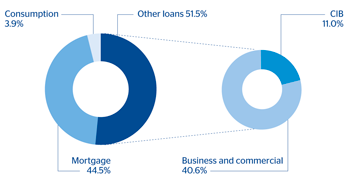

BBVA’s banking activity in Spain continues to be affected by the deleveraging process underway in the economy. At the close of the second quarter of 2013, the area’s balance of performing loans stood at €182,667m, a decline of 2.1% over the quarter and 3.5% less than a year ago.

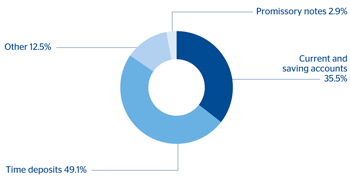

BBVA had a volume of €183,392m in customer funds in Spain as of June 30, 2013, including customer deposits, promissory notes, mutual and pension funds. The upward trend in these headings continued in the quarter. Overall, they registered year-on-year growth of 22.5% and 3.7% over the quarter.

Customer deposits under management, at €144,468m, are up 4.2% in the quarter and 26.9% since the end of June 2012, thanks to the positive performance still seen in time deposits held by households and companies, which together have risen 44.2% in year-on-year terms and 5.7% in the last 3 months. This represents 215 basis points gain in market share in private-sector deposits (other resident sectors, retail activity) over the last twelve months, and 11 basis points over the quarter, according to information available as of May. This positive performance is due to the Bank’s high network capillarity and customer-centric business model, based and focused on establishing stable and lasting relationships with its customer base.

With this performance of lending and on-balance sheet customer funds, the loan-to-deposits ratio (1) in the domestic sector has declined to 128% as of 30-Jun-2013. Including mortgage-covered bonds, the ratio stands at 100%.

(1) The ratio excludes securitizations and repos and includes promissory notes placed in the retail network.

Spain. Banking activity. Performing loans breakdown(June 2013) |

Spain. Banking activity. Deposits from customers(June 2013) |

|---|---|

|

|

Off-balance sheet funds performed positively in the last quarter, with increases in both mutual funds (up 2.0%) and pension funds (up 1.3%). As a result, BBVA has retained its privileged position in asset management, with market shares of 14.6% in mutual funds and 19.5% in pensions, according to the latest available figures from Inverco (May and June, respectively).